Funds Europe examines the most interesting funds recently unvieled and profiles several including offerings from Smith & Williamson, Jupiter, Amundi, Ashburton and Pimco.

VALUE IN EM

With emerging market asset prices depressed owing to doubts about macroeconomic factors, now could be a good time for a value investment approach, according to Smith & Williamson Investment Management.

Its new Emerging Markets Value Fund will invest between 50 and 90 stocks with market capitalisations of at least $500 million (€367 million), according to a screening process examining prices, price-to-earnings ratios and dividend yields.

Its new Emerging Markets Value Fund will invest between 50 and 90 stocks with market capitalisations of at least $500 million (€367 million), according to a screening process examining prices, price-to-earnings ratios and dividend yields.

Richard McGrath, portfolio manager, says the long-term prospects for emerging market assets remain attractive. With his fund’s screening process, “We should be able to identify stocks that have short-term difficulties but ultimately have strong core businesses which will drive a recovery in their financial results and share price”, he says

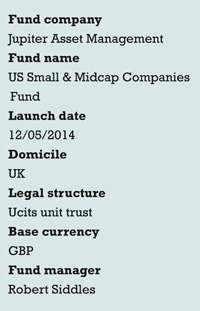

SMALL CAPS STILL CHEAP Although some have wondered if the US equity market is due for a correction, fund manager Robert Siddles believes the mid- and small-caps are still good value.

Although some have wondered if the US equity market is due for a correction, fund manager Robert Siddles believes the mid- and small-caps are still good value.

The Jupiter US Small & Midcap Companies Fund aims to invest in between 50 and 75 stocks with market capitalisations of between £100 million (£123 million) and £5 billion out of a universe of about 3,000. “Small cap share valuations remain well below their 2000 peak and there are still many companies which, in my view, have the ability to perform,” comments Siddles.

Siddles joined Jupiter in January from F&C, where he managed the US Smaller Companies Investment Trust.

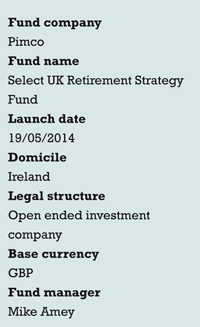

HOPE FOR ANNUITIES? The decision by the UK Chancellor George Osborne to scrap the effective requirement for pensioners to buy an annuity on retirement did not stop Pimco from launching a fund that is aimed at preparing savers for such a purchase.

The decision by the UK Chancellor George Osborne to scrap the effective requirement for pensioners to buy an annuity on retirement did not stop Pimco from launching a fund that is aimed at preparing savers for such a purchase.

The Pimco Select UK Retirement Strategy Fund seeks to replicate factors that underpin annuity prices so that savers in the UK can get the maximum from their retirement purchase.

“For most investors, the few years before retirement are when their pension savings are at their highest but also most at risk from irrecoverable losses,” says Mike Amey, fund manager.

Annuity providers report reduced demand since the chancellor’s decision. Standard Life, a Scottish insurance company, said in August that its sales of annuities halved following Osborne’s announcement.

CURRENCY ALPHA Investing in currencies can be an additional source of alpha when actively managed according to portfolio risk targets, says Cédric Morisseau, manager of the Amundi Funds Global Macro Bonds and Currencies fund.

Investing in currencies can be an additional source of alpha when actively managed according to portfolio risk targets, says Cédric Morisseau, manager of the Amundi Funds Global Macro Bonds and Currencies fund.

As well as currencies, the fund can invest in government and corporate bonds and takes an absolute return approach.

“A traditional long-only benchmarked approach typically provides investors with low returns and exposes them to asymmetrical downside risk,” Morisseau says.

“With our absolute return concept, bond exposure is managed to target positive returns, even in declining markets,” he adds.

ONE YEAR ON Frontier markets have been in vogue as investors have shifted their money out of troubled emerging markets, such as India and China, and put it to work in fast-growing economies which aren’t burdened with debt and current account concerns.

Frontier markets have been in vogue as investors have shifted their money out of troubled emerging markets, such as India and China, and put it to work in fast-growing economies which aren’t burdened with debt and current account concerns.

Ashburton’s launch of an Africa opportunities fund at this time last year could well be seen as prescient timing.

As Paul Clark, the lead adviser of the fund, said at launch, seven of the ten fastest growing economies in the world in the next five years will be in Africa.

The institutional share class of the Ashburton Africa Equity Opportunities Fund has rewarded its investors with performance of 16% since launch, compared to 11% for its benchmark, the MSCI Emerging Markets Africa ex South Africa index. The retail share class, which launched earlier has returned 11% compared to a benchmark return of 2.6%.

However, a press representative for the company said they didn’t have sales figures “to hand”. The fund size was $35 million (€26 million) as of April 30.

©2014 funds europe