The role of CFO within real estate investment platforms is becoming increasingly complex. Michael Hornsby and Renaud Breyer of EY Luxembourg explain why.

The CFO function has become the cornerstone of the operation of real estate investment vehicles. Traditionally, the role consists of maintaining historical books and records, reporting to investors and ensuring compliance with laws and regulations. It includes an ever-more diverse range of activities.

Other important activities include managing treasury, raising and managing financing, controlling the up-streaming of cash and related distributions and supporting capital markets teams.

More recently, the finance function is expected to be involved in more value-added activities, such as transactions, and to drive improvements that will increase the vehicle and manager performance.

Despite this widening agenda, resources to perform these activities are reducing. Deals with returns that can absorb high structure cost and allow managers to generate the returns expected by investors are getting more difficult to find.

The pressure on finance teams is also growing. More than ever, managers need to maintain the confidence of financial stakeholders (investors and bankers) to be successful in launching new products. The ability of managers to win the confidence of the stakeholders is essentially based on their track record of historic financial performance but also their ability to demonstrate and manage stakeholders’ perception of how they manage intrinsic risks. This is strongly influenced by:

• How the manager communicates the performance of the fund

• The ability to respond quickly and accurately to requests from stakeholders

• How well the manager anticipates and responds to the constantly changing regulatory and economic environment.

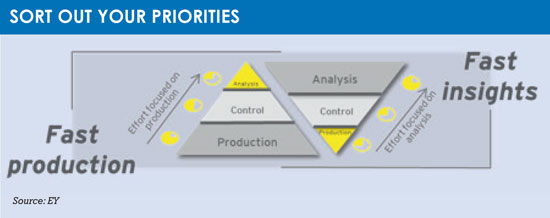

To deal with this agenda and challenges, many CFOs work at improving the performance of the finance function. As presented in the graphic opposite, finance teams should spend more time analysing, commenting on and explaining fund performance rather than preparing the data.

In addition, finance teams should implement a model that allows them to be agile and that can be adapted to the dynamic of new reporting requirements, new regulations and numerous demands from investors.

The task is not easy as, often, improvement projects are complex due to the Alternative Investment Fund Managers Directive (AIFMD). Indeed, the implementation of the AIFMD has often resulted in the dissemination of the finance activities over the alternative investment fund manager, the valuers, the investment adviser, the administrator and the accounting agent.

USING ROBOTICS

Typically, CFOs launch finance-function streamlining projects. Sometimes, those projects are combined with the implementation of fast close techniques. These techniques are well known by most CFOs and involve identifying all tasks needed to prepare the financial data, measuring the time spent doing those tasks and defining a plan to decrease the production time (i.e. suppression of redundancies, automation).

Once the process is streamlined, solutions like robotics can even replace repetitive and consistent human actions.

Once the process is streamlined, solutions like robotics can even replace repetitive and consistent human actions.

Robotics is a good alternative to the offshoring of back-office activities, which has not been systematically successful. Robotics can address high-volume and repetitive tasks, with a more predictable outcome and at a cheaper price. This also helps to produce faster and more accurate data, as robots work 24/7.

Nevertheless, it is often forgotten that the starting point of any successful improvement project is the standardisation of the data and of the reports to produce. Organisations, such as the Association for Investors in Non-listed Real Estate Vehicles (Inrev), are working hard to ensure that European CFOs and investors have the right toolkit to operate.

Indeed, having a set of guidelines that are recognised by the market as robust and relevant helps managers towards consistency in practice and in the measurement of the performance of the funds. For instance, the recently released Inrev modules on ‘Fee and Expense Metrics and Performance Measures’ provided detailed guidelines and examples that are a good starting point for any standardisation project.

The Standard Data Delivery Sheet is also a great tool to ensure consistency of reporting to investors. The relevance of Inrev guidelines is increasing as Inrev works at the consistency of its guidelines with the ones developed by Inrev’s equivalent organisation.

As real estate investment markets become more global, investors’ expectations on the definition of performance measures should converge and not be fundamentally different depending on the location of the managers.

Having consistent data also generates new opportunities, such as the implementation of analytical tools. Indeed, when the right data has been collected and are consistently defined, the finance team can make a relevant analysis of the data.

Data analytic tools can be equally used by controllers to review the accuracy of the financial data and also to create opportunities to better understand the performance of the funds (i.e. per deal, per geography) and identify the areas and costs that have a negative impact on the fund performance. The measurement of the various components of return is the first to take action on the right levers and improve the fund performance.

As a whole, this landscape requires finance teams to take a broader, long-term view of their strategic priorities, rather than just focus on compliance and record-keeping. This will allow the CFOs to make the right investment as the implementation of new technology can be costly.

We have noticed that the best managers focus their reporting on core key performance indicators and strike a fair balance between speed and accuracy.

EY Luxembourg’s Michael Hornsby is partner and head of EMEIA asset management real estate. Renaud Breyer is executive director

©2017 funds europe