A ranking of the world’s largest 500 asset managers gives a snapshot of trends in the industry. Some are obvious, others less so, says Alan Chalmers.

Assets managed by the world’s top 500 asset managers fell 1.7% last year, according to a ranking by adviser Willis Towers Watson. It was the first time assets declined in a year since 2011.

Market performance played a role. The Dow Jones Industrial Average index lost 2% in the year, while the FTSE 100 declined nearly 5%.

Currency movements also affected the results, which the report authors have given in dollars. The pound, the euro and the yen all depreciated against the US currency during 2015 – in the case of the euro, by more than 11%.

Among the top players, there was little change. BlackRock holds the number-one position, followed by Vanguard and State Street. Fidelity moved up to number four, swapping places with Allianz. The changeover reflected outflows at Allianz subsidiary Pimco in the wake of Pimco’s co-founder, Bill Gross, leaving to join Janus Capital in September 2014.

The most impressive gainers were US-based Wells Fargo, which moved up 14 places to 19 in the ranking, and Germany’s DZ Bank, which jumped 13 places to 48.

Franklin Templeton suffered a decline in assets that meant it fell five places to 26, while Generali, from Italy, fell four places to 41 and the UK’s Aberdeen fell four places to 44.

Overall, the larger players did a better job of maintaining their asset levels than the smaller ones. The top 50 asset managers in the ranking together had nearly $50 trillion in 2015. This implied a decline of 0.7% compared with the previous year.

LONG-TERM SHIFTS

On the face of it, there seems to be little change. However, an analysis of long-term trends reveals some interesting findings. Overall, asset managers in the top 500 saw an increase in assets of 43% between 2005 and 2015.

This gain was not distributed equally. The sum of assets managed by American companies rose more than 80% to nearly $44 trillion in the period. In contrast, European firms’ assets rose to $25 trillion, an increase of less than 5%.

Japanese asset managers experienced a rise of 8% in the period, to $4 trillion, while asset managers elsewhere in the world more than doubled their assets – from a relatively low base – to $3.6 billion.

The growth of assets at US-based managers is partly due to acquisitions of European businesses. BlackRock bought Barclays Global Investors, BNY Mellon bought Insight Investment, Legg Mason bought Martin Currie, MassMutual bought Baring Asset Management and New York Life bought Dexia Asset Management.

Though there have been acquisitions going in the opposite direction – from Amundi, Aberdeen, Natixis and others – most of these deals have been small.

PASSIVE GROWTH

During the decade, some new players came in at the top end of the market. Vanguard, which had less than $1 billion of assets in 2015, now boasts nearly $3.4 billion. The firm has benefited from increasing demand for index funds and exchange-traded funds (ETFs), as have BlackRock and State Street, two industry leaders.

Indeed, the rise of ETFs in the US, where they are used by both institutional and retail investors, has led some of the traditional active managers to launch their own ETF products. Fidelity, Franklin Templeton and JP Morgan are among them.

Indeed, the rise of ETFs in the US, where they are used by both institutional and retail investors, has led some of the traditional active managers to launch their own ETF products. Fidelity, Franklin Templeton and JP Morgan are among them.

Europe, where ETFs are still substantially aimed at institutional clients, is behind the curve with these products, although some European ETF players are now targeting the wealth management sector.

BARBELL

There is likely to be further consolidation in the industry to enhance profitability and ensure greater market penetration and coverage. Amundi’s recent acquisition of Pioneer Investments would put Amundi at 11 in the list, once Pioneer’s assets are included. Meanwhile, the merger of Janus Capital and Henderson Global Investors is expected to create a company with $325 billion under management that would be ranked at 55 in the list.

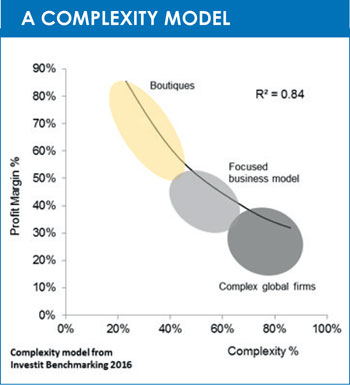

In future, the industry is likely to barbell with the larger players becoming larger and the smaller players succeeding as specialist houses. The difficult area will be the middle ground where firms will bear the full cost of regulation but have limited ability to specialise.

In future, the industry is likely to barbell with the larger players becoming larger and the smaller players succeeding as specialist houses. The difficult area will be the middle ground where firms will bear the full cost of regulation but have limited ability to specialise.

Gaining traction with distributors is likely to become more difficult as distributors themselves seek business efficiency. Some smaller players are looking for tie-ups with major houses to increase their distribution ability. This is the idea behind the acquisition of DNCA Finance by Natixis.

The industry would appear to be coming to a tipping point where participants must decide who they are and what they do. While more consolidation is likely to offset and reduce fixed costs, care needs to be taken not to increase the complexity of the business.

EFFICIENCY

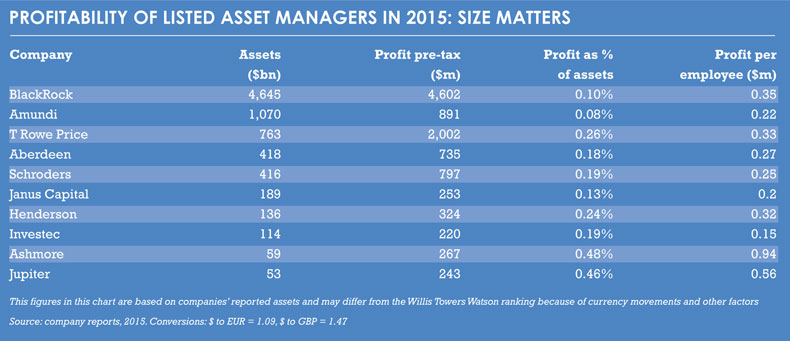

An analysis of the data also reveals differences in profitability (see ‘profitability of listed asset managers’ table above).

BlackRock’s profit as a percentage of its assets is 0.1%, a low level that reflects the company’s wide range of low-cost funds.

For T Rowe Price, the corresponding figure is 0.26%, even though BlackRock makes more money per employee than T Rowe Price.

In contrast, Ashmore’s profits are equal to 0.48% of its assets under management, a figure that reflects its more focused range of funds with higher fees. Schroders and Investec each have 0.19% on this measure, on account of their broad product range.

LOOKING AHEAD

While the 2015 figures do not show any great movement, they may indicate changes ahead. ETF and index fund providers continue to push change in the industry. Combined with regulatory pressure, these players are likely to reduce profit margins in the industry. That will lead to defensive consolidation.

Distribution is key. Owning the customer is likely to become more burdensome. Bank distributors are wondering how to service their customers and how to create an effective model. In the UK, banks largely withdrew from financial advice, but are examining possible solutions such as robo-advisers.

The whole technology drive in the industry, both from an operational profit point of view and as an access and advice point for investors, is currently under exploration.

There are uncertainties ahead concerning low savings rates, low interest rates, Brexit, President Trump and low growth. These are potential obstacles that the asset management industry must overcome in the years ahead.

©2016 funds europe