To many, the bull market in gold that peaked in 2011 now looks like a classic bubble. With equities looking robust, David Stevenson asks whether the precious metal still deserves a place in portfolios.

From Aztecs, Incas and Mayans to Ian Fleming’s Goldfinger, the commodity that behaves like a currency, gold, has exercised a curious hold over the human imagination – one different in quality from any other investment asset, simple or complex.

Notoriously, whatever the ups and downs of gold and precious-metals markets, ‘goldbugs’, whose faith in the shiny yellow substance is as unshakeable as it is huge, are a permanent – and voluble – presence in debates on asset allocation.

And for other investors, the role of gold as a hedge against inflation and other economic troubles, or indeed geopolitical upheavals, means that its importance is always a factor in any portfolio.

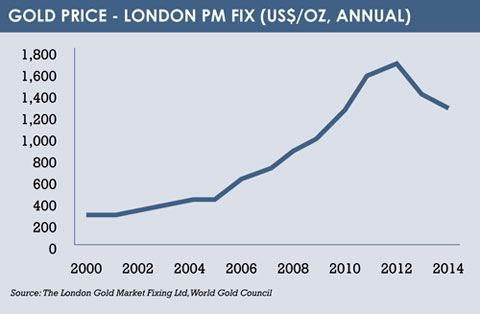

Rarely has the fascination with gold been stronger than during the metal’s long upward march in a sustained rally from 2000 – a rampage sparked by a weak dollar and stoked after the 2008 collapse of Lehman Brothers.

From the end of 2008 until mid-2011, gold bullion prices rocketed by 70%, scaling remarkable heights above $1,900 an ounce as investors fled to what – for a time – seemed a rare, maybe the only, safe haven against a threatened and only narrowly averted global depression. As stocks and bonds slumped, gold seemed unassailable.

Yet, as so often with protracted and powerful rallies, bullion’s long run-up skittered to an abrupt halt – to the humiliation of goldbugs everywhere. From 2011 through 2013, the gold price tumbled by a third (see chart), plunging below $1,200 an ounce, as what some observers now regard as a decade-long bullion bubble burst.

Last year, too, proved lacklustre for gold, with the shine remaining truly off. It traded down a little once again, marking its first back-to-back annual drops since 2000, as markets focused on a widening US economic upturn and the powerful upside this heralded for equities. Loose monetary policy, meanwhile, kept the bond markets of the developed world bubbling.

Just as suddenly, though, gold has burst back on to investors’ radar screens in the short weeks since the turn of the year.

SHINE ON?

Having posted its first monthly rise in five months in December, bullion had once more breached $1,300 an ounce by the second half of January 2015 – albeit briefly, before slipping back – and gold futures had staged their longest rally in 11 months.

The key question, then, is are the gold bulls back in town?

Unfortunately, there is no clear answer, with the world’s leading investment institutions, analysts and traders divided over the direction of the gold market.

Goldman Sachs has just cut its 2015 forecast for bullion to $1,089 an ounce, from its previous projection of $1,200. UBS also scaled back its 2015 average gold price outlook to $1,190 during January. But HSBC analysts predict a more bullish $1,234 an ounce, and the Australia and New Zealand Banking Group (ANZ) sees a climb to $1,280 an ounce. At Capital Economics, the leading independent consultancy, Julian Jessop, head of commodities research, told clients in a recent report that gold could leap to $1,400 by the end of the year.

Who to believe? Much depends on investors’ assessment of some of the key driving forces that shape the gold market.

Given that a central reason to turn to gold is to hedge against rising prices, one critical influence is the expectation of inflation in key economies.

When the US Federal Reserve began its programme of quantitative easing (QE) – in effect, printing money and injecting it into the American economy via asset purchases to fend off depression and rekindle growth – sceptics feared the ultimate consequence would be to ignite inflation instead. Such anxieties were a factor in spurring the surge in gold up to 2011. Yet inflation has remained low – the dog that didn’t bark – even as the US economy has bounced back, contributing to gold’s subsequent fall from favour.

“I think a lot of people will look back at that period and see that there wasn’t as much inflation that came out of that process as initially feared,” says Nitesh Shah, an analyst at ETF Securities.

Now, even as the Fed winds down QE in the US, the same questions over the role of printing money in stoking future price pressures, and the potential need to hedge against that with gold, are being raised in the Eurozone as the European Central Bank launches its own audacious QE strategy.

Will Eurozone QE trigger an influx of nervous money into gold? Shah is dubious. Investors, he suggests, “might be reluctant to repeat that process [as] the ECB starts QE. If it wasn’t successful in raising inflation in the US, do we need to get into gold as the ECB starts its programme?” In reality, as oil prices plunge, current economic fears in Europe revolve not around inflation, but deflation.

A DIFFERENT PHASE

Others also doubt whether the ECB’s QE moves alone will send gold skywards again. “I don’t see it [gold] as a hedge against inflation,” says Steve Ruffley, chief market strategist at Intertrader. “The world’s in a completely different phase. People have short memories – gold did nothing but tank in the 1980s,” he adds. Ruffley can hardly be described as a goldbug, having been quoted in 2013 predicting that prices would drop to $1,000 an ounce by this year. He wasn’t too far off.

Yet Shah and others do see the intensity of Eurozone economic troubles – such as a possible Greek exit from the euro and a resulting crisis for the currency – as a potential factor in pushing gold higher. “If people’s fears override, they might want to hold a hard asset,” Shah suggests.

The same fear factor also comes into play when hard-to-predict geopolitical events erupt. Each event tends to encourage safe-haven buyers to flee into gold.

David Mazza, head of research at State Street Global Advisors’ SPDR exchange-traded funds (ETFs) business, says: “We are moving into a situation where there is greater monetary uncertainty, along with political uncertainty, that may bring more eyes on to the role that gold can play in portfolios from an insurance perspective.”

However, Mazza concedes that while gold often receives a further boost in times of equity market stress, for the moment that factor is not in play as leading stock markets continue the resurgence that has accompanied Western economic recovery.

RESERVES BOOST

Amid this array of influences, two additional factors fuelling demand offer consolation to hopeful bullion bulls.

The first is a revived demand for gold from some central banks keen on boosting their reserves in times of increased economic jitters. Russia, beset by financial turbulence, added 20.73 tonnes of gold to its reserves in January, according to data from the International Monetary Fund (IMF) – extending a recent bullion-buying spree for a ninth consecutive month. The IMF also confirmed that the Dutch central bank, the ninth-largest official player in holding gold, had raised its reserves of the metal for the first time in 16 years.

Meanwhile, a second bullish boost is seen coming from the opposite end of the market – from increased demand from retail and wholesale jewellery markets and for coins and gold bars bought by non-institutional investors. Rising Asian demand in these markets was cited by Barclays this month as likely to push gold upwards once more, while HSBC also tipped a “moderate recovery” in such demand from China and India.

China and India are the biggest net importers of gold, with the latter’s cultural affinity for the metal central to its huge purchases (it is estimated that 11% of the world’s gold sits in Indian jewellery boxes). The rising affluence of the subcontinent’s middle classes is predicted to increase such purchases still further. Recently, the new, pro-reform government of prime minister Narendra Modi tore up a prohibitive restriction that required 20% of all imported gold to be re-exported by the country’s jewellery industry – a contentious policy that provoked a strike among Indian gold shops.

China and India are the biggest net importers of gold, with the latter’s cultural affinity for the metal central to its huge purchases (it is estimated that 11% of the world’s gold sits in Indian jewellery boxes). The rising affluence of the subcontinent’s middle classes is predicted to increase such purchases still further. Recently, the new, pro-reform government of prime minister Narendra Modi tore up a prohibitive restriction that required 20% of all imported gold to be re-exported by the country’s jewellery industry – a contentious policy that provoked a strike among Indian gold shops.

Mazza says: “Investment demand [for gold] is smaller than most people think. It’s less than 10%. The majority of the demand is for jewellery.”

Emerging markets as a whole are an increasingly potent force in gold trading. Ani Markova, portfolio manager at Smith & Williamson’s Global Gold and Resources Fund, notes that while emerging markets represented a mere 14% of overall gold demand back in the Eighties, by last year that had swollen to 50% – part of a trend for gold holdings to shift from West to East.

MIND THE MINES

In the midst of all this, investors and miners alike will be keeping a close eye on the consequences for gold miners.

Gold mining groups provide another means for institutions and investors betting on an upside for bullion to buy into the asset. Yet the sector, never an easy one, has been suffering some of its toughest times ever in recent years. Gold mining is a highly capital-intensive industry, and with costs to extract each ounce of gold at well over $1,000, the price slump of the past two years has seen severe fallout for the industry. As well as cuts in exploration and production, mining groups have endured restructuring and writedowns running into billions.

Markova, at Smith & Williamson, believes the gold outlook and recent trends will lead to a new generation of smaller mines. Analysts argue too that the recent spate of restructuring will leave the sector as a whole in more efficient shape and better equipped to cope with future price volatility.

The restructuring is reflected in the merger talks embarked on last year by two of the biggest producers, Barrick Gold and Newmont.

Yet even as the production sector reshapes itself, stock pickers note that the small size of the industry relative to oil extraction, for example, limits investment options and introduces issues over liquidity and accompanying risk.

“In the gold space, the biggest stocks [Barrick and Newmont] are in quite a lot of trouble and their balance sheets are looking quite precarious,” says James Sutton, portfolio manager at JP Morgan Asset Management (JPMAM).

Nonetheless, JPMAM announced last month that it is to increase its allocation to gold in its Natural Resources Fund from 13% to about 17%.

Sutton points out that the fund had cut its allocation to gold sharply in 2013 to underweight the metal. He says that while it continues to believe it should be underweight in gold, a better performance by gold-related equities last year made a case for a slightly larger asset allocation.

This tentative re-examination of bullion seems symptomatic of the current uncertainty in the gold market and the sharp divisions of analyst and trader opinion over its direction. The goldbugs will continue to lust after the metal, while the sceptics will echo the sentiment of Steve Ruffley: “We could live without gold tomorrow. No-one is going to say, ‘My life is ended as I can’t go on without gold.’”

For the majority of investors re-examining gold, a ‘wait and see’ attitude seems likely to prevail as long as the economic recuperation in the US continues to sustain the renewed bull market in global equities.

Gold tends to do best in a climate of market fear. As things stand, the current recovery and stock market revival means that in the constant tussle between fear and greed, greed has the upper hand, keeping investors focused on the upside for equities. As Shakespeare had it: “All that glisters is not gold.”

©2015 funds europe