We profile some of the most interesting fund launches in recent weeks and examine the performance of a product already on the market.

FIXED INCOME

FIXED INCOME

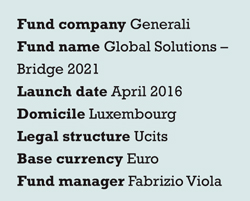

Italian asset manager Generali Investments is to launch a fixed income fund called Bridge 2021.

The fund will distribute a fixed annual coupon in its first four years (2016-20) and a floating coupon during its fifth year (2021), while seeking to preserve capital at maturity.

Its portfolio will be comprised of about 30-40 debt securities denominated in both euros and US dollars, issued by developed and emerging countries. Holdings will be split between roughly 80% developed, and 20% emerging.

Non-investment grade debt securities qualify for inclusion, although a minimum of 60% will be rated above or equal to CCC+.Generali said the fund may also invest in non-euro-denominated assets (up to 10% without currency hedging) and may use derivatives such as credit default swaps for the purpose of hedging risks and for efficient portfolio management.

The fund’s manager, Fabrizio Viola, has been promoted from the firm’s fixed income credit team, where he has worked for nine years.

Viola will also be in charge of managing corporate bond portfolios of third-party clients, as well as of insurance companies owned by the Generali group.

The firm currently manages assets of €370 billion.

EQUITY ALPHA

EQUITY ALPHA

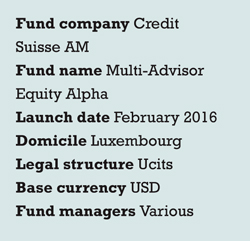

The asset management arm of Credit Suisse has launched a new equity long/short offering, the Multi-Advisor Equity Alpha fund.

The fund intends to capture the ‘best’ ideas of six external managers, specialising in different regions and sectors.

The management team will craft the overall portfolio, then report on the performance of their largest positions to Credit Suisse on a daily basis.

The firm will subsequently select the ten biggest and most liquid long and short positions respectively.

The strategy was chosen due to the firm’s belief that high-conviction trades tend to generate higher levels of alpha.

Weightings are decided by the fund’s portfolio manager in combination with a senior Credit Suisse investment committee.

The fund will be part of the Credit Suisse Asset Management Alternative Fund Solutions division, which currently manages €9 billion on behalf of retail and institutional investors.

CENTRAL EUROPEAN EQUITIES

CENTRAL EUROPEAN EQUITIES

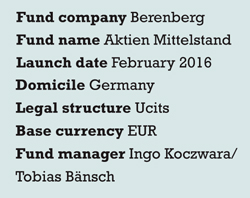

German private bank Berenberg has launched the Mittelstand fund, in co-operation with Universal Investment.

The fund’s portfolio will comprise around 25 small and medium-sized businesses in Germany, Austria and Switzerland, with a maximum market capitalisation of €5 billion.

While it uses the MDAX as a benchmark, the investment universe is open to stocks that are not included in the index. The fund is open to both retail and institutional investors.

The firm moved to create the fund due to the outperformance of smaller firms dependent on domestic consumption over many export-reliant Dax stocks in recent years.

Moreover, Berenberg finds small and mid-cap businesses attractive as they tend to be family-owned. The firm believes familial ownership increases the likelihood that firms will pursue long-term strategic targets and share common interest with shareholders.

GOLD AND SILVER

GOLD AND SILVER

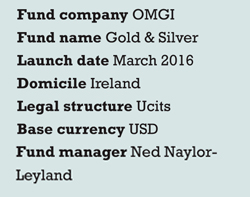

As equity markets falter and risk appetites wane, the price of gold reached a 12-month high this month – and Old Mutual Global Investors (OMGI) is launching a gold and silver fund in response.

The fund will diversify its exposure though a combination of indirect investments in gold and silver bullion, along with precious metal mining equities, identified via a bottom-up selection process.

Weightings will be adjusted at various points throughout the market cycle, to ensure portfolio balance.

Ned Naylor-Leyland, who joined OMGI from Quilter Cheviot in September 2015, will manage the fund. He will be supported by analyst Joe Lunn and investment administrator Amelia Bowyer, who also worked with him at Quilter Cheviot.

Gold prices have risen at their fastest level since the financial crisis this year, increasing by 20% since the start of the year.

While below the peak price of €1,764 reached in 2011, gold stood at €1,133 per ounce at the end of February.

With further volatility expected in global markets over the course of this year and potentially beyond, the firm believes prices will rise even further in due course, as they have in previous bear market cycles.

OMGI manages assets of around €32 billion.

ONE YEAR ON

ONE YEAR ON

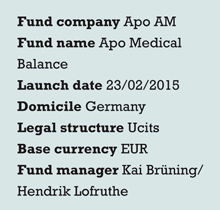

The Apo Medical Balance fund turned one this February. The fund invests in global healthcare stocks and corporate bonds, and is the first in Europe to offer this mix.

The management team takes a bottom-up portfolio construction approach and is diversified across capitalisations, regions and sectors/subsectors.

The portfolio is typically comprised of around 70 holdings; currently, 40 equities and 30 bonds.

Since launch, the fund has returned -5.21%, against an average of -10.67% delivered over the same period by the fund’s benchmark (MSCI Daily TR World Net Healthcare).

Increased M&A volumes, digital health developments, the approval of new medicines and the confirmation of ‘Obamacare’ by the US Supreme Court all contributed positively to the portfolio’s relative results.

The Chinese stock market crash in the latter half of 2015, ongoing debates about high pharmaceutical costs in the US, the global capital market crash in January this year, and euro-USD development (the fund generally hedges currency exposure and could not participate in USD appreciation in recent months) all contributed negatively to the fund’s performance over the year.

©2016 funds europe