Business expansion is high on Asian asset managers’ to-do lists, but regional stability and a strong balance sheet are essential before taking the first step, claim our roundtable of experts. Chaired by Stefanie Eschenbacher.

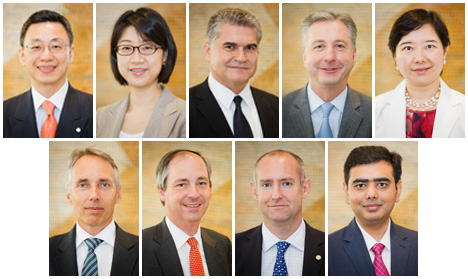

King Lun Au, chief executive officer, Bank of China (Hong Kong) Asset Management)

Iris Chen, chief executive officer, China Asset Management (Hong Kong)

Andrew Economos, managing director and head of sovereign institutional wealth strategy, JP Morgan Asset Management

Stewart Edgar, chief executive officer, BNP Paribas Investment Partners Asia

Ting Li, head of Asia ex Japan, State Street Global Advisors

Graham Mason, chief executive officer, Eastspring Investments

Blair Pickerill, head of Asia Nikko Asset Management

Ben Rudd, executive director, head of overseas investment at Ping An Asset Management (Hong Kong)

Shashank Srivastava, acting chief executive officer, Qatar Financial Centre Authority

The Qatar Financial Centre Authority (QFC Authority) is proud to present the latest Executive Panel in the series of discussions organised in partnership with Funds Europe and Funds Global.

Each panel looks at the core issues affecting the industry and includes some of the leading chief executive officers, chief operating officers and chief investment officers from companies driving the industry forward and shaping change. Many topics discussed are core to the QFC Authority’s beliefs: efficiency, transparency and integrity. It is the QFC Authority’s goal to build a world-class financial services marketplace where all participants, both domestic and international, will benefit from the considerable local market potential which they can use not only as a springboard into other countries in the Gulf Cooperation Council, but also as a powerful regional base from which to tap into the broader growth markets of the Middle East, north and sub-Saharan Africa and the Indian sub-continent.

By supporting and participating in these initiatives, we hope to gain valuable insight into the future development of the global fund management sector and help us to realise our own aspirations to become a regional hub for asset management within the Mena region.

Funds Europe: Which international markets offer Asian asset managers the most compelling opportunities in terms of business expansion?

Graham Mason, chief executive officer, Eastspring Investments: For asset managers with pan-Asian businesses, the easiest first step is moving into the UK and Europe, at least from a retail point of view, because Sicavs are recognised in these markets. Institutional is a different proposition, though, because the asset consultants are the key intermediaries and they have a global presence.

There are opportunities for institutional mandates world-wide, whether the funds are headquartered in the Middle East, the UK or Europe. The order of sequencing for institutional opportunities are, therefore, broader than for retail funds.

Blair Pickerill, head of Asia Nikko Asset Management: Those headquartered in the outlying countries of Asia might first consider setting up an office in Hong Kong or Singapore. Coming from, say Korea or Taiwan, it may be easier to set up a Ucits or Sicav in Hong Kong, rather than trying to go straight to London or Paris. We have had offices in London and New York for over 20 years. In the past few years we have converted ourselves from being a Japan-based asset management company into a truly regional asset management company. We first went to Singapore and China, and more recently to Australia, New Zealand, Malaysia, and Hong Kong.

How to expand in Asia depends where asset managers are from, what they are trying to accomplish, balance sheet strength, and also cultural fit.

Stewart Edgar, chief executive officer, BNP Paribas Investment Partners: Many asset managers have failed when they tried to expand beyond their home markets. Asset managers have to consider their key capabilities, what value they can add for potential clients and if there is demand for their products outside their home market. The institutional route is probably longer, but more likely to pay back. Using consultants means not having to set up the offices, the infrastructure for distribution and everything else.

Tapping into new markets as a newcomer is expensive. Another option is aiming to become a regional specialist product, though this is unlikely to build a global business.

Ting Li, head of Asia ex Japan, State Street Global Advisors: Asian asset managers should probably start from their home base, whether it is China, Hong Kong or another country. Being able to compete with global players is only possible with a strong regional product.

Iris Chen, chief executive officer, China Asset Management (Hong Kong): For most Asian companies, probably with the exception of Japanese ones, the natural base would be Hong Kong.

There is a limitation for the Asian managers, and the products they are trying to sell, because most of them are only very good in the country they are based in. We have an Asia team but can we compete with a company like JP Morgan Asset Management? The majority of Asian asset managers wanting to expand globally will likely fail because the conditions in Asia are different from the rest of the world. There are so many global fund houses already in the market, which is difficult for Asian asset managers to compete. We just have to be very good at what we are doing. The only area where we have a competitive advantage is China, where we know every part of equity, bond, and even alternatives.

Ben Rudd, executive director, head of overseas investment at Ping An Asset Management (Hong Kong): We have always been institutional managers. We have managed our own capital for a long period of time, so we are able to show those skills and that ability to other institutional investors. Whereas the problem, as we see it on the retail front, is each market is different. The only way asset managers are able to break into a completely new retail market is if they have a local partner, which can act as a sales conduit. Otherwise, the amount of money necessary to create a platform and a sales force would be prohibitive.

Andrew Economos, managing director and head of sovereign institutional wealth strategy, JP Morgan AM: Success is down to sequencing and staging, which is critical. Knowing strengths and competitive advantages is also key. Whether asset managers use a third party sales relationship or another distributor, the most important factor is building a brand and a sound track record.

There are just too many of us in the business right now and it is hard to get any kind of shelf space from the distributors or any kind of mind share from the investors themselves.

Chen: Global distribution channels are difficult to access for Asian asset managers, whether these are private banks, retail banks or fund platforms. Even when we tried to work with a third party, we struggled to form a partnership. Selling things through someone is not a real partnership; it means asset managers pay distributors to sell their products. A partnership, however, is a little more than that.

Edgar: Asset managers that aim to sell the same product that is already widely available, will struggle. They will have to offer something new or different.

Chen: Even though we are one of the oldest asset managers from China, and currently the largest, we struggled to gain investors’ trust at the beginning. It will take a few years for people to feel more comfortable with Chinese asset managers.

Meanwhile, we need to prove we have investment philosophies, strategies, process, trading systems, complaint procedures and risk management tools as global asset managers.

Edgar: With our joint venture, which we established years ago, our strategy was to be the first to get a rating from Fitch. The rating gave us credibility when it came to approaching international investors.

King Lun Au, chief executive officer, Bank of China (Hong Kong): We have been around for just 15 months, but have already won several mandates.

Asian asset managers have a once-in-a-lifetime opportunity in Hong Kong because of the internationalisation of the renminbi and the rapid development of the offshore renminbi bond market. We have managed to build a track record for our offshore renminbi bond funds. We have also benefited from the prestige brand of Bank of China Hong Kong in gaining the confidence of our distributors and clients. Now we have to demonstrate that we have a valid investment process and ability to deliver performance. Asian asset managers need to differentiate themselves from their competitors in terms of investment process and product offering. China-focused fixed income products, including those investing in renminbi bonds, are just some examples.

Rudd: The potential is in new markets, even though they are not necessarily as large as the United States and Europe, they are growing rapidly. In large, established capital markets, competition is great. Those asset managers that target new markets will face less competition and might be rewarded in the end. In particular, in the Middle East, asset growth has been huge, but also in Latin America and some parts of Asia.

Chen: Asian asset managers often struggle to find sufficient funds to finance brand building and marketing for their fund range. Moving into a new market is not only time-consuming but also costly.

Pickerill: Asian asset managers, no matter how successful they are, have to have strong balance sheets if they want to establish themselves outside their home market. Moving into Hong Kong, Singapore, London, New York or Sydney, and building a meaningful presence, is expensive. There is also a belief that most asset managers based in Asia do not have the same level of risk management systems or compliance systems or trustworthiness those in the West have. Overcoming this perception is a challenge. Attracting and retaining the right staff are others.

Chen: We need to get approval from China Securities Regulatory Commission to set up an overseas office. We currently only have Hong Kong on the list. We set up the first Sicav by a Chinese asset manager in October 2010, which was Ucits III and is Ucits IV compliant now.

Over the past two years, we have been approached – not only by Chinese asset managers, but also by Taiwanese and Korean – who enquired about our Sicav and how much it has cost us.

We cannot tell how much we spent altogether on this Sicav because we constantly pay for various services, not just the structure but also legal, tax consultation and administration.

Our first fund has $50 million of assets under management at the moment. We cannot sell the fund to private banks because we have no track record in the international space, which leaves us going to family offices for now.

Edgar: Even Japanese domestic asset managers, which have been expanding into Asia longer and have a Ucits presence, gather a small amount, in general. It is difficult to distribute funds, not because of the quality of their funds but also because they are managing an asset class that has failed to generate investor interest in the past years.

Li: In terms of geographics, testing a regional strategy is probably more sensible than starting with an international one. After the Asian financial crisis 15 years ago, Asian investors now feel much more comfortable investing in this region. Today, we feel much more comfortable investing in each other so we are not just considering buying into Europe or the United States.

Au: Another factor is whether asset managers aim to grow their assets under management in terms of distribution or in terms of manufacturing capability. Rather than setting up our own Ucits funds in Europe, we are working with distribution partners in Europe instead.

Funds Europe: Are there any markets or countries where you see a lot of compelling opportunities but the barriers to entry are just too high?

Li: Expansion into Asia probably means first establishing a presence in either Hong Kong or Singapore for most asset managers. Malaysia, for example, would seem like an unusual choice for a first step. Asset managers need to gather the synergy from those countries and cities that have the capability to attract regional money.

Au: Working with third-party distributors brings benefits because it helps me fund my development and reduce my cost burden. The track record, on the other hand, will still be mine even if the fund is in their name.

Li: The brand is what’s most crucial. It is not about manufacturing a capability because most of the assets we manage are for other asset managers. In Hong Kong, for example, we manage assets for several other corporate names. We do a better job than they do, but we make the least money on the whole chain because we are being squeezed.

Whoever manages to gather assets because they own the brand, profits most. One day investors will feel they can trust our own brand enough. Then we’ll have been paid off for the whole Sicav because we can put that into the private banking channels.

Economos: The challenge for most Asian asset managers is to think innovatively and move away from traditional asset classes, such as long-only equity funds. That is how they can leapfrog.

Distributors, private banks and institutional investors have their eyes on the alternative space. Long-short equity China funds with good track records, for example, are rare. There are few competitors in this space.

Private equity and venture capital are other areas, both more innovative. But Asian asset managers can build a strong brand in this space, owing to their local expertise, while smaller foreign institutional investors and retail investors will struggle.

Mason: Another area where Asian asset managers should have a clear advantage is, as it has been mentioned earlier, the RQFII space.

Economos: This, however, is a capacity-constrained strategy. Asset managers that build their strategy around RQFII are constrained by government quota which limits scalability.

Chen: We have a long-short fund investing in Chinese A-shares and H-shares. It took us a year to get approval from Commission de Surveillance du Secteur Financier. Even though it is a great concept, using the wider power of Ucits, we found it difficult to generate interest in Europe until now.

Economos: Two big constraints are not having $100 million of assets under management and a three-year track record. Existing players in a competitive market make sure it will be difficult for new ones to enter, by increasing the barriers of entry.

Chen: Even under Ucits IV, it is not easy to sell such a strategy. Most of the European clients and family offices are actually buying into our Cayman version of the same fund, instead of Ucits. We do not know why they have such a preference.

Funds Europe: How useful could Europe’s Ucits fund structure be in an intra-Asian expansion strategy? Is that only relevant for global expansion, for example, into the Middle East, Latin America, Europe, or also within Asia?

Mason: Ucits, in particular Sicav funds, dominate the Hong Kong platforms. In Singapore, about 40% of the market is Sicav, and Sicav funds are well accepted there. In Taiwan, about 60% of the market is Sicav. After those three jurisdictions, the use of Ucits funds starts to tail off very rapidly.

A number of markets are still closed to offshore registered funds, such as China and Vietnam, while the likes of South Korea are very small in terms of offshore.

Ucits is not the dominant form, by any means, when the entire Asian funds market is considered, as locally registered funds remain dominant. For offshore, Cayman Island structures are popular, too.

Pickerill: Ucits are a viable passport to Hong Kong, Singapore, Taiwan and Korea. But nobody has really added to that list in recent years. Thanks to increasingly sophisticated regulators and some of the issues that have happened in recent years, Asian regulators are now coming up with their own rules.

Funds Europe: Is there a backwards trend to domestic registered funds? Is it easier to get Hong Kong funds registered than it is Ucits funds?

Pickerill: Hong Kong and Singapore are basically two European countries, such as Italy and Spain. Luxembourg- or Dublin-registered funds are just as easy to get authorised for sale in Singapore as they would be in Italy. In this aspect, our governments are efficient.

Beyond Hong Kong and Singapore, it becomes more difficult. This may be because countries want to protect their own domestic asset management industry or because they are not convinced that the authorities in Europe have got the needs of Asian investors in mind.

There is generally pressure in Europe to allow Ucits to get wider and have more freedom, such as allowing them to use derivatives. Asian regulators, however, tend to tighten up in terms of regulation when it comes to derivatives.

Funds Europe: It appears the European Commission is considering involving Asia in the development of further Ucits directives, probably Ucits VI. What is your stance on this?

Economos: When it comes to Asia passports, Shanghai and Beijing will be the wildcard. They will be the driving forces for anything that comes out of Asia in terms of standardisation.

Li: In terms of sales, 40% of them come from Asia.

Rudd: Ucits is still very much focused on the needs of Europe and it slows us down enormously because we are tagged onto the back of that. But as there is no viable alternative, so it remains the only option.

I find it more and more difficult to see how we can have the flexibility here to drive these various businesses and to grow these countries, while sticking hard to the Ucits mentality. There will be a split at some point.

Au: The Asian passport concept, for obvious reasons, is difficult. This is because every country in Asia wants to be the regional financial centre. China will be the deciding factor and I would not be surprised to see passporting between Hong Kong and China in future.

Given that Hong Kong has an effective and efficient regulatory and legal framework, and all other positive attributes such as talents and infrastructure that we have, it is an ideal place to be the offshore fund domicile centre for Chinese investors. Regulators in

Hong Kong and China are talking to each other constantly so there is trust and there are relationships we can build on.

I hope one day the Hong Kong government will realise that the fund domicile centre concept will bring long-term benefits to the market. I understand the government was actually looking at this possibility last year, but decided not to put it as a top priority item, mainly because they did not see much benefit in this in terms of job creation.

Looking at the broader perspective: this would have made Hong Kong a genuine financial centre, not just a marketing hub, in the long run.

Economos: Chinese regulators underestimate the clout they wield on the Asia passport concept. They will drive it, and once they decide on a standard, the rest of Asia will basically abide by it.

Au: China’s size and potential is key.

Pickerill: It is much bigger and more significant than Europe.

Funds Europe: Asia as a whole remains underinvested. How long will it take for this to rebalance?

Li: Asia accounts for 16% of global GDP, but for just 8% of the MSCI World Index. There is a huge discrepancy between the economic growth and what the financial market is. But there is good reason for that, not just because of the home bias but also because there is no link between growth and stock market performance. This has become particularly apparent in China.

For Asia to become a true investment destination, all countries need to improve the efficiency of their financial markets. We can claim that the economic growth is critical, but as an investment centre or investment destination, the efficiency of the financial market and the mechanism of how the market works matters more.

Rudd: Investors see the economic reality of fiscal imbalances, growth and growth outlook. Today, they tend to have a greater focus on fixed income.

The issue with fixed income within Asia for foreign investors was that markets used to be either too small, too highly regulated or difficult to access. This is why the dim sum bond market in China has been so popular. Capital flows are still low in the grand scheme of things, but the trend is up and the potential is huge.

Au: China is the second-largest economy in the world, but the size of its bond market is 50% of GDP. In the US, in comparison, it is two and a half times GDP.

Looking at the fixed income indices, the weighting for the renminbi is zero. With the liberalisation of the Chinese currency, there are huge opportunities for domestic fund managers.

Li: This is true not just for China, but for the entire region. The next step will be to improve the corporate bond market, which also lacks development.

Mason: There is no doubt that investor money is coming into the region. The question is will Asian managers take a bigger slice of it? In our view, they are. There is definitely a trend towards using Asian managers.

Edgar: A lot of money is coming from the Middle East, where investors appear to prefer Asian and single-country funds. Korean funds or Indonesian funds, for example, have caught investors’ attention.

Mason: There is a misconception that asset managers will only do well in the Middle East if they sell Islamic finance products, which is not the case.

Shashank Srivistava, acting chief executive officer, Qatar Financial Centre Authority: This is indeed a misconception. Investors can market Ucits funds into Qatar, they can also sell them right to the retail level. In fact, there is more conventional investing that happens than Islamic finance.

©2012 funds europe