Everyone has a role in reducing fund expenditure, says Martyn Cuff of Allianz Global Investors. But the industry must also make consumers aware that ‘frictional costs’ have already been greatly limited over the past 25 years.

The wealth and asset management industries are vital parts of the capitalist economic system and they have been active, at least in some recognisable form, for several hundred years. As such, it is of interest to society that the value-add of these industries is maximised.

One aspect of adding value is to keep frictional costs under control. These being costs that could be reduced over time without detracting from the quality of service and performance of a product ultimately consumed by the investors.

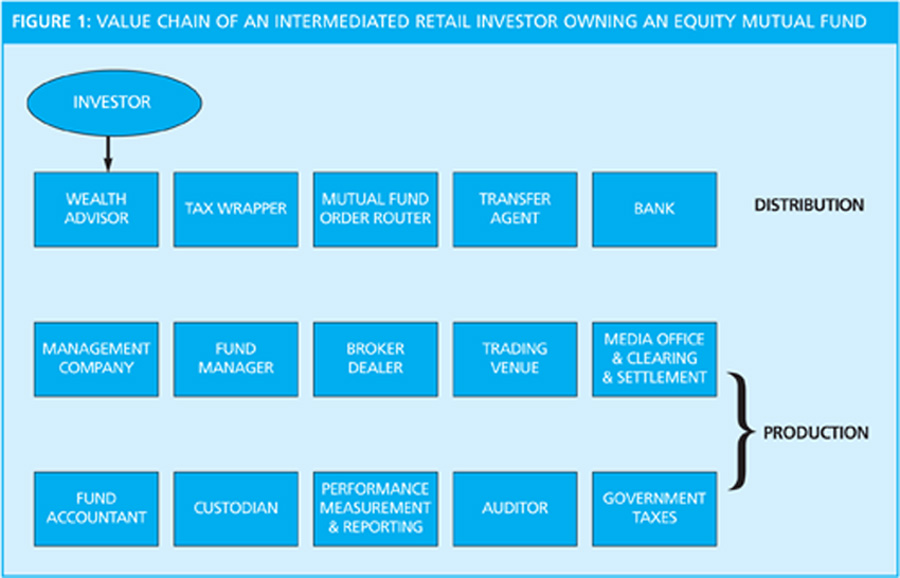

To elaborate, consider a common situation such as that of a client who owns an equity mutual fund which is held within some form of tax-efficient wrapper and that the client has some form of wealth adviser. In value-chain terms this could be summarised as seen in

Figure 1 (below). It should be obvious from this that it is not the responsibility of any one player in the chain to remove frictional cost – it should be a focus for everyone.

The long value chain

So what is it that makes it difficult to manage these costs? First, there are a lot of parties in the value chain. So far, we have yet to find a way of totally removing any of these activities and, therefore, the focus has been on making each one of them more efficient and risk managed. However, the disconnected nature of the value chain can create silo thinking, whether at the macro level between production and distribution or at the more detailed level of functional steps. In turn, this does little to reduce the human temptation of each actor to direct attention for costs to someone else in the chain.

Perhaps of more significance are the following four factors:

• Globalisation

Anyone who worked in the wealth and asset management industries 25 years ago will fully appreciate that compared with today, there has been a seismic shift in access for retail and institutional investors to truly global investment opportunities. The home bias of investors has been reducing for many years and this has been, in part, facilitated by the easier access to overseas investments.

In the past, it used to be a challenge to venture beyond domestic borders for investment. Today, investors expect to be able to deal immediately and at any time in all manner of multi-currency cash and derivative markets all around the world. It is one thing to write books about how the world is now global and “flat”, but it is an entirely different thing to put in place the infrastructure that allows investors to trade in a trusted fashion with ever diminishing borders.

• Complexity

Partly as a consequence of the above but also because of the increased array of investment instruments and investment products, running operating models that smoothly and efficiently administer multi-currency hedged or non-hedged portfolios of cash, government bonds, corporate bonds, domestic equities, overseas equities, on-exchange and off-exchange derivatives, exchange-traded funds, mutual funds, hedge funds, private equity funds, real estate funds, and so on, is no simple task. Allied to this is the increasingly complex world of taxes, which asset managers and their administrators have to consider, at least to some extent, on behalf of investors.

• Volume

Trading volumes of most instruments have significantly grown in the past couple of decades. Without the accompanying development of technology it would have been impossible to handle these massive volume increases at all and certainly the costs would have been unsustainable. Today, these volumes continue to grow, which maintains pressure on operating model infrastructure.

• Regulation

It is not necessary to write much on this as the reader will no doubt already feel bombarded by the range of articles dedicated to the significant increase in regulation being felt by our industries as well as the change in regulatory agencies as well. Suffice to say that whether or not all of this increased regulation reduces risk, it surely adds to the quantity and diversity of work – and cost – necessary in running businesses.

In any debate about costs, it is important to remember the above points since coping with globalisation, complexity, volume and regulation has to be paid for through the ongoing re-investment of industry profits into staff and technology. Together, these various factors result in product and service offerings which are much more sophisticated than in years gone by. If we assume that this sophistication translates into recognised value-added, then economics would suggest there is a price to be paid for it by the end consumer.

However, look back over the past 25 years and there is a case to be made that costs have not risen even though the demands placed on the industries have.

Giving up on costs?

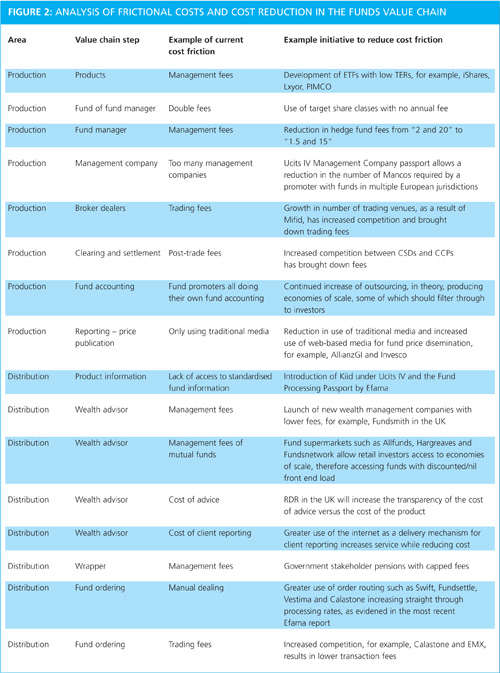

Do the above four factors mean that we should give up on managing costs? Clearly not, and there are a number of examples which show that actors all along the chain are making various contributions to control and reduce costs (see Figure 2 below).

This battle of cost control/reduction is ongoing. We should remember that the industries are in competition with other sectors within financial services, namely the likes of banking and insurance. These sectors are traditionally more familiar to the retail market and have a strong political and lobbying voice.

Also, the need for their services has historically been pretty clear, for example, mortgages, current account, car and house insurance. Therefore, it is necessary for everyone in the asset and wealth management value chain to fight to be heard in a packed financial services market and this will require clear demonstration of relevance and value for money. Having a reputation for tight cost management should surely help in this regard.

Martyn Cuff is a managing director at Allianz Global Investors

©2011 funds europe