Funds Europe analysis of Lipper data shows where ETFs have beat active returns and supports the investment thesis that gives guidance on blending active and passive investment, says Nick Fitzpatrick.

What do European pension schemes use exchange-traded funds (ETFs) for, where they use them at all?

Ironically, it’s not for the ETF’s much vaunted intra-day pricing and liquidity, which means these funds can trade faster than traditional mutual funds. As time goes by, ETF providers are finding that pension funds are not interested in this facet. They are long-term investors, after all.

But the ETF is finding a purpose in the European market as a convenient way of gaining temporary exposure to an asset class that investors want to hold but have not had time to research.

“We see clients use ETFs to get to market quickly, to get the necessary data before attempting to switch to an active manager after a few weeks or months,” says Arnaud Llinas, global head of ETFs and indexing at Lyxor Asset Management, the third largest ETF provider in Europe with a 10.6% market share (as at January 2013).

But Funds Europe analysis finds there may be occasions when an investor would be better off sticking with the ETF.

Investors have misgivings about active managers.

Actives may find it difficult to beat index returns – the very returns ETFs seek more cheaply to mirror. It is also well known that investors find it difficult to identify managers that can outperform indices consistently.

Analysis of Lipper data supports these misgivings.

ETF VS ACTIVE

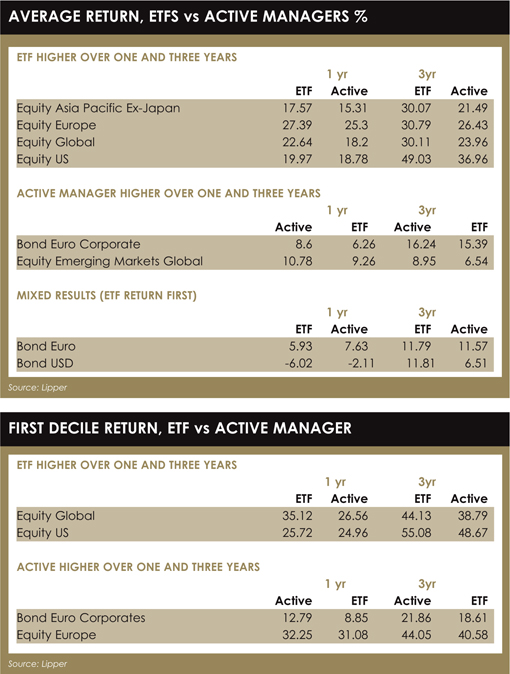

Figures reveal that the average ETF returns over one and three years beat the active returns in four out of eight Lipper fund categories. These were Equity Asia Pacific ex-Japan, Equity Europe, Equity Global and Equity US (see tables).

Active managers beat the average passive return over one and three years in Bond Eur Corporate and Equity Emerging Markets Global.

Returns for the remaining two of the eight fund categories – Bond Euro and Bond USD – were mixed over one and three years.

On occasion, the ETF average return even beat the active managers’ first decile return over one and three years. This occurred in Equity Global and Equity US.

Beating actives with passive returns calls into question the value of active management. But the figures should not shock too much; they also support the investment thesis that argues active investment management is more likely to add value in inefficient markets.

Beating actives with passive returns calls into question the value of active management. But the figures should not shock too much; they also support the investment thesis that argues active investment management is more likely to add value in inefficient markets.

Perfectly in line with this view, we see that over one and three years the average active return has beaten the ETF return in Equity Emerging Markets Global and failed in Equity US, respectively the most inefficient and efficient equity markets in the world.

“Big institutions in Europe tend to think that it is very hard to beat the S&P 500, that very few active managers can outperform it,” says Llinas.

The many strengths of the S&P 500 index include its liquidity and that it is a homogenous index whose constituents are subject to the same laws and, in simple terms, one currency.

Currency can be a source of inefficiency in an emerging market index, such as the MSCI EM Global, where different markets will be subject to different swings in foreign exchange. This creates inefficiencies – or opportunities for active managers to outperform.

But what about Europe, where the average active return failed to beat the average ETF return? (At least the active return managed to beat the ETF when first-decile returns of both products are compared – though by a slim margin for the one-year period: 32.25% vs 31.08%).

The concentration in the Euro Stoxx 50, a popular index for ETF providers, is one reason that makes investors feel they can still find active managers able to exploit inefficiencies and outperform in European equities, says Llinas. So that is often what they go for.

A lack of consensus over fixed income indices may also be a reason for actives’ outperformance in that fund category, Llinas says.

“It does not surprise me that good active managers may be able to outperform these indices.”

But the analysis will be very much dependent on timeframe, says Leen Meijaard, head of sales in Europe, Middle East and Africa at iShares, the industry’s largest ETF provider which is owned by BlackRock.

“There are market cycles in which active managers tend to do better, like in up-markets and momentum markets.”

Meijaard agrees that it would normally be easier to outperform in emerging markets and more difficult in developed markets, but not consistently over all time frames.

Do investors take any of this into consideration?

An iShares survey last year found no clear pattern in how insurance companies, wealth managers and other investors with €2.4 trillion of assets were devising ways to blend active and passive investments.

“If wealth managers can find a good active manager, they will go active,” says Meijaard.

He also highlighted that clients still have developed-market portfolios that continue to employ active managers.

ACTIVES ‘WAY BETTER’

The imperfections of buying indices are highlighted by Alper Ince, managing director at Pacific Alternative Asset Management Company (PAAMCO), a fund of hedge funds.

Consider, for example, the current yield-led trend of equity dividend investing.

“If investors buy baskets containing every yield stock that there is, it creates a bed for even low-quality yield stocks that should perhaps not even be paying a dividend in the first place. I would short it.”

Ince, who is also the sector specialist responsible for long/short equity and event-driven hedge fund managers in the various PAAMCO portfolios and, therefore, an active investor, explains further the merits of active management in emerging markets, where index stocks are likely to be subject to more government planning and correlation with commodities.

“Buying the Brazilian index, for example, means you buy Petrobas, which is government backed, and Vale, which is a commodity play… The returns generated by active management in Brazil are way better than buying the index.”

And fear haunting European stock markets has led to inefficiencies there too, which active managers could exploit.

Noting that in 2011 “people sold anything with a European listing”, Ince adds: “If people shorted the Spanish index because they were scared regardless of where revenues from Spanish companies came from, that’s an inefficiency.”

Noting that in 2011 “people sold anything with a European listing”, Ince adds: “If people shorted the Spanish index because they were scared regardless of where revenues from Spanish companies came from, that’s an inefficiency.”

The average ETF return beat the average active return in Equity Eur, however, though actives beat the ETF in the first decile and first quartile position.

The figures given here are intended only as an indication of how passive investment through ETFs stacks up against active management. It should be noted the benchmarks that active managers are using may not be the same used by the ETFs.

Also, as they are paid to take bets it is inevitable that active managers will underperform occasionally.

But at a time when passive management is on the rise yet pension funds are allocating to ETFs mainly as a holding strategy until a suitable active manager is found, the returns that we present here will give them something to think about while they are waiting.

©2013 funds europe