Funds Europe pulls out some of the most interesting fund launches of recent weeks.

Getting picky about emerging markets Emerging market assets had a terrible time in 2013 and many investors reduced their exposure. But according to BlackRock, there are good returns to be had as long as fund managers are flexible and canny.

The BlackRock Strategic Funds Emerging Market Allocation fund can invest in any asset class across emerging and frontier markets, freeing up its managers to try alternative strategies such as long-short.

“It is becoming harder to talk about emerging markets as a group,” says Jeff Shen, head of BlackRock emerging markets, the lead manager on the new fund.

“It is becoming harder to talk about emerging markets as a group,” says Jeff Shen, head of BlackRock emerging markets, the lead manager on the new fund.

“We believe the fund will be attractive to investors because it can move swiftly to seize the best opportunities for growth, but also reduce risk at times of market stress, meaning investors enjoy a smoother ride.”

THE PHOENIX OF SOUTHERN EUROPE

Portugal, Italy, Greece and Spain were among the worst-affected countries during the eurozone crisis. Unemployment in these countries, particularly among the young, remains high.

Yet fund managers have seen promising signs of recovery.

Generali Investments, based in Italy, has launched an equity fund to seek out 35-40 stocks in these countries that will do best out of the return to growth.

Generali Investments, based in Italy, has launched an equity fund to seek out 35-40 stocks in these countries that will do best out of the return to growth.

Fund managers at the firm say the southern European countries are due for a re-rating by global markets, which will aid the recovery. They also see signs that the deep and painful restructuring undergone is yielding results.

“With the first signs of recovery we are seeing some very attractive opportunities across the region,” says Santo Borsellino, Generali Investments chief executive.

SHORT-TERM BONDS FOR CHEAP

SHORT-TERM BONDS FOR CHEAP

Fund managers and investors alike seem to be agreed that the best way to protect fixed income portfolios against a forecast rise in interest rates is by going into short-term bonds.

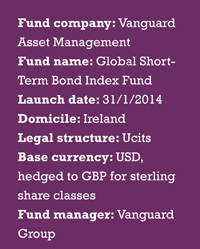

Now Vanguard, champion of low-cost investing, has launched what must be one of the cheapest ways to gain exposure to this asset class.

The Vanguard Global Short-Term Bond Index Fund tracks an index from Barclays and invests in a range of government bonds, investment grade credit and ex-US securitised mortgages. The total expense ratio for the institutional US dollar share class is 0.15%.

“Not only do global short-term bonds provide stability and diversification, they also play a valuable role in protecting the downside risk of portfolios,” says Axel Lomholt, head of product for Vanguard’s international business.

THE SWEDES GO TO CHINA

THE SWEDES GO TO CHINA

Stockholm-based asset manager East Capital was the first fund manager in the Nordic region to gain approval from the Chinese authorities under the qualified foreign institutional investor programme.

Capitalising on its achievement, the firm has launched the China A-Shares Fund to invest in renminbi mainland China equities markets.

Karine Hirn, partner and co-founder of East Capital says “reforms in the financial sector in China and the impending reduction of global investors’ current major underweight to Chinese equities could potentially trigger a re-rating of the market”.

East Capital manages its Asian operations from Stockholm and Hong Kong. It established an office in Shanghai in 2010.

©2014 funds europe