We profile some of the most interesting fund launches in recent weeks and examine the performance of a product already on the market.

UK EQUITIES

UK EQUITIES

This month, Axa Investment Managers is to launch an unconstrained multi-cap UK equities fund – the Axa World Funds Framlington UK fund.

Chris St John, who currently manages the Axa Framlington UK Mid Cap Fund, will be its lead manager, supported by Nigel Thomas, lead manager of the firm’s UK Select Opportunities Fund.

Like other Axa UK equity funds, the new product will employ a bottom-up approach to stock analysis but maintain a structural bias towards mid-cap and small-cap companies relative to the FTSE All Share.

The fund – which will be a Sicav, domiciled in Luxembourg – intends to capitalise on the UK’s growing domestic economy.

It will be registered for distribution in the UK, France, the Netherlands, Sweden, Finland, Norway, Denmark, Austria, Belgium, Germany, Italy, Switzerland and Spain.

Meanwhile, St John will continue to manage the €200 million UK Mid Cap fund.

This has returned 70.1% over the three years to January 8, against the IA UK All Companies sector average of 24.5%.

Axa’s UK equities division manages approximately €16 billion at present.

IRANIAN SECURITIES

IRANIAN SECURITIES

On January 16, the EU terminated all economic sanctions on Iran, including a ban on the purchase of Iranian crude oil and restrictions on Iranian trade, shipping and insurance. In response, emerging market asset manager Charlemagne Capital and Iranian financial services group Turquoise Partners are to launch a fund. The pair will jointly manage the Turquoise Variable Capital Investment fund, which is aimed at institutional investors across Europe.

The firms expect Iran to see growth rates of between 6% and 8% annually “for the foreseeable future”.

At present, the Tehran Stock Exchange offers a dividend yield of around 15%.

The fund’s investment team is led by Turquoise Partners’ Shervin Shahriari, who has been an investor in Iran since 2002, and Stefan Bottcher and Dominic Bokor-Ingram of Charlemagne Capital.

ROBOTICS

ROBOTICS

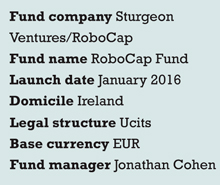

Sturgeon Ventures and RoboCap have jointly launched a robotics fund, giving investors the chance to invest in companies developing 3D printers and high-precision surgical robots.

The firms believe the fund is the second of its kind, following the launch of Pictet Asset Management’s robotics fund in September 2015.

Robotics and automation stocks have performed three to six times better than general equity indices, returning around 17% over the past ten years, the firms say – and they believe the market for robotics and automation is estimated to reach more than €10 trillion by 2025.

The fund will invest in listed companies mainly in the US, Japan and western Europe. It will focus on just 22-30 long positions with an average holding period of approximately 12 months.

The fund is open to all investors, including retail, with a minimum investment of 10,000 pounds, euros or dollars.

LIQUID ALTERNATIVES

LIQUID ALTERNATIVES

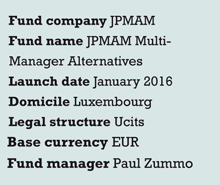

JP Morgan Asset Management has launched a Ucits fund that invests in underlying hedge funds.

The JPMAM Multi-Manager Alternatives fund is offered as a ‘liquid alternatives’ Ucits and is part of the JP Morgan Funds Sicav range in Luxembourg.

The firm said the most difficult part of constructing the product was sourcing high-quality managers to sub-advise on liquid hedge fund strategies, and the due diligence to ensure that managers were capable of offering a liquid offering within the Ucits compliance regime.

The fund is managed by Paul Zummo, co-founder of JP Morgan Alternative Asset Management, and has seed capital of €92.4 million. It draws on multiple hedge fund managers and aims for returns with lower sensitivity to traditional equity and bond markets.

The fund will initially include between eight and 12 hedge fund managers. A spokesperson for the firm was unwilling to name collaborators, but says the fund’s structure (with sub-advisers running managed accounts) offers access to a broader range of managers than would be available through a pure Ucits fund. JP Morgan’s asset servicing division provides administration and custody, while Deutsche Bank and Morgan Stanley act as swap counterparties.

ONE YEAR ON

ONE YEAR ON

The Neuberger Berman Global Real Estate Securities fund arrived at its first anniversary this January. The aim of the fund is to maximise income and achieve capital growth by investing in real estate securities issued by real estate investment trusts (REITs).

The management team takes a top-down approach to portfolio construction, picking securities based on regional, country-specific and sector considerations. The team considers the global macroeconomic environment and its effect on real estate markets regionally and by country. Its portfolio is generally comprised of 50-70 holdings. Since launch, the fund has returned -0.9%, net of fees, against -1.88% delivered over the same period by the fund’s benchmark (FTSE EPRA/NAREIT Global Index (NET)).

Regional allocation, country allocation and stock selection all contributed to relative results. An overweight to North America and an underweight to Continental Europe were the largest contributors to performance. Conversely, an underweight to France and an overweight to Hong Kong were drags on results. The portfolio’s retail holdings were the most beneficial for performance.

©2016 funds europe