While some companies have been stymied by Japan’s low or no-growth environment, others have learnt to thrive, finds Fiona Rintoul.

“It’s important not to buy into the Western press’s view of Japan,” says Michael Stanes, investment director at Heartwood Investment Management.

In this market like no other, there is perhaps no better advice for potential investors. It’s not that the scare stories about Japan’s declining population and economic stagnation are untrue; with the Japanese population destined to fall from 130 million today to 90 million in 50 years’ time if current birth and mortality rates persist, they are all too true. It’s just that these problems are not new.

“Population stagnation and specifically a decline in the working-age population has already been going on for years,” says Michael Lindsell, joint founder and portfolio manager at Japanese and UK equity specialists Lindsell Train. “Nominal GDP is now at about the same level it was 20 years ago and coincidentally, so is the stock market.”

While some companies have been stymied by this stagnation, others have learnt to thrive in a low or no-growth environment that is by now familiar.

“It is important not to confuse investing selectively in a stock market with investing in an economy,” says Lindsell. “Within the stock market there are some wonderful companies, some that are unique in their fields that we expect will thrive despite the economy.”

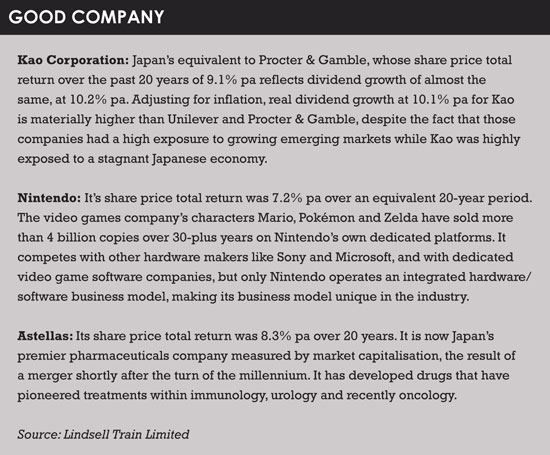

Lindsell cites the examples of pharmaceutical companies Kao Corporation and Astellas and the video game company Nintendo (see box). Kao Corp, in particular, whose share price total return over the past 20 years of 9.1% a year reflects dividend growth of 10.2% a year, demonstrates that a seemingly stagnant economy need not be a barrier to corporate growth.

“Adjusting for inflation, which has been negligible in Japan over 20 years, real dividend growth at 10.1% a year for Kao is materially higher than at both Unilever (6.4%) and Procter & Gamble (7.5%),” says Lindsell.

This is despite Procter & Gamble and Unilever’s high exposure to growing emerging markets (30%-60%) and Kao’s high exposure to the stagnant Japanese economy (about 70%).

UNLOVED COPMANY

Of course, pharmaceutical companies such as Kao Corp benefit from increased demand from Japan’s ageing population. There are other ways to play this theme too.

“People think of an ageing population as a negative, but it creates opportunities,” says Peter Jenkins, senior investment specialist at Nomura Asset Management.

As people age, they tend to shop locally, and so convenience stores have done well. So has Unicharm, a manufacturer of disposable hygiene products. It was an unloved company, producing nappies for a dwindling number of Japanese babies, says Jenkins. However, it has successfully diversified its business by embracing both exports and elderly consumers.

“It had a new lease of life from people in China flocking to buy anything related to childcare. Then you have people in their 80s and 90s needing nappies. The nappies are bigger, and they need them for longer.”

These kinds of scenarios underline an interesting point about Japan: it demands a reassessment of what growth is. The population is not growing. GDP is not growing – or not much. But alternative measures do reveal growth. For example, GDP per capita is growing at around 2%-3% a year.

“The case for Japan has never been about changes in demographics,” says Stanes.

“It’s an economy that struggles to grow at a fast rate, but it is doing a good job of growing per-capita GDP.”

That GDP-per-capita growth is one reason why some companies are flourishing on a flat stock market. The Japanese story is partly about sectors that can do well in Japan’s unique landscape. Naoki Kamiyama, chief strategist at Nikko Asset Management, sees opportunities in robotics – where the ageing population is again a factor – new types of materials (such as carbon fibre), and autos and machinery.

Of course, some may fear that Japan’s export-oriented auto sector will stumble on the rock of protectionism from the Trump administration. Most professional Japan investors are not seriously worried about this, however, although they concede sabre-rattling from the US may create short-term noise.

Of course, some may fear that Japan’s export-oriented auto sector will stumble on the rock of protectionism from the Trump administration. Most professional Japan investors are not seriously worried about this, however, although they concede sabre-rattling from the US may create short-term noise.

“Rhetoric or threats can unnerve investors, but the US has spent a lot of money in Japanese auto manufacturing,” says Stanes. “Japan’s place as an important producer of high-end goods will not change.”

CORPORATE GOVERNANCE

But sectors are just part of the story. Perhaps the biggest single reason to invest in Japan is what Kamiyama says are efficiency improvements. The way Japanese companies are managed is changing with more attention paid to shareholders.

“In the 1990s, shareholders were viewed as a distraction rather than stakeholders,” says Stanes. “Now return on equity is hitting new highs, reflecting improved corporate management structures.”

Recently the focus has been on corporate governance. This follows the introduction of the Stewardship Codes for institutional investors in 2014 and Corporate Governance Codes as one aspect of rules for listed companies.

“Corporate Japan has started really communicating with shareholders,” says Kamiyama. “Although in the early stages, we feel confident that more frequent and meaningful discourse will lead to higher margins and [return on equity] in the next few years.”

People argue about the influence of prime minister Shinzo Abe’s policies (‘Abenomics’) on this process and even whether Abenomics exists.

But there can be no doubt that the government is encouraging companies to reform.

“There’s a lot of official pushing to get companies to up their game,” says Jenkins.

In some cases, whole sectors are being restructured.

Some companies have also taken steps to address the large amounts of unproductive cash on their balance sheets.

“Japanese corporates are undergeared relative to Western companies,” says Stanes. “There is plenty of scope for a more productive use of that cash. In recent years, there’s been an increasingly sensible debate in a number of companies about the role of cash.”

The pace of change is uneven, and not all companies are embracing corporate restructuring. For that reason, many Japanese companies remain cheap.

“Because they are in a market where there is a lot of dead wood, there are a number of extremely attractive companies in Japan that can compete on the domestic and international markets that are trading at relatively low valuations,” says Jenkins.

This can mean rich pickings for canny investors, particularly as the Japanese market is quite inefficient. As Japan’s share of global capitalisation has dropped – falling from around 50% in the 1990s to around 10% today – so has analyst coverage.

“A large number of companies have very little analyst coverage,” says Jenkins.

“If a company changes its spots and there aren’t hordes of analysts covering it, there will be mispricings.”

This is especially true in the small to mid-cap sector where Heartwood Investment has been building its position for some time. “Analyst coverage below the bigger companies is very thin,” says Stanes.

This means that local knowledge and a presence on the ground are essential for successful investment in Japan. Typically, foreign investors misunderstand the market and move money at the wrong times.

“It’s quite schizophrenic,” says Stanes. “There are periods when Japan performs well and foreign investors get sucked in.”

Another issue, he notes, is that in the short term, the Japanese stock market reflects currency movements. This year, the market has been one of the worst performers in local currency, but is up 6.3% in global indices because the yen has strengthened.

©2017 funds europe