Luxembourg may be more expensive as a fund domicile, but this has to be looked at from the perspective of cost versus market reach, says Fundsquare’s Olivier Portenseigne.

When assessing the competitiveness of fund servicing centres, it is important to take into account the impact of cross-border distribution on the servicing costs in domiciles providing operating platforms with multi-country requirements.

As a fund firm enters into a global distribution strategy, are cross-border fund platforms more expensive than their local competitors? Are there synergies to be captured to further enhance their competitiveness?

Fundsquare and Deloitte Luxembourg have carried out research into the distribution costs across various domiciles.

It confirms that funds on the international platforms of Luxembourg and Ireland are more expensive at face value than their national local competitors – but this is mitigated when the cross-border nature of the funds domiciled in these centres, and the ease with which a firm can reach target markets as it deploys a cross-border distribution strategy, are considered.

CURRENT CHALLENGES

Recent regulatory developments highlight the pressure to minimise the costs borne by the funds for servicing and distribution. In such a context, efficient distribution is a key factor. It plays a determining role in addressing the issues of cutting costs related to distribution support (such as multi-share classes, multi fees and translation) and the access to distribution channels (for example, order routing and platform connectivity).

Another factor for costs combines reporting and disclosure requirements, such as financial statements, prospectuses, key investor information documents (Kiids) and dissemination and publication of net asset values.

A growing number of firms use external fund processing platforms that leverage state-of-the-art technology to deliver standardised infrastructures, the aim being to enhance the cost-effectiveness and quality management of cross-border fund distribution between all stakeholders. Such issues shed light on the importance of achieving an equilibrium by using the right balance of centralised fund platform and local products while eliminating redundancies across the value chain – for instance, in reporting and distribution channels connectivity.

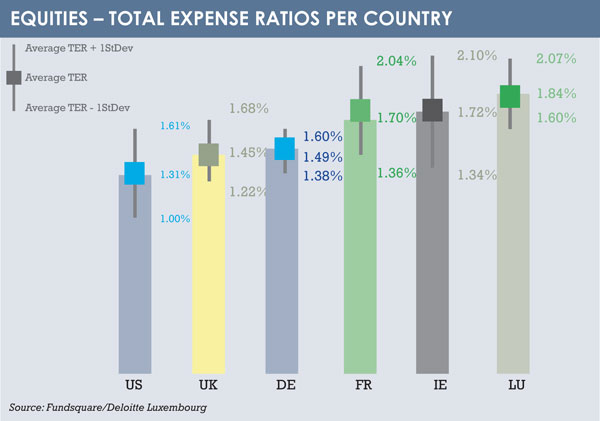

In this context, Fundsquare and Deloitte Luxembourg are conducting a study to assess the competitiveness of various domiciles from a cost-versus-market reach perspective, and we are exploring ways to improve efficiency in distribution channels and their requirements. The study reviews equity, fixed income and balanced funds domiciled in Luxembourg, Ireland, the UK, France, Germany and the US. The sample includes data from 60 management companies on 405 funds totalling more than €500 billion of assets under management.

COST ANALYSIS

Methodology: Costs associated with each domicile were compared based on the average total expense ratio (TER), as it provides an accurate measure of all the costs borne to manage and operate an investment fund. These include management fees and additional expenses such as legal fees, auditor fees, custodian fees and other costs.

Although all funds are required to disclose their charges, the breakdown of TER may not be consistent and comparable from one management company or one domicile to another. In particular, the evasiveness of national laws plays a role in the level of transparency required and the efficiency of the investment funds industry.

Although all funds are required to disclose their charges, the breakdown of TER may not be consistent and comparable from one management company or one domicile to another. In particular, the evasiveness of national laws plays a role in the level of transparency required and the efficiency of the investment funds industry.

In the UK, for instance, the Financial Conduct Authority’s directive is representative of most countries’ regulatory environment. Although it requires firms to act in the best interest of investors by disclosing their charges in a clear and consistent manner in all literature, the absence of a unique charging structure makes it difficult to compare the costs of funds. To conduct our analysis, we established a mapping of the charging structure of each fund with harmonised categories to enhance the comparability of data and obtain relevant results throughout the study.

Results: Like the prices of most goods and services, the expenses of individual mutual funds differ considerably across the array of available products. The expense ratios of individual funds depend on many factors, including investment objective and domicile.

For instance, we observe that funds investing in bonds tend to have lower TERs than combined bonds, which in turn are cheaper than funds investing in equities. These differences can be explained in terms of the greater expertise required to manage the equity asset class.

Beyond this obvious variance in TER across strategies or asset classes, it is interesting to note the difference between domiciles in terms of TER (see chart). In this sense, our findings highlight that across all asset classes, Luxembourg and Ireland are the most expensive domiciles, whereas the US is the least costly. France, Germany and the UK stand in between. Although such contrast is largely expected, little research has been conducted within the existing literature to identify the exact causes of these discrepancies.

Interpretation: Although more expensive, Luxembourg and Ireland stand as the largest investment fund centres in Europe, leading cross-border distribution. As they continue to attract more and larger funds, it is interesting to revisit the drivers behind such costs. Intuitively, professionals from the fund industry point out the costs related to the impact of cross-border distribution on the market infrastructure.

An interesting example is that of the US, the largest fund centre in the world with more than $15 trillion (€14 trillion) of assets under management. The costs of funds in the US are much lower, due to economies of scale related with their relatively large size compared to European products. As US funds are distributed purely domestically, the market relies on a unified distribution network with standardised procedures.

Although some of the funds in Luxembourg and Ireland tend to be larger than for other European domiciles, such economies of scale do not apply due to cross-border distribution.

TENTACULAR NETWORKS

Funds domiciled in Luxembourg and Ireland are distributed across more than 70 countries; this broadens and diversifies their target investors but, on the other hand, submits them to multiple set-ups for distribution, resulting in a complex infrastructure characterised by heterogeneous procedures and tentacular distribution networks.

Typically, the distribution of funds in multiple countries requires, among other things, the translation of Kiid and other required literature, the hedging of share classes or the calculation of multiple tax figures. All of these activities obviously generate costs that funds distributed on a domestic market only do not bear.

The next steps of the study include a detailed analysis of cross-border distribution cost factors, featuring a sizing of their impact on the TER and, finally, the identification and quantification of streamlining opportunities along the European cross-border fund distribution value chain. This last phase will identify redundant distribution activities and assess the related operational and/or financial synergies that could be realised from the use of a specialised market infrastructure.

The results of the study will be published in a Deloitte and Fundsquare joint white paper and explained at the Fund Forum conference in Monaco at the end of June.

Olivier Portenseigne is chief commercial officer at Fundsquare

©2015 funds europe