The next generation of smart beta will respond to world events and produce the best returns for investors, says Marc Barrachin of Markit.

Amid mixed projections for global growth, there remain signs that the worst economic crisis since the Great Depression has left remarkably deep scars on the psyche of players in the investment world. This has led to an increased demand for safe but innovative investment products, coupled with a quest for yield in an artificially low rate environment alongside a performing stock market. Usher in ‘smart beta’ 2.0.

Drawing on ‘beta’, which focuses on overall market performance, and ‘smart’, which implies outperformance, beating the market is what smart beta is all about. The idea is to move beyond market cap weighted investment strategies, as seen by many passive index funds. Equally weighting stocks can be one smart beta method, emphasising low price-to-book ratios another.

In the past few years, the industry has further developed smart beta into a number of different indices including fundamentally weighted, low volatility, maximum Sharpe ratio and momentum.

The popularity of smart beta exchange-traded funds (ETFs) shows no signs of abating. EY recently reported that Europe is likely to see the most launches of smart beta ETFs, and institutional investors are expected be the main driver behind growth.

Markit’s ETF data highlights that assets under management has grown to $190 billion as of the start of this year.

SYSTEMIC ALLOCATION STRATEGY

Today’s smart beta products fit neatly into the traditional style and market-cap boxes; a context that investment professionals can leverage. There are, however, strategic and tactical decisions regarding asset allocation that still require an adviser or asset manager to choose which strategy will work and when. While attempting to follow numerous and complex factors within the global economic cycle, the ability to react in a timely manner is essential if opportunities are not to be missed. The next generation of smart beta involves market timing, but instead of simply stock-picking, the focus is more on portfolio construction and style-tilting applied across geographies, asset classes and sectors.

A deep value fund, for instance, can outperform the market in general. The investor, though, may be subject to wide performance swings through which growth may, at times, outperform value. The challenge is to change portfolio allocation quickly to avoid the periods of value underperformance, which is fundamentally a matter of market timing – and therefore an active strategy.

A deep value fund, for instance, can outperform the market in general. The investor, though, may be subject to wide performance swings through which growth may, at times, outperform value. The challenge is to change portfolio allocation quickly to avoid the periods of value underperformance, which is fundamentally a matter of market timing – and therefore an active strategy.

A systematic allocation strategy would essentially follow certain smart beta indices and automatically shift the allocation from value to growth, based on determined metrics. At a very high level, today’s investor still needs to make an active decision when choosing the region in which to invest (e.g. Europe, emerging markets or the US). True smart beta, or outperformance, can come as a result of being able to use metrics, such as economic data, to shift global equity portfolios into economies that have superior performance.

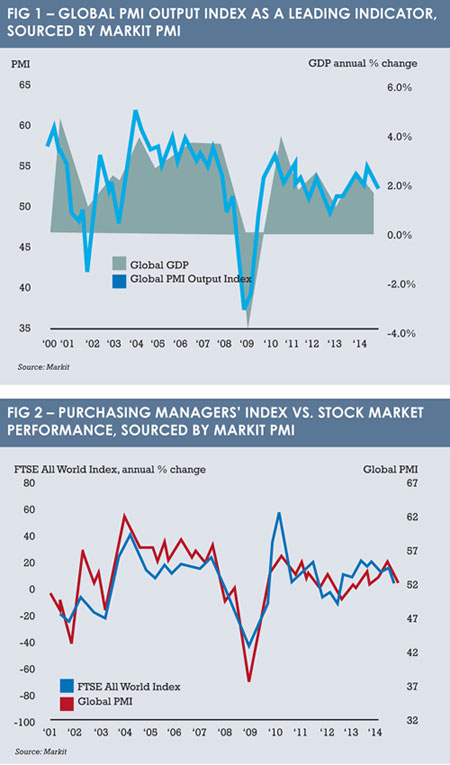

Some investors have already employed GDP as a weighting mechanism instead of market cap, but there are more independent, timelier indicators with which to capture economic growth. Purchasing manager surveys, for example, can be a consistently reliable predictor of economic activity and are more timely than official GDP data. Their use as a proxy for GDP as a weighting mechanism, instead of market cap, is an example of how smart beta can develop to aid asset allocation.

Fig. 1 shows that Markit Global Purchasing Managers’ Output Index is a leading indicator of GDP. Coupled with Fig. 2, which shows a strong relationship between a Global Purchasing Managers’ Index and stock market performance, a systematic approach to global investing can be envisioned.

Another investment example is the ability to automatically increase fund allocation from equity to fixed income when the economy slows. Similarly, in the fixed income arena, allocations can systematically shift from treasuries to investment grade to high yield as the economy expands. The real value of smart beta 2.0 comes from its efficient and constantly current application across all relevant geographies, asset classes and sectors.

A CLEAR FUTURE

Systematic allocation is a new type of smart beta profile – not seen before in the equity or fixed income markets – that resonates with investors. Scarred by the ‘credit crunch’ and the poorly understood, opaque products that unravelled, today’s investment professionals are looking for opportunities that are transparent, replicable and comprehensive. Indeed, EY’s Global ETF Survey cautioned that “sustaining current growth rates depends on the industry’s ability to keep improving the service it offers investors, including around transparency of pricing. Outside of the US, the industry needs to crack the code to unlock the retail investment market.”

Recent moves by regulators show that they are of the same mindset. The International Organisation of Securities Commissions (Iosco) established a set of principles in July 2013 that index providers are now complying with. It is likely that the European Commission will base forthcoming regulations for index provision on the Iosco principles. At the heart of these initiatives is the pursuit of transparency to address the risk of conflicts of interest. Smart beta 2.0 is consistent with these goals.

Just as the first raft of smart beta products responded to the post-2008 investment world, smart beta 2.0 has the potential to respond to today’s environment, enabling market participants to react swiftly to economic events. Given the continuing increase in passive management, smart beta is likely to grow, especially now that investors are starting to use it more systematically. In order for smart beta products to continue to succeed, however, they need to remain transparent, replicable and understandable. The industry is now well aligned around these goals. We should not lose sight of them.

Marc Barrachin, managing director, indices, Markit

©2015 funds europe