Despite the apparent demise of UK manufacturing, niche companies show favourable signs of growth, finds Pavle Sabic, of S&P Capital IQ.

British manufacturing has been on a well-reported and steep decline since the 1970s, as businesses moved to countries with cheaper overheads. Recent figures from the Office of National Statistics (ONS) appear to bear this out, showing that industrial production fell by 2.7% over the two-year period to April 2012 while the UK re-entered recession.

But in spite of the negative trends in its wider sector – and the British economy at large – output from the manufacturing industry rose by 1.5% over the same period.

Examining the trend in detail, we have found that the individual companies defining this upward trend operate in niche markets, and show positive signs not only in the equity markets, but in terms of their credit health, too.

Equity outperformers

Using a year-long timeframe in the period covered by the ONS growth figures cited above, we looked for UK public manufacturing companies that have outperformed the S&P UK BMI Industrials Index from February 2011 to February 2012.

This produced a list of 29 firms, all niche manufacturers. For example, Halma offers fire and smoke detectors, audible and visual warning devices and elevator safety sensors. Spectris has a multi-niche outlook, making instruments and data analysis machines for environmental monitoring. Rotork and Spirax-Sarco both deal in steam control systems and valve actuators for controlling fluid flows from chemical and oil plants.

Not only do these examples benefit from lower levels of competition due to the small number of global competitors in their respective areas, they generally produce necessary rather than discretionary items. IMI, for instance, produces engineering solutions for control and movement of fluids in pneumatic machinery for the rail and energy sectors.

Credit risks

While the equity outperformance shown by these firms is a strong indication of financial health, the global downturn continues to expose credit risks in institutions and companies where they previously went unnoticed. One way of assessing a company’s credit health is by running its key fundamental metrics – such as return on capital, total assets, and operating income – through a model that assesses the strength of each metric to produce a relative score.

The firm can then be stress-tested by defining the two metrics that are most significant to the final score and tweaking them negatively, showing how the top ten companies in our search are prepared to weather hypothetical austere scenarios where their cash-flow breaks down or return on capital falls.

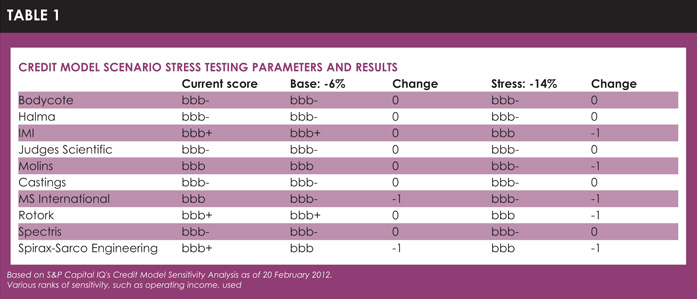

We used two stress-test scenarios: the base-case (a reduction of 6% on the two inputs) and stress-case (a reduction of 14%). See table 1 – the creditworthiness scores produced can be mapped to an equivalent scale used by S&P Credit Ratings.

Table 1

The base-case scenario lowers the creditworthiness score for two of the companies in our portfolio (MS International and Spirax-Sarco Engineering) by one notch, while the stress-case scenario lowers the score for three more companies (IMI, Molins, and Rotork) by one notch. All in all, a fairly resilient batch of results.

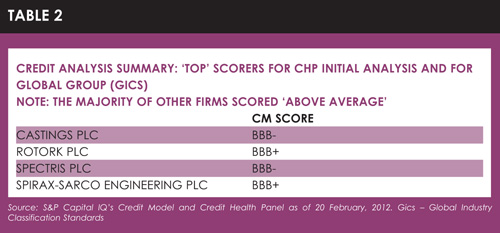

However, while these ten companies may be niche manufacturers based in the UK, they all operate on a global scale. It makes sense to view their credit health relative to a global peer set as well, as in table 2, which shows relative credit health scores compared with global and domestic peers. While all ten companies have relatively strong rankings, Casting, Rotork, Spectris, and Spirax-Sarco Engineering have top rankings in both categories.

Table 2

It seems these four firms have the strongest correlations between outperformance, business strengths, and credit quality. Having so established the present credit health and equity performance of these niche manufacturers, it can be useful to look at equity analysts’ views on future performance.

Continued performance

Will these companies continue to outperform? Analyst consensus recommendations serve as a useful pointer on a firm’s future growth potential by providing an indication of what investors are willing to pay for a company’s shares. Currently, looking at an aggregated survey of analyst views, Spectris and Rotork have “outperform” recommendations.

Castings is the only entity with an outright “buy” recommendation, while Spirax-Sarco lags with a “hold” recommendation.

However, this relatively simple consensus methodology only weighs the outcome in favour of the most historically accurate analyst. Those such as the Intelligent Estimates Model employ a more complex weighting process, and examine factors such as the age of the estimate, broker size, forecast horizon and tenure.

For this exercise, we reviewed earnings per share (EPS), dividends per share (DPS), and cash flow per share (CFPS) forecasts. This playoff is a good indication of future growth and profitability of a company. When CFPS exceeds EPS, the company has grown shareholders’ wealth over time. EPS alone does not give the full picture, so the CFPS helps ascertain the sustainability of the business model.

Finally, DPS reflects management’s belief in the company’s unremitting growth.

Under this hypothesis, all companies show an upward trend in estimated DPS, showing possible signs of management confidence in future growth. Rotork, Spectris, and Spirax-Sarco’s future estimates show upward trends for EPS and CFPS, again providing positive signs for future growth.

Pavle Sabic is solutions architect at S&P Capital IQ

©2012 funds europe