The Swiss Parliament aims to bring the country’s regulatory standards in line with the AIFMD. Helen Tschümperlin Moggi, of Centro di Studi Bancari, looks at what this involves and what impact it may have.

The scope and intensity of international financial regulation has increased significantly and this trend will persist in the future. Switzerland is not part of the EU, and has its own financial regulator, Finma, or the Swiss Financial Market Supervisory Authority. Finma is in charge of supervising all financial intermediaries and closely works with the Swiss National Bank that oversees financial stability on a macroeconomic level.

Foreign managers come to Switzerland not only for the high quality of life but also for reasons related to the tax framework and the flexible system of self-regulation that is more business-friendly when compared with the rest of Europe.

Ticino, in particular, the third largest financial centre in Switzerland, has considerable flexibility because it enables new taxpayers to get in touch with the tax authority, evaluate their position as taxpayers and determine ad hoc solutions.

Finma and the Swiss Parliament are joining forces and aligning Switzerland with the rest of Europe from a regulatory perspective. However, Finma must also continue co-operating at a national level with institutions and authorities to keep the unique regulatory advantages that Switzerland offers intact. Of course, every challenge presents an opportunity and this gives Switzerland the chance to offer a dual advantage in terms of regulation and access to foreign markets.

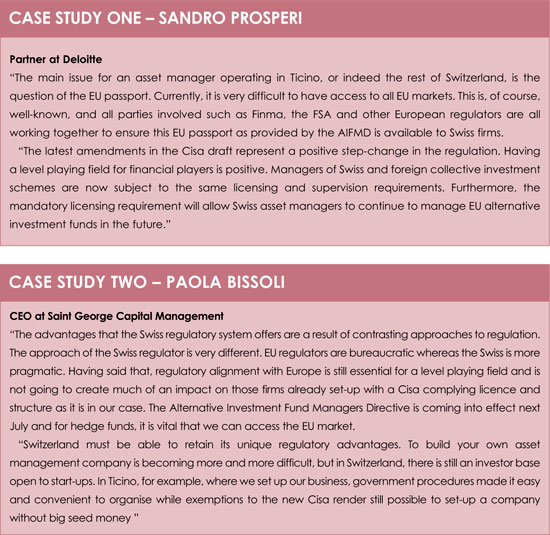

The Swiss Collective Investment Act (Cisa) is a scheme released by the Swiss Parliament that aims to bring Switzerland’s regulatory standards in line with the Alternative Investment Fund Managers Directive (AIFMD). The version of the act which will come into force requires all asset managers to obtain a licence from Finma, meaning that not only asset managers managing Swiss collective investment schemes, but also asset managers managing foreign ones must now apply for a licence with Finma. There are, however, exemptions for managers with assets under management totalling less than CHF100 million (€83 million) – including the use of leverage – or CHF500 million – unleveraged. Furthermore, foreign investment schemes distributed to qualified investors will now be required to have an official representative and paying agent in Switzerland.

The Swiss Collective Investment Act (Cisa) is a scheme released by the Swiss Parliament that aims to bring Switzerland’s regulatory standards in line with the Alternative Investment Fund Managers Directive (AIFMD). The version of the act which will come into force requires all asset managers to obtain a licence from Finma, meaning that not only asset managers managing Swiss collective investment schemes, but also asset managers managing foreign ones must now apply for a licence with Finma. There are, however, exemptions for managers with assets under management totalling less than CHF100 million (€83 million) – including the use of leverage – or CHF500 million – unleveraged. Furthermore, foreign investment schemes distributed to qualified investors will now be required to have an official representative and paying agent in Switzerland.

Other changes in Cisa also include more restrictive definitions of qualified investors. High-net-worth investors are no longer automatically considered qualified investors but can choose to be treated as such.

There is no doubt that the latest changes to Cisa help in bringing the Swiss market in line with the EU. This means the Swiss jurisdiction will “not be left behind” when the directive is implemented in the EU jurisdictions as it was when the Ucits regulations were first adopted in the EU. However, mutual co-operation between both parties is essential to maintain progression. Currently, the discussions around aligning financial regulation and granting Swiss financial intermediaries a facilitated access to the EU market are part of a broader conversation between Switzerland and the EU. There are political questions, discussions on bilateral agreements, tax, and many other broader issues.

It is still not guaranteed that the latest regulations will ensure Switzerland’s fund rules will be considered as “equivalent” by the EU, once the directive is adopted. One key issue that still needs to be addressed is that asset managers operating in Switzerland require access to all foreign financial markets and it is very difficult for them to compete with foreign asset managers without this admittance. Swiss firms aiming to distribute alternative investment funds in the EU will have to wait until at least 2015 before obtaining a “passport” to operate in the EU market.

Despite this, the latest changes are being welcomed by the financial operators in Switzerland; Ticino, as part of Switzerland, ought to be able to keep the unique advantages it currently offers while still aligning itself with the AIFMD.

Helen Tschümperlin Moggi is a chartered financial analyst, and head of area banking and finance at Centro di Studi Bancari in Lugano, south Switzerland

©2013 funds europe