We profile some of the most interesting fund launches in recent weeks and examine the performance of a product already on the market.

SMART BETA

SMART BETA

The current climate is proving tough for bond investors, with yields from many government and sovereign bonds falling into negative territory.

A number of providers are now responding to this atmosphere by offering new options for achieving a return. Paris-based Lyxor Asset Management has stepped up to the table with the launch of a commingled bond product, the Lyxor EuroGovies Risk-Balanced Fund, which is available to European investors.

Currently focused on an area it labels ‘active smart beta’, the firm is exploring risk- based strategies which allocate to high-quality liquid assets. The approach aims to generate improved returns, compared to more traditional approaches, while minimising downside exposure.

The fund was offered to banks in November 2014 and after a good reception is now available to the wider institutional market.

In light of ongoing bond market trends, Lyxor sees new smart beta products as a major theme for the coming year, helping institutional investors to meet their funding goals. It has $8.5 billion (€7.6 billion) within these strategies, across equity and fixed income.

LIQUID ALTERNATIVES

LIQUID ALTERNATIVES

Halcyon Liquid Strategies Ucits Management, an affiliate of alternative investment firm Halcyon Asset Management, has teamed up with Guggenheim Partners, a global investment and advisory firm, to launch the GFS Halcyon Liquid Opportunities Fund, a catalyst-driven Ucits fund domiciled in Ireland.

The fund aims to identify public equities where there may be structural market inefficiencies or opportunities for asymmetric returns. It will employ a range of strategies including long/short, relative value and liquid credit, and will also offer weekly liquidity.

The fund launches with more than $40 million in capital on the Guggenheim Fund Solutions platform, a technology and risk management infrastructure for operating alternative Ucits funds, with a focus on the industry’s increasing demand for greater transparency.

Todd Solomon, co-portfolio manager of the fund, says the launch is a direct response to demand for Ucits strategies that attempt to capture equity upside but limit the downside. Halcyon continues to grow its liquid alternatives business, which started in 2014 and now manages more than $200 million.

CAPITAL GROWTH

CAPITAL GROWTH

JP Morgan Asset Management (JPMAM) has launched a new Sicav strategy, JP Morgan Funds – Global Capital Structure Opportunities, with a focus on generating capital through a diversified approach to investing in high quality companies. The Global Capital Structure Opportunities Fund aims to provide capital growth, by seeking out the most appropriate instrument within a company’s capital structure. It will use bottom-up security selection to identify exposure that offers the best risk/reward profile.

The fund will take an unconstrained, flexible approach to investing in corporate names, and will balance allocations across different instruments, including equities, convertibles, corporate bonds, and cash. It will invest in a diversified range of high conviction companies from different regions and sectors, and will target a return of 2% over its benchmark.

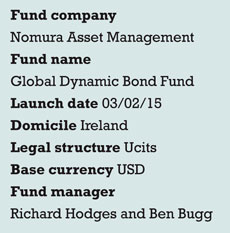

FIXED INCOME

FIXED INCOME

A diversified approach within the fixed income space is offered by Nomura Asset Management through its new Global Dynamic Bond Fund. Unconstrained by benchmark allocations, the fund aims to generate total returns by investing across a range of fixed income securities.

The fund uses top-down analysis of macroeconomic and market themes to construct a portfolio of cash bonds, which account for at least 80% of the strategy’s assets.

Nomura says allocations will look to take advantage of expected changes in markets, with the fund’s diversification allowing greater flexibility to invest across all fixed income assets, including convertible bonds and local currency instruments.

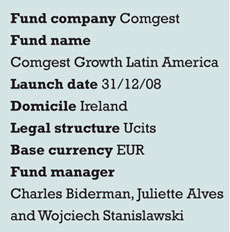

ANNIVERSARY

ANNIVERSARY

The Comgest Growth Latin America fund has celebrated its five-year anniversary, with assets under management of €50 million. It has returned 1.68% since inception, outperforming the MSCI Emerging Markets Latin America index, which has returned -1.97% in euros as of January 31, 2015.

The Comgest fund is also rated five-stars by Morningstar and was in the first quartile over five years, according to Morningstar data on Latin American equities.

Comgest says this strong performance is due to positions in fast-growing companies, purchased when they were at an inflection point. The firm has conviction in companies such as Brazilian dental services firm OdontoPrev, which has double-digit earnings growth and delivers a 5% dividend yield

Juliette Alves, portfolio manager for the fund, says: “Generally speaking, the fund does not succumb to unjustified periods of euphoria and is resistant in declining markets, which has led to outperformance of the index.”

©2015 funds europe