The amount of people who are confident they will have enough money to afford the life they want in retirement is higher than those who lack confidence, an international survey indicates.

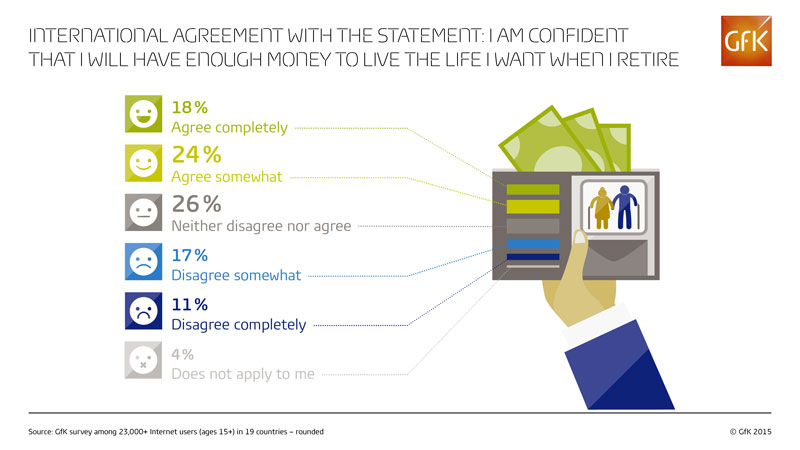

About 28% of 23,000 people in 19 countries lack confidence about affordability in retirement, but 42% believe they will have enough money for the life they want, including 18% who say they are completely confident.

There appears also to be a correlation between confidence in retirement funding and whether a country has a state-funded pension or not, with people in countries where the state provides a pension feeling less confident.

GFK, a market research firm that carried out the research, found that people in the US, China, Russia and Spain were the most confident in having enough money to live the life they want when they retire. This is led by the US at 22%, followed by China at 21% and then Russia and Spain level at 17%.

Sweden, Poland and France, by contrast, mark themselves the most as completely lacking confidence.

Alexander Zeh, GFK’s global lead for financial services research, says: “Countries that provide government-funded pensions – as many of the European countries do – actually have lower levels of confidence than countries such as the USA, where there has been no government-funded pension plan.

“This suggests that people in Europe have finally become aware that the aging population means that public pensions can no longer be relied upon to support them comfortably in retirement. Conversely, people in the likes of America have grown up knowing that they have to fund their own retirement from the start, and so are in a better mind-set than their newly awakened European counterparts.”

GFK found men and women hold very similar levels of confidence, but that the percentage of people in the 40-49 and 50-59 age ranges that lacked confidence was higher.

However, even in the 20-29 age group, nearly a quarter lack confidence about being able to afford a decent life in retirement.

“The quarter of 20-29 year olds who show early concern about their financial comfort in old age are an ideal audience for pension plan marketing that focuses on the benefits of starting contributions at an early age,” says Zeh.

©2015 funds europe