Conforming to the stereotype of German efficiency, one law is likely to become the new legal framework for all fund structures. Stefanie Eschenbacher reports on regulary battles in Europe’s largest economy.

Germany’s €2 trillion asset management industry has been, in many respects, a battleground lately.

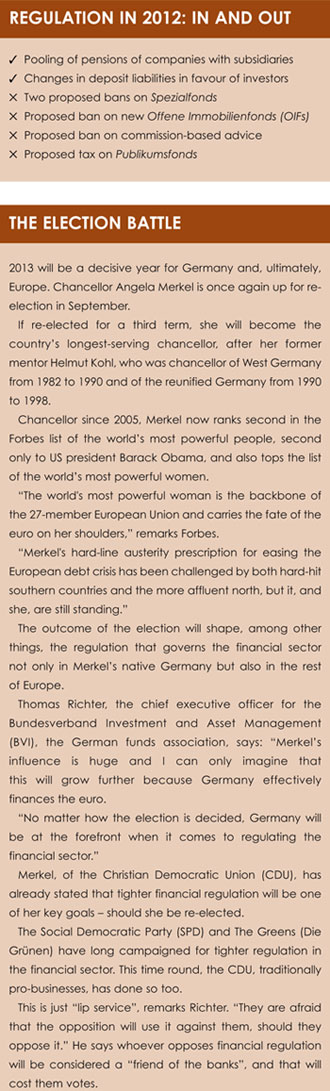

Regulators proposed to ban Spezialfonds, intended for institutional investors, last year. Twice.

First, there was a plan to transform the status of Spezialfonds into a partnership, a Kommanditgesellschaft.

This would have resulted in uncertainties regarding their legal structures and tax payments.

Then, the Ministry of Finance considered abolishing the standardised product regulation of Spezialfonds under the Alternative Investment Fund Managers Directive (AIFMD).

Much has changed in recent months, but asset managers in Germany still have to deal with local regulation as well as that from Europe and elsewhere in the world.

The Kapitalanlagegesetzbuch (KAGB-E), a draft capital investment act, is likely to replace the current investment act in Germany.

Conforming to the stereotype of German efficiency, the KAGB-E is likely to become the legal framework for all future fund structures in the country. The KAGB-E also transfers the provisions of the AIFMD into national law.

Thomas Richter, chief executive officer at the Bundesverband Investment und Asset Management (BVI), the German funds association, says hedge funds and other alternative investment funds will be governed by this law. It will apply to both retail and institutional investors.

Detlef Glow, head of research for Europe, the Middle East and Africa at Lipper, says Germany has been taking regulation “very seriously” and has gone even further than other EU member states.

“Under the first draft proposal of the AIFMD in Germany, it would have been close to impossible to run an alternative investment fund here,” he says. “After the financial crisis, there has been a lot of willingness on the political agenda to punish the financial industry.”

But it came as a surprise to many when Spezialfonds came under intense scrutiny. Long hailed as a true German success story (see Funds Europe, May 2012), Spezialfonds manage the bulk of investment money in Germany.

Offene Immobilienfonds (OIFs), which directly invest in real estate, face a different battle. Regulators proposed to ban new OIFs. The proposal was abandoned.

Data from Lipper shows OIFs registered for sale in Germany had more than €100 million of assets under management but, of the 44 funds, just 24 are active.

Four OIFs are temporarily closed, six have been closed since 2008 and another ten will be closed on a planned date.

BIG MISTAKE

Glow says some of these OIFs struggled as people withdrew money during the financial crisis and “the vast majority of these funds went into trouble” when redemptions hit.

“These funds had been sold without fees,” he says. “People used them as cash-equivalents. There was roughly no volatility, but they generated much higher returns than a cash account.”

Glow says the big mistake at that time was that these funds had skipped the initial charge. “If there had been a 5% fee, investors would have needed to stay in the fund for three years.”

Torsten Knapmeyer, managing director at Deka Immobilien, says during Germany’s real estate crisis between 2005 and 2006, his range saw substantial outflows.

Knapmeyer says this led to two strategic decisions: reducing the number of institutional investors in OIFs, and managing future inflows.

Today, 97% of the investors – about 800,000 – in its OIFs are retail investors, which Knapmeyer says means a more stable investor base as they tend to invest longer term.

Regulation has changed, too.

New and existing investors will have to give 12 months notice should they wish to redeem money. New investors will initially have to invest for 24 months, though investors can make redemptions of €30,000 every six months.

Knapmeyer says despite ongoing discusssions, “we are glad we no longer have to worry about a ban: at that time we asked ourselves whether we would like to belong to a product category that will be protected by existing regulation, but the future will lie elsewhere”.

With proposals to ban Spezialfonds and new OIFs off the table, at least for now, asset managers still have to deal with what is left on the table.

REGULATION

Richter says regulation in Germany has always been made with the intention of protecting ordinary citizens.

“If in doubt, it will go in favour of the consumer,” he says. “Products targeted at retail investors are particularly tightly regulated. Even if such products are approved in other European countries, it does not necessarily mean they can be distributed in Germany.”

“If in doubt, it will go in favour of the consumer,” he says. “Products targeted at retail investors are particularly tightly regulated. Even if such products are approved in other European countries, it does not necessarily mean they can be distributed in Germany.”

Germany has been at the forefront when it comes to regulation, but Richter casts doubts over the short-term future of the single European market.

He echoes concerns from Peter de Proft, director general at the European Fund and Asset Management Association, who recently said he was concerned that the July 22 deadline for the introduction of the AIFMD was “a little too ambitious”.

It gives European Union countries just three months to transpose the directive and its associated Level 2 measures into national law.

The Level 2 measures set out some general principles with which alternative fund managers must comply when delegating, and specify the types of entities that need to meet these criteria.

Although a spokesperson for the European Securities and Markets Authority says the regulator is “confident that these agreements will be signed by the AIFMD transposition deadline”, there are doubts elsewhere in Europe.

“Only Germany and Luxembourg, and perhaps the UK, will manage to meet the July 22 deadline,” Richter predicts. “Austria recently said they had heard about AIFMD for the first time ever.”

“In terms of interpretation, we do not know any details yet,” says Richter, dismissing speculation that Germany will adopt a much stricter version of the AIFMD. “It is not clear how individual countries will deal with the AIFMD and who will be left behind in terms of competitiveness.”

Tobias Pross, who heads institutional business development for Europe at Allianz Global Investors, says while regulation is a challenge for asset managers, in the case of AIFMD it will at least be a level playing field.

“We can complain about it or look at how to deal with it,” he says. Asset managers, he says, face other problems, such as generating returns for their investors in difficult market conditions and protecting investors.

But Glow says some German alternative asset managers have already moved to other countries, mainly Liechtenstein, which tries to position itself as a hub for alternative investment funds, just like Luxembourg and Ireland.

POOLING

Yet other alternative asset managers have started to pool regulation and let one company deal with it. These companies are called Haftungsdach and are not only used by alternative managers.

“We see already that those asset managers falling under the AIFMD are looking for new business models,” says Glow. “Instead of selling alternative investment funds, they are selling bonds that are linked to a project.”

He says these are essentially the same investment, just on the “other side of the balance sheet”. Bonds might remain unregulated.

Holger Naumann, managing director and chief operating officer at Deutschen Asset & Wealth Management in Germany, says alternative investment funds were “definitely subject to detailed regulation” even before AIFMD.

He says the AIFMD will now encompass all non-Ucits funds, including those that had, until recently, been considered Ucits-like. “Scale is helping in larger organisations,” he says, adding that larger asset managers will already have extensive compliance and risk management processes in place.

Pross says risk management and transparency have become more important to investors. Asset managers in Germany, he says, are not just following regulatory requirements but are increasingly looking to fulfill the wishes of their customers.

Union Investment, another large German asset manager, declined to comment on these matters.

©2013 funds europe