We profile some of the most interesting fund launches in recent weeks and examine the performance of a product already on the market.

ABSOLUTE RETURN

ABSOLUTE RETURN

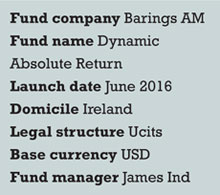

Baring Asset Management has set out to challenge the absolute return market’s big hitters with the launch of the Dynamic Absolute Return fund.

The Ucits long-short market-neutral strategy will be managed by James Ind, who will target a positive absolute return and 7% volatility over a three-year rolling period.

The fund can invest in any asset class, country or sector. Its investment team will seek to identify both absolute value and relative value opportunities. There is no performance fee, and an annual management charge of 0.55%.The fund marks the firm’s first absolute return venture, and the latest addition to its expansive multi-asset range, which includes the flagship (€2.05 billion) Dynamic Asset Allocation fund, aimed at institutional investors.

Ind, who joined Barings last September from Man GLG’s Total Return fund, was specifically hired to head the new strategy. Prior to Man GLG, he spent five years at Russell Investments as managing director of the multi-asset division.

A Barings spokesperson said the firm moved to launch the fund in response to significant client demand for low-risk products, adding that it could appeal to both liquid alternative and conservative or defensive investors.

JAPANESE EQUITIES

JAPANESE EQUITIES

Diam International, the London-based subsidiary of Asian asset manager Diam, has launched a Japanese equity strategy for the Ucits market, the firm’s first Ucits-compliant vehicle. The firm has unveiled plans to launch several Ucits funds over the coming months for institutional investors based in Europe, the Middle East and Africa. Mooted strategies in the pipeline include pan-Asian and liquidity funds, as well as other Japanese strategies.

The fund aims to capture returns from investment in growth companies, and relies on a bottom-up research-based stock-picking approach that identifies companies with a value gap between their price and value.

It will be managed by Tomoaki Kouta, senior portfolio manager, based in Tokyo.

Diam managed approximately $70bn (€62.1bn) of assets in Japanese equity strategies at the end of 2015.

A spokesperson said this was the first of several planned Ucits fund launches this year.

CREDIT

CREDIT

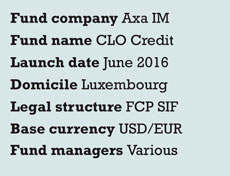

Axa Investment Managers is to launch a new credit fund.

The fund invests in debt tranches of collaterised loan obligations (CLOs) issued in US dollars and euros, and seeks to provide net annualised returns of 6%-8%, with projected annual volatility of 3%-5%.

The fund is available to institutional investors in Belgium, Denmark, Finland, France, Germany, Italy, the Netherlands, the UK, Luxembourg, Sweden and Switzerland.

Christophe Fritsch, co-head of securitised and structured Assets at Axa IM, said the current market environment made the asset class attractive, with the macro-economic context, in particular the fall in oil prices, driving the widening of CLO spreads.

The fund has already attracted more than €45.4 million from pension funds and family offices in Germany and Switzerland, with Nordic institutions expected to follow suit soon.

Since 2000, Axa IM has invested about €15.4 billion in the CLO market.

GOLD EQUITIES

GOLD EQUITIES

Schroders’ commodities team has launched its first gold equities fund.

The fund will actively invest in global gold and other precious metals equities.

Open to both retail and institutional investors, it has the flexibility to invest across other precious metal stocks, such as silver and platinum, when there may be opportunities based on the underlying commodity’s outlook, as well as hold cash when the team feel it necessary.

The fund’s management team will use an unconstrained bottom-up strategy to pick stocks.

Its managers, James Luke and Mark Lacey, have 30 years’ experience between them in precious metals and commodities investing.

UK investors are increasingly turning towards ‘safe-haven’ commodities since the UK voted on June 23 to secede from the European Union.

Schroders expects physical gold prices to continue recovering in coming years, driven by negative interest rates and increased macro risks.

According to UK Investment Association data, commodities funds have soared since the referendum, particular those with a focus on gold and precious metals. Out of 35 funds in the category, two posted negative returns in the week following the referendum on a sterling basis; others have produced double-digit returns.

ONE YEAR ON

ONE YEAR ON

One year ago, Ireland’s EI Sturdza Investment Funds, an independent firm, launched a new European small-cap fund. The fund aims to outperform European equity markets by investing in a concentrated portfolio of companies domiciled in Western Europe, with a market capitalisation below €5 billion.

Its portfolio is typically comprised of 20-30 investments, drawn from an investment universe of around 2,000 European SMEs. Key targets include companies deemed to be priced “significantly below” their intrinsic value, with defendable market share. The fund’s management team takes a strictly bottom-up approach to stock selection.

Since launch, the fund has delivered a return of 0.49%, or +8.59% on a relative basis compared to its benchmark index, STOXX Europe 600 NR, which has returned -8.10% in the same period.

The biggest positive contributors were Aubay, SLM Solutions and Brembo, while the biggest detractors were Mersen, Tom Tailor and Fermentalg.

Of the 35 investments made by the fund since launch, 22 were profitable and 13 of them loss-making, a profitable ratio of 63%, despite a severe decline in European capital markets.

©2016 funds europe