Luxembourg’s hedge fund administrators are preparing for the Alternative Investment Fund Managers Directive. Nicholas Pratt finds asset servicers do not mind that Luxembourg was not the first to implement the regulations.

Luxembourg’s status as a successful centre for cross-border fund distribution with more than €2 trillion of industry assets under management in its care has relied heavily on its effective regulatory regime. This means that new legislation is typically issued in as timely a manner as possible and in a way that is advantageous for the industry’s participants.

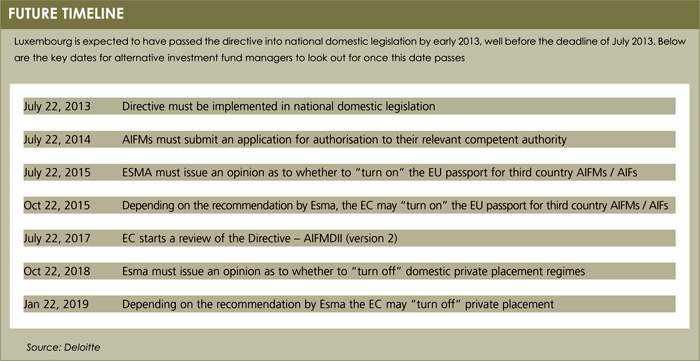

And so it is also with the Alternative Investment Fund Managers Directive (AIFMD), the European Union’s regulations for the management of alternative funds that are due to become effective from July 2013. The new rules were introduced in the wake of the financial crisis and were viewed initially with some scepticism by the fund management industry. Critics accused politicians of a knee-jerk reaction and of political grandstanding. However, attitudes have changed on both sides.

“The AIFMD foresees a stricter supervision of alternative funds and their managers,” says Kavitha Ramachandran, manager, client services at the Luxembourg office of fund administrator Maitland. “But in return, a new EU passport will open up new opportunities for fund managers and will allow them to offer management services and distribute their funds in all EU member states.”

The steps taken by the Luxembourg authorities have concentrated on two main areas: amendments to the existing rules for specialised investment funds (SIFs); and the introduction of new rules for the transposition of the AIFMD. Changes to the SIF laws cover the approval process for funds along with documentation and reporting, risk and portfolio management, delegation of duties, conflicts of interest and further verification that investors are well-enough informed.

SOCIÉTÉ EN COMMANDITE SPECIALE

The newly introduced laws for the directive allow for a new category of firm to act as a depositary for alternative funds and introduce the société en commandite speciale (SCS), a new tax-transparent form of limited partnership designed to help private equity structuring.

These new laws were submitted to the Luxembourg Parliament on August 24, 2012 and the anticipation is that they will be approved in the first quarter of 2013. Luxembourg has always stated its intention to be among the first jurisdictions – if not actually the first – to implement the directive. The honour of being the first fell to the Netherlands which passed the AIFMD into law earlier in 2012 (see cover story, page 12).

The idea that Luxembourg somehow lost by not being the first to implement the legislation is dismissed by the fund administrators in the region. “I would not qualify it as a horse race. It is not about being first or second but about demonstrating commitment, courage and leadership,” says Jean-Michel Loehr, head of regulatory and government affairs at RBC Investor Services.

“It is a complex piece of legislation with a large scope and it may have been easier to let other countries lead and to follow their example.”

The translation of the directive into law in Luxembourg has been well considered and there has been a lot of consultation with the industry over the transposition process, says Loehr. “The aim has been to add benefits without disrupting the current structure. For example, allowing special limited partnerships for hedge funds via the SCS – which is something that has been used in the Anglo Saxon market.

“So we welcome the opportunity to create a unique regulatory environment for the alternative investment community in Europe that can also be available to non-EU managers or investors.”

Such a view represents a noticeable change in attitude from when the directive was first proposed in the wake of the financial crisis and at a time when the hedge fund world was fending off accusations of an incendiary role in the financial markets meltdown.

“The industry and regulators started off on the wrong foot post-Lehmans but now we must focus on the opportunities – creating a new framework and being attractive to as wide an audience as possible,” says Loehr.

“The competitive issue is secondary. I would encourage everyone to implement quickly because it will present an image of certainty and clarity.”

So what changes do Luxembourg’s administrators have to make to meet the demands of AIFMD?

“We need to provide our clients with a better understanding of what is needed to comply with the directive in terms of risk management, reporting and delegation of duties and we are also setting up a depositary service,” says Laurent Vanderweyen, global head of funds at Alter Domus, a specialist fund administration firm in Luxembourg.

He expects an increase in business from both existing clients that are looking to concentrate their real estate and private equity funds in Luxembourg and internationally distribute them, and also from new clients currently based offshore. For the larger fund managers, a big influencing factor will be the demands of end investors and pension funds to see their assets invested in a well-regulated investment vehicle.

CONSOLIDATION

Meanwhile, a lot of the smaller alternative managers with a less institutional investor base will have to consider the cost of complying with the directive.

There is also the cost of change for administrators to consider, both in terms of personnel and systems, and that could lead to consolidation among service providers.

In terms of system changes, the market was quite slow to get started but activity has picked up in the past six to nine months, according to Keith Hale, executive vice president, client and business development at MultiFonds, a provider of fund administration technology.

The fact that Luxembourg’s administrators have been running SIFs for years means that the basic structure is in place and the work needed on the technology front is more about slight adjustments than major overhauls.

“There is some additional reporting and tagging of data required,” says Hale.

AIFMD is not as onerous as the US Foreign Account Tax Compliance Act (Fatca), Hale adds. This piece of legislation is designed to identify US persons investing in non-US funds and its requirements must be implemented by January 2013. Fatca will require significant changes to internal processes and systems.

But AIFMD has not been revolutionary in terms of technological change.

“A lot of it is more about getting the data out of the system for reporting to the regulator,” says Hale.

The concerns about additional cost and complexity are understandable, especially as they will ultimately be borne by the end investors. Even though the directive is aimed at the alternatives market, it cannot be ignored by administrators with mainstream client bases.

Most administrators expect the directive to trigger changes in the subsequent Ucits V and Ucits VI guidelines and it is also likely to have an influence on the rapidly developing alternative Ucits market, especially given that alternative funds under AIFMD will have more transparency and higher risk management standards than many alternative Ucits funds.

In many ways the attitudes to the AIFMD mirror what happened with the introduction of Ucits 25 years ago, says Vanderweyen.

“Back then there were people in the industry complaining about the extra compliance. But now we have seen the benefit of that additional layer of protection and oversight in terms of developing a strong brand.

“I can see the same thing happening with the AIFMD, where there will be pension funds looking to see if a fund is AIFMD-compliant. Some are saying that the AIFMD is adding too much cost and too much complexity but I think once the market settles down, we will all see the benefit.”

©2012 funds europe