In our new regular feature, we will profile some of the most interesting fund launches of the previous month. However, this inaugral data goes back to October and shows a good spread of equity and bond funds.

The final months of 2011 were a difficult time for the asset management world, with market volatility challenging fund managers, but that did not stop asset managers bringing out a range of new products. As the markets have become less volatile in the opening weeks of 2012, some of these funds could well be making money.

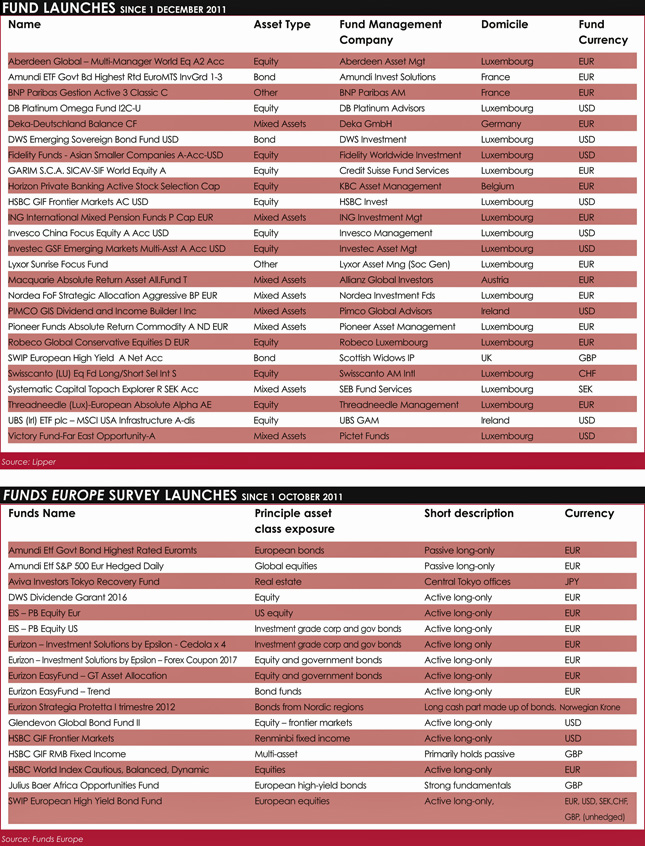

We examined a database provided by Lipper in addition to conducting our own survey. We found there were 213 funds launched since 1 December 2011, according to Lipper for Investment Management, and 71 of these were from the top 50 European asset managers. For each of the top 50 which launched funds in the period, we have chosen one product to profile.

Of these 71, roughly a third, invest in equities and a third in bonds. The rest are split between mixed-asset, real estate and other asset classes. By far the most popular domicile was Luxembourg, accounting for two-thirds of the products.

For our own survey, we sought data on funds launched since 1 October 2011. We received information from nine companies about 18 new funds.

The second table shows the results of Funds Europe’s own survey of funds.

©2012 funds europe