Funds of ETFs look set to be the next innovation in the exchange-traded products space. Stefanie Eschenbacher takes a closer look at how these ‘active-passive’ funds may challenge traditional funds of funds.

The relentless innovation in the exchange-traded fund (ETF) market is on its way. It is the ‘fund of ETFs’ – in essence a fund of passive funds.

These funds of ETFs are predicted to designate a new battlefield for European providers of ETFs to take on the more traditional passive fund providers.

Cerulli Associates, which advises financial institutions on strategic positioning and new business development, recently reviewed some of the investment trends in Europe. Its analysis focussed on Europe’s biggest markets: France, Germany, the UK, Italy, Spain and Luxembourg.

One of the key findings was that funds of passive funds are piling pressure on the charging structures of traditional funds of funds. This is particularly the case in the UK, where Barclays and Seven Investment Management have already built substantial asset bases.

And as German providers are testing the waters with funds of ETFs, Cerulli’s analysts predict this type of product to spread.

“The surprise is that so many big groups that offer traditional mutual funds and ETFs have not tackled this market,” says Yoon Ng, the report’s lead analyst. “We are convinced it will be a new battlefield.”

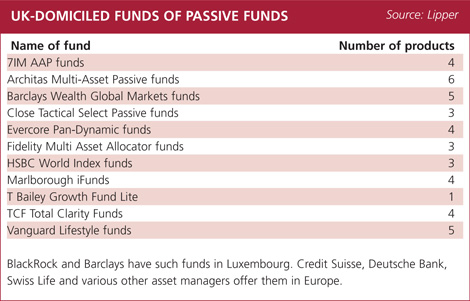

According to Lipper, a data provider, there are at least 12 asset managers offering funds of passive funds in the UK and other parts of Europe.

The experience of a US firm shows the potential in the funds of ETFs market. Cambria Investment Management launched its first fund of ETFs in October 2010. The Cambria Global Tactical ETF is a global macro fund that invests across all major asset classes via ETFs. In its first year, the product attracted $160 million (€119.4 million) in assets, making it one of fastest growing funds of funds in the ETF market.

While the number of launches of funds of active funds is declining, funds of passive funds are just taking off. Relatively high costs associated with active single-manger funds, along with funds of active funds, have been a drag on both performance and popularity.

Actively managed single-manager funds have an average total expense ratio of 1.68%, according to Lipper.

Funds of active funds carry an additional layer of charges, typically a 1% management fee and, in some cases, a performance fee.

The total expense ratio for funds of funds investing in externally managed equity funds is 2.47%, while the fee for those investing in internal ones is 1.72%.

Whereas the average expense ratio across all European ETFs, as calculated by Morningstar, is just 0.38%.

Ben Johnson, the director of European ETF research, warns the total expense ratio is just one of many costs associated with ETFs. Costs of buying, selling or index-specific costs all affect shareholders’ ultimate returns. Yet these are not necessarily reflected in the total expense ratio. Nevertheless, he says, expenses for ETFs compare “very favourably” with actively managed funds.

Asset allocation

Exact figures for the average cost of funds of passive funds are not readily available. Initial fees for the underlying investments, however, are low, which typically translates into lower fees for a fund of funds structure.

TCF Investment, for example, offers such a strategy for a total expense ratio of 0.8%, including administration, annual management cost and costs associated with the underlying investments.

David Norman, the joint founder and chief executive officer, says his proposition invests in a mixture of ETFs and index mutual funds. It revolves around low cost, risk matching and due diligence of the underlying vehicle.

The impending Retail Distribution Review in the UK will also see the abolition of commission. This means independent financial advisers are more likely to consider low-cost offers, such as passive investment strategies which do not pay commission.

“Research shows that the bulk of portfolio returns comes from asset allocation,” Norman says. “A fund of passive funds makes a lot of sense as it removes the high cost of stock selection.”

The low costs of passive products in general, as well as liquidity and transparency, are some of the most compelling arguments for investors.

“The best predictor for future performance are still fund fees and those of passive funds are lower,” says Johnson. “Exchange-traded products (ETPs), under which ETFs fall, have been enormously popular. Awareness and availability of ETPs has increased, helped by a general disillusionment with active fund managers and their general inability to consistently add value.”

The scale of the boom in the ETP market has astonished the investment industry for more than a decade – as has providers’ creativity when it comes to product development. Since ETPs were first made available to European investors more than a decade ago, assets under management rose every year except for the year ending November 2011.

Passive investment

Passive investment

At the end of November, assets under management totalled $308.3 billion (€229.7 billion), according to BlackRock Investment Institute’s latest review of the industry. With the exception of 2002, the number of products available also increased every year. At the end of November, there were 1,226 ETFs and 566 ETPs.

Research from Lipper supports Johnson’s argument on cost. The team analysed relative performance of 271 European equity funds between 2006 and 2010.

Most active managers, Lipper concludes, have failed to add value for the investor over the medium term. Their funds have on average lost 1.15%, compared with a 4.17% increase of the MSCI Europe TR. One fund, the Universal Aktenfonds, lost as much as 36.99%.

The median, which divides the higher half of the sample from the lower half, was a 2.65% loss. Only 101 out the 271 funds compared delivered positive returns.

As passive investment gained popularity, providers created new strategies aiming to track performance of niche countries, industries, currencies, trends or commodities.

Index Universe lists various products that enable passive investors to gain exposure in countries like Pakistan, industries like fishing, currencies such as the Icelandic krona, trends like medical inflation and commodities such as soybeans.

Faber says in most cases the landscape is already “saturated” with funds that cover all the asset classes, but he adds that truly unique funds, and funds that perform well at a reasonable cost, will continue to attract investor capital.

“There are still certain segments of the market that might be more difficult to access for ETP investors,” Johnson says. “Even in liquid markets there are parts where an active manager can add value.”

A second look at Lipper’s analysis of European funds shows that although the average manager has failed to beat the index, a few have delivered outstanding returns.

The Fidelity Fast Europe A, for example, returned 43.17%, which is more than ten times the performance of the index in Lipper’s list.

As Europe’s big providers of traditional mutual funds and ETFs are preparing themselves for the battlefield, investors need to ask themselves whether they are willing to sacrifice the ability to exploit opportunities for something more stable.

©2011 funds europe