With at least 27 different pieces of regulation challenging the investment fund sector, our roundtable looks at how participants have been preparing. The panel also criticises co-ordination between major regulators. Chaired by Stefanie Eschenbacher.

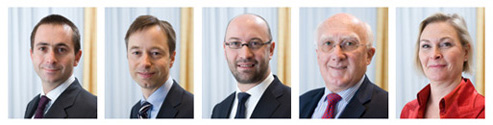

Denise Voss, vice chairman (International Affairs, Association of the Luxembourg Fund Industry)

Vincent Heymans, partner (advisory) KPMG

Michael Ferguson, asset management leader (Ernst & Young)

Jon Griffin, managing director (JP Morgan Asset Management)

Thibaut Partsch, partner (Loyens Loeff)

Jean-Florent Richard, partner (Vilret-Avocats)

Funds Europe: The Key Investor Information Document (Kiid) has been a major challenge for asset managers both in terms of implementation and upkeep. What can be done to help asset managers producing this essential document?

Griffin: We have had a project running for more than a year dealing with the various aspects of Ucits IV. Obviously, producing the Kiid has taken a lot of effort and resource in understanding the prescribed elements of the document and then getting all the necessary investor information on two sides of A4 in all relevant languages. At the end of this month, we are planning to release around 16,000 of these documents. It has introduced a whole new business process for us, it has also introduced new providers into the market who help in handling the document. We have had to recruit individuals for what we call ‘Kiid control’ because the document is very different from the simplified prospectus that it replaces.

We have engaged with our distribution base to make sure they understand what their requirements are and to see how they would like to receive it – paper, electronic, via websites or bespoke portals. The new industry around it brings new cost, which is either absorbed

into the current pricing of a fund or potentially passed to clients.

Heymans: The challenge ahead is the dissemination of the Kiid. Many distributors are totally unprepared to receive so many and to propose them to investors. In the months ahead they will start receiving thousands of them. The responsibilities and liabilities of the management companies should concern us.

The distributor is the weakest link in the chain. The producers of funds have tried to help end investors take an informed decision. Now I hope that the legislation around distribution will be reinforced in a way that distributors will be made to advise an investor properly and not just tick a box saying they have given them a Kiid.

Voss: The Kiid-like documents that have to be produced in Asia or elsewhere – so-called Kiid cousins – are a challenge as well because the requirements are different from those of the Ucits Kiid.

But the requirement to produce a Kiid and these related documents has been an opportunity to re-engineer the process around the production of many investor-focused documents, including fund fact sheets. It has been an opportunity to stand back and look at the way fund groups are organised and the way systems speak to each other. From an asset management perspective, it meant going out and re-engaging with distributors. So one can say that, even in the short-term, the Kiid exercise has had its positive elements as well.

Ferguson: The cost of production, dissemination and so on, has exceeded expectations, some industry players have indicated that the Kiids will end up costing them double that of the simplified prospectus. The real issue here is the longer term impact. Will this greater transparency and so on lead to better comparative analysis between competing products and ultimately product consolidation and lower costs?

Funds Europe: The amount to cover the potential risk required under the current proposals for depository liability under Ucits IV has been criticised as disproportionate. What is your stance?

Partsch: Once again, the European Union is placing too much obligation on the custodian banks, as it does with the Aifm directive, and this will entail costs to both banks and investors.

It seems that the European civil servants have overlooked the real functioning of the custodians. A credit institution will always hold securities indirectly through national central depositories, and none of them can have a control on each of the credit institutions in the chain of holding. Also, creating direct right of actions against custodian banks creates more questions than it solves during the liquidation procedures of funds. If the liquidator has already sued a custodian bank, can the investors also sue in parallel, which would imply a double counting of the same liability in the banks’ balance sheet?

Ferguson: There is certainly a lively discussion going on around the depository provision and it’s unclear whether the European Commission will accept all the Esma [European Securities and Markets Authority] advice on the depository role or attempt to make the liability provisions more strict. As to what all of this may mean for Ucits, we do expect Ucits IV to include a tighter version of the Aifm directive depository provisions.

Having said all this, the unintended consequences of certain regulations such as Ucits IV, Ucits V and the Aifm directive are perhaps not always fully thought through. This does then give rise to issues such as the current Aifm directive depository discussion where you may have key players exiting the industry. This could well result in greater, not less, systemic risk.

Heymans: For Ucits to be fully effective we would need a review of the taxation of management companies and of funds. So far, this is one of the most significant difficulties that the industry has to consider when it comes to rationalisation of funds and eventually of management companies.

Ferguson: If we want some of this regulation to be transformational, I would agree. Ideally, some form of a tax-neutral regime in order to facilitate cross-border mergers, the creation of cross-border management companies and master-feeder structures especially to tidy up legacy entities created over the past 20 years.

Funds Europe: Fatca requires foreign financial intermediaries holding accounts that belong to US clients and/or to access the US market to sign an agreement with the Internal Revenue Service or apply a 30% withholding tax rate on all US-sourced payments and income. How will this affect Luxembourg’s fund industry?

Griffin: We are currently waiting for the draft regulations which should be out when this article is published. In which case, it will be a matter to review and understand them in detail. As this applies globally Luxembourg is really no different from other countries in having to deal with the complexities of Fatca.

The industry has been active on this for the past two years in terms of lobbying, direct engagement with the Inland Revenue Service and the US Department of Treasury so, hopefully, this dialogue will bear fruit in ultimately having sensible, practical and implementable rules.

However, it does open up the world to Fatca-like legislation from other countries which would be very complicated for domiciles like Luxembourg that have such an international distribution base for their funds.

Voss: But would you agree that over the past several months the whole discussion has transformed a bit because, finally, politicians have started discussing it?

Griffin: It has been raised to the level of the European Commission, so Michel Barnier’s [a member of the European Commission, responsible for internal market and services] cabinet is aware and concerned in terms of the impact on the European financial industry.

Voss: It took a while.

Griffin: It seemed like it took a very long ‘while’ to get traction and focus, and that underlines my point about effective lobbying. In the early days it appeared that the thinking was generally that Fatca was ‘that US thing over there’ and was only a general tax matter as opposed to being a more serious and pressing business issue. Volcker, in respect of the ‘covered funds’ issue, has received attention more quickly in Europe which is important due to the short lead-times involved.

Ferguson: Don’t you think that in terms of lobbying and getting your voice heard, since the regulators were primarily concentrating on trying to solve the banking crisis, the voice of asset management industry got lost somewhere in the wilderness?

Griffin: I totally agree with that. The commission has been quite clear on saying that it needs to hear more from the buy side. Efama [European Fund and Asset Management Association] does an excellent job but with limited resources if you consider the overall size and scale of its membership coverage. It has great relations with the commission and it needs it members to contribute time, effort and expertise to make an impact. Alfi is probably similar in size staff-wise to Efama.

Voss: Yes, that is one reason Alfi has a lobbyist in Brussels and recently added a second person.

Not that two is necessarily enough, but at least we have doubled the resource.

Griffin: ICI Global is a new voice representing the global asset management community which has been very active recently, particularly on Volcker.

Ferguson: I guess many of the asset managers in Europe, which are either owned by the banks or insurance companies, also have a lesser voice in the overall bigger corporate scheme of things?

Griffin: Asset management businesses as fiduciary business will always be separate from the bigger investment banking divisions in larger banking groups. They have different voices at the table.

Partsch: And the problem with EU regulations for the moment is that they are self-referential. When they think they have solved issues in the credit institution context with a certain type of regulation, they think they can basically ‘copy and paste’ their bits and pieces into other areas. That is what we’ve seen with the Aifm directive. They have basically copied the Ucits rules without even looking at what an alternative investment fund was.

I think that education about what happens outside Brussels is more and more crucial because officials are not necessarily aware of what happens in the alternative funds industry.

Funds Europe: Is the EU starting to get to grips with understanding the fund management industry or is there still a lack of understanding by legislators meaning an educational process still has to take place?

Voss: Education is still as much an absolute requirement as in the past. I do not think that has changed at all. Given the amount, the volume and the interconnectedness of it all, we have had to focus even more on educating the commission, the parliament and the council.

Griffin: At the moment the education is on the basis of a consultation. It is our job to take time to engage and to explain our business in order to help shape useful regulation.

Voss: Yes, it is reactive, not proactive. We are lucky when there is a representative in the parliament for a particular piece of legislation who does have experience or interest in the industry. But that is unfortunately not always the case.

©2012 funds europe