Since Sifs were launched to attract hedge funds to Luxembourg, over 100 specialised vehicles have been given clearance. But Dublin is still ahead, finds Angelique Ruzicka

Dublin should be watching with interest the increasing appeal of specialised investment funds (Sifs), which were launched by the Luxembourg regulator in February this year. The new law is expected to attract more hedge funds and their administrators to set up shop in Luxembourg instead of the favoured alternative European jurisdiction, Dublin, because the new law is more flexible and allows funds to be set up more quickly.

“It’s Luxembourg’s attempt to set out a stall for alternative vehicles, where Dublin steals the March. Luxembourg’s response with the Sif structure is a good one,” says Ian Hoddy, vice president and senior product manager of T. Rowe Price, in Luxembourg.

says the new law has been welcomed by the industry. “Sifs have been well received so far and this is not surprising because it has been drafted to make it compliant with market expectations and the market has a very favourable perception of this new legislation.”

Increased flexibility

According to Alfi, in excess of a 100 Sifs have been launched in Luxembourg or are in the process of being launched pending approval. In June this year, more than 20 of these vehicles were launched. “I think it’s a very positive number after this short period of time,” says Kremer.

Sifs have a number of improvements over the funds that were created under the 1991 law. Companies launching Sif funds will be able to target a broader range of eligible investors, provided they are well informed.

“The main point of the new law is that it has increased the flexibilities. The scope of relevant investors has been enlarged from institutional investors to include professional investors and also private individuals who can contribute more than e125,000. So the new Sifs can be sold to a large circle of investors as opposed to the old institutional funds,” says Kremer.

An added benefit of the new law is that it no longer requires that promoters be approved by the Commission de Surveillance du Secteur Financier (CSSF), the Luxembourg regulator. Kremer acknowledges that this created problems in the past and got in the way of perfectly legitimate players manufacturing funds in Luxembourg. “This was an impediment as it prevented small but reputable players in the market from accessing the Luxembourg domicile. Despite being skilled, honourable and reputable they did not meet the financial conditions imposed by the CSSF,” says Kremer. The law does, however, still require that the directors, custodian bank and the auditor be approved by the CSSF.

The third improvement is that the new law has a more flexible approach regarding risk diversification rules and it does not impose any quantitative investment restrictions. “The risk diversification principle is still an inherent principle of the Sifs because that’s inherent to any type of fund but we do not have any explicit and quantitative investment restrictions in the new statute, neither will we get explicitly quantitative rules from the CSSF so every fund manager is free to define his own interpretation of what he believes is an appropriate risk diversification in the given product,” says Kremer. But he is quick to add: “That does not mean that fund managers may do anything, but the CSSF will look into these methods on a case-by-case basis because no pre-established guidance notes or other legal requirements would represent an impediment to this.”

Fund management firms also benefit from having their funds further fast tracked under the new law. “It’s a surprising move by Luxembourg to allow no regulator approval to launch a Sif fund. It’s a huge headache normally as you have the client on the one hand demanding more now, but you have to go at the pace the regulator sets,” says T. Rowe Price’s Hoddy.

Proper approval procedure

But Kremer still encourages fund creators to go through the proper approval procedure. “Theoretically, you can launch your fund and then submit it for approval to the

CSSF. In practice that is not recommended, as sometimes the investment policy may be specific, new or unusual, so it’s always a good idea to consult the CSSF on any critical points. But if there aren’t any points and if the fund is merely replicating another fund as a clone or as a mirror fund, and it was approved recently by the CSSF, there is no reason to go through the pre-approval procedure as one can take it for granted that the fund will be improved,” he says.

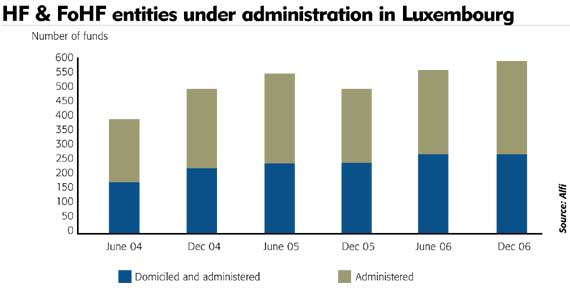

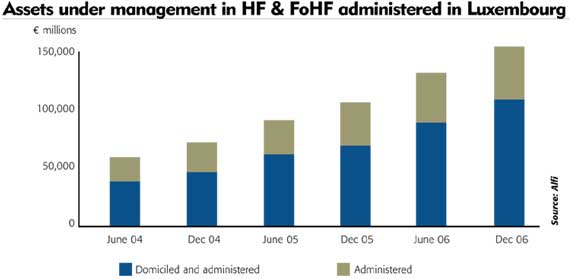

While the new law certainly allows managers to create tailor-made funds for high-net-worth individuals and institutional players, Luxembourg still has a lot to do to entice alternative business away from Dublin. Ireland is still the preferred domicile for launching alternative investments and recent figures by the Irish Funds Industry Association show that the number of funds (including sub funds) has risen to 4,728 in January 2007 from 3,020 in June 2005 and that the net asset value of alternative investments now stands at e771bn. Meanwhile, Luxembourg struggles to attract alternative players. December 2006 figures show (see tables) that only 257 funds were domiciled and administered in Luxembourg and a further 313 were only administered in the jurisdiction.

Manufacturing top spot

Luxembourg can claim, however, to be the number one jurisdiction where funds are manufactured in Europe. Kremer admits that if it wants to hold this top spot and steal alternative investment business from Dublin, Luxembourg will continuously have to watch its back and adapt its regulation constantly. “You always have to watch competitors, the worst is to underestimate them. We watch what happens in other domiciles and indeed we need to make sure that they [other jurisdictions] don’t offer more flexibility than we do and if so we would have to catch up and imitate them.”

Hoddy does expect some action from Dublin, especially if Sifs continue to do well. “I don’t think either centre can afford for the other to get too far ahead in the competitiveness of various structures, they are always very close and it’s difficult to choose one over the other. Gaps like this are usually closed quickly.”

Certainly, Dublin is currently Luxembourg’s main rival. Together, they seem unstoppable – they have become the two main manufacturing countries in Europe – and 90% of all funds in Europe come out of Luxembourg or Dublin. “This gives us a comfortable position, but that doesn’t mean that it will remain like this indefinitely in the future,” says Kremer. “We have to watch out and try and maintain this position.”

© fe September 2007