The twin regulatory requirements of greater transparency and asset segregation create tough challenges for distributors, fund managers and their asset servicers. A processing model based on a single omnibus account is looking less and less suitable.

The compliance challenges faced by fund managers and distributors have multiplied in the past five years. In an era of increasing cross-border distribution, ‘know your customer’ (KYC) rules have put a premium on transparent information flows between distributors, transfer agents and fund managers. Gone are the days when the interchange between the different parties focused solely on the sales effort. Today, regulatory compliance issues play a major role in the relationship.

Key among those issues is investor suitability. For example, the fund manager needs to be assured that an incoming order is from an end-investor resident in a country where the fund is authorised for sale. Where there are retail and institutional fund classes, it is vital that sales are accepted only from eligible investors. Ideally, this must be done at the pre-trade stage. Unwinding mis-sold transactions can be costly while regulators may come down hard on any failure to comply.

“Legal responsibility for investor suitability lies with the fund manager. But, in practice, the fund manager delegates the checking process to the distributor as part of the distribution agreement,” says Lieven Libbrecht, Investment Fund Product Manager at Euroclear. “However, the fund manager must be able to demonstrate to the regulator that the distributors have the processes in place to fulfil the investor suitability and KYC checks.

“Fund managers argue that where the distributor is a bank it is inevitably covered by KYC rules and therefore has an obligation to identify the source of funds whenever there is a cash transfer. In reality, this is a shared problem – fund managers and distributors are in this together,” he argues.

A bigger challenge arises when an order comes in from either an unauthorised distributor or another intermediary such as a transaction bank. Fund managers need to know that mechanisms are in place that prevent an unauthorised distributor or other party from executing a trade until the relevant suitability checks have clearly been done. And that requires a fund processing system that is capable of intervening at the critical pre-trade stage and offers transparency throughout the fund processing cycle.

The push for transparency is coming from another direction, too. In the wake of the Lehman collapse, many institutional investors have been demanding full asset segregation from their custodians. While the co-mingling of assets in an omnibus account may not, in practice, endanger the investor’s title to the holdings if the custodian goes bust, getting speedy access to those holdings is another matter entirely. There should be no such problems with segregated accounts.

Steve Libby, a partner at PwC who leads the firm’s asset management practice in Luxembourg, says: “Both investors and regulators are imposing reporting and segregation requirements on depository banks and across the distribution chain, largely arising from the inability to distinguish between client assets following the Lehman collapse. All this creates requirements for a transparent distribution chain and greater, more flexible account segregation which the traditional omnibus approach will be challenged to meet.”

The challenges will only increase. The liabilities imposed on depositories by both the AIFMD and MiFID V are encouraging segregation at the sub-custody level. The demand for ever more detailed reporting by tax and other authorities is another prompt in the same direction.

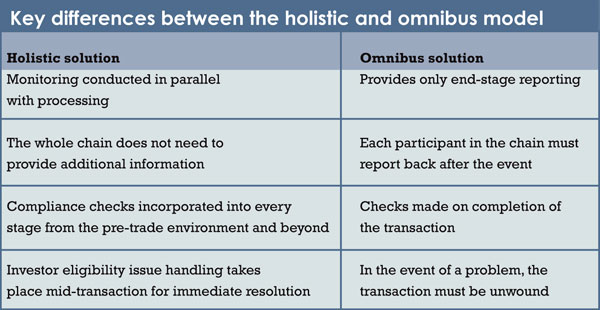

The answer is a holistic solution that uses a segregated account system stretching from the beginning to the end of the fund life-cycle with inbuilt compliance checks at every stage. Fund managers have a number of sub-accounts, each corresponding to a different distributor or institutional investor. No unauthorised distributor can execute an order until the fund manager has approved the opening of a new account at its transfer agent in that distributor’s name, thereby minimising the potential for ineligible investors in the system. The whole life-cycle of each transaction has its own work stream and every party can see what stage the transaction has reached. Errors are immediately visible and easy to trace and correct.

By contrast, the omnibus model requires a parallel system of reporting to deliver the information fund managers require. Most crucially perhaps in the funds context, that reporting can only come after the event. The only way of dealing with an ineligible investor is to unwind the transaction. Having to explain to a distributor why their investment has been rejected can not only be embarrassing but may jeopardise a potentially important relationship.

When built out from a dedicated fund infrastructure – as Euroclear has done – the holistic fund processing solution also delivers the segregation that market participants are increasingly looking for. As importantly, it provides the transparency that regulators are demanding.

It also delivers efficiency and speeds up processing for both manufacturers and their distributors. It eliminates the frictional cost of manual intervention required to populate post-facto messaging and no investment in new infrastructure is required. Finally, such a holistic solution fits with any back office set-up to handle listed bonds and equities.

A solution bringing transparency to all stages of the transaction life-cycle confers several important advantages. As well as satisfying regulatory demands, it improves the accuracy of the information collected and the resilience of the system to errors.

“A higher level of transparency means distributors are more likely to be paid correctly and on time as the fund manager has a clearer picture of when and to whom new fund units have been sold,” says Mr Libbrecht. “In addition, fund managers can more easily see which distributors are outperforming their peers, where and over what timescale.”

But it is the potential cost advantage that many back office managers will see as compelling. The twin regulatory requirements for greater transparency and clearly segregated client assets come at a challenging time for all involved in the fund distribution chain. In many cases, competitive pressures have shifted the focus from cost containment to cost reduction. The principal means for this reduction is structural transformation, and the back office has become a particular focus for this activity.

The omnibus platform, built to support bonds and equities, faces a challenge when it is asked to meet the demands of today’s funds industry. It requires a variety of adaptations in order to provide fund managers the visibility they require over each transaction. A series of independent processes must be bolted together. The vital checks come only at the end of the process. For any organisation with a worthy compliance function, this would seem less than ideal. With recent regulation around transparency and segregation, friction has intensified. The result is lost efficiency and added cost.

There is one other key benefit to the holistic model. Rule-makers are becoming ever more demanding. Being able to demonstrate full transparency and control in a segregated processing environment ensures a degree of future-proofing the omnibus solution cannot claim. The regulators’ drive for ever tighter controls and fund managers’ need for increased operational efficiency need not be in conflict.

©2015 funds europe