Andrew Short looks at the opportunities in the Brazilian equities market for income investors after the first dividend index was launched earlier this year.

In developed markets there is a glut of yield-oriented investors searching for attractive income options. As central banks continue to keep interest rates pinned as close to zero as possible, the play of generating defensive income from a portfolio of government bonds has become inadequate.

This has implications for investors: as people begin to retire, individuals and pension funds are under strain because comparatively safe and regular income flows are in short supply.

Many investors have turned to dividend-paying equities in their asset allocation to gain a stable income stream.

According to Pimco, halfway through 2013 in the US, these strategies had received $40 billion of net inflows. As a result of increased attention, dividend investing has been called a “crowded trade” or “overvalued”.

The common theme of this criticism, according to Pimco portfolio manager Brad Kinkelaar, is that these warnings address a US-centric approach.

“A one-country approach is the root of the problem for dividend portfolios – from ones used in individual retirement accounts to institutional pension plans,” says Kinkelaar. “It’s like putting all your eggs in one basket and developed market investors risk limiting their income potential because yield opportunities in these markets are slim pickings.”

The temptation is for investors to only hunt in their backyards for these types of opportunities and buy the highest yielding stocks.

But investing in one market could concentrate risk into one or two sectors, according to Kinkelaar, and a market like the US is very narrow as – beyond telecoms and utilities – no US sector yields more than 3% currently.

However, moving out of the comfort zone to other locations in the hunt for yield can offer potential benefits, including stock diversification.

Many people think of emerging market stocks as pure growth plays, and may not realise that there is a separate potential benefit – dividends – that can also be available to investors in these markets. These stocks taken as a whole can be volatile; however, in specific regions there are a number of companies that are stable and solid.

Although Brazil has recently fallen out of favour with foreign investors (lacklustre GDP and a potential ratings downgrade from S&P), it still has many opportunities for dividend hunters.

DISPOSABLE INCOMES

Even with the short-term noise, the long-term fundamentals are promising. The country is well positioned to benefit from a youthful population and a growing middle class with increasing disposable incomes. There are also developments in infrastructure across the country, in particular with regard to transportation ahead of the World Cup in 2014 and the Rio Olympics in 2016.

Bradesco Asset Management (Bram) portfolio manager Milton Cabral Filho says what makes Brazil interesting is that it is a huge and relatively closed market. “This is why companies have the ability to distribute good yields – mixed in with long-term income protection. Add to this fact that Brazilian companies pay high taxes and because of this can charge high prices, profits are strong. The economy is also closed with a number of sizable companies with a captured market,” he says.

Bradesco Asset Management (Bram) portfolio manager Milton Cabral Filho says what makes Brazil interesting is that it is a huge and relatively closed market. “This is why companies have the ability to distribute good yields – mixed in with long-term income protection. Add to this fact that Brazilian companies pay high taxes and because of this can charge high prices, profits are strong. The economy is also closed with a number of sizable companies with a captured market,” he says.

RICH HUNTING GROUND

The BM&FBOVESPA is the main Brazilian stock exchange located at São Paulo. It is the 13th largest stock exchange in the world, with a market capitalisation of around $1 trillion. Its main index is the iBovespa.

According to Ashmore equities portfolio manager Julie Dickson, the Bovespa is a rich hunting ground for dividends in Latin American. “Currently the average yield is approximately 4.5%,” says Dickson. “However, it is possible to find companies at higher levels. Having a portfolio of companies that yield 5% to 5.5% is not unrealistic.”

BlackRock managing director for Latin America Will Landers agrees and says Brazil is a good place for those looking for attractive and stable yield. “Brazil is an interesting market for those looking for dividends – it has a dividend yield of over 4% – by far the highest in Latin America,” says Landers.

There is also an interesting quirk: Brazilian companies listed on the local exchange are required to maintain a minimum 25% dividend pay-out ratio, leading to an established dividend culture among domestic corporates.

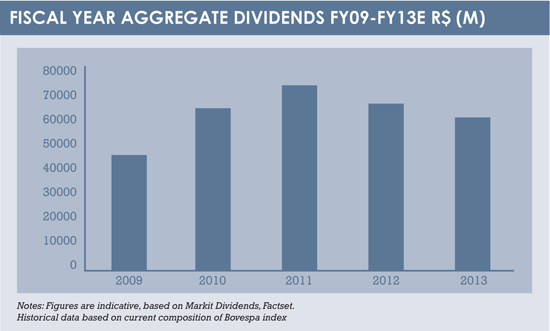

Dividend payments will be made through the first half of 2014 retroactive to fiscal 2013 earnings. The top ten companies with the largest pay out represent 70% of total dividends. Excluding cuts by Petrobras and Vale, aggregate pay outs are expected to rise 1.6% in 2013. A current average dividend yield of 3.9% and is relatively flat compared to 2012, corresponding to share price performance and expected dividend cuts.

A research note by Markit Economics published this year forecasted that 60 billion Brazilian real ($26 billion) in dividends would be paid by companies on the iBovespa index for the fiscal year (see table one).

Markit equities associate Daniel Victor says that dividends are forecast to drop this year in Brazil as the real had a down swing which meant companies had to pay more for materials abroad. He adds: “Many companies with foreign denominated debts had increasing cost as the real had depreciated severely against the US dollar.”

However, a higher dollar is not all bad, as was visible in earnings reports for June to September. A weak Brazilian real helps operating profitability of Brazil’s multinationals and other companies including steel mills, pulp exporters, and iron-ore miners.

PASSIVE OR ACTIVE

The growing importance of dividend income investing has not gone unnoticed in Brazil. This year S&P Dow Jones Indices (S&PDJI) launched three indices, the first in its history for tracking Brazilian dividend paying stocks.

S&PDJI senior director of strategy indices Vinit Srivastava explains the three indices have different styles. “S&P Dividend Aristocrats Brazil is based on the dividend growth theme; S&P Brazil Dividend Opportunities focused more on pure yield; and S&P Brazil Dividend Opportunities SmallMidCap draws on high yield companies in the small-midcap space,” he says. He adds S&PDJI is working with international and local funds to license the last index for a product.

S&PDJI senior director of strategy indices Vinit Srivastava explains the three indices have different styles. “S&P Dividend Aristocrats Brazil is based on the dividend growth theme; S&P Brazil Dividend Opportunities focused more on pure yield; and S&P Brazil Dividend Opportunities SmallMidCap draws on high yield companies in the small-midcap space,” he says. He adds S&PDJI is working with international and local funds to license the last index for a product.

Srivastava says investor demand underpinned the launches. “Brazilian equities have generally paid high dividends in comparison to some other markets. The S&P Brazil BMI was yielding 3.4% annually at the end of last month. If you look across the spectrum of emerging market dividend indices, Brazil tends be in the top three or four among the highest exposure countries, other prominent ones being Taiwan, South Africa.”

For investors wishing to track a benchmark, using such an index is an appropriate way to gain exposure to the total universe of Brazilian companies (or sub-sets of companies) that pay out dividends. However, investors wishing to gain alpha will need to look at more actively managed strategies. Passive funds cannot exclude unfavourable companies or sectors (see box: State intervention).

Bram’s Filho says that indices are heavily weighted towards certain companies that are not of sufficient quality. “It’s not ideal because it allows a concentration of certain companies and that is not healthy as a benchmark fund,” he says. “For inclusion in a dividend fund the company must pay dividends in an important way and be low risk. For us, low risk means a robust balance sheet and good management.

“We are interested in the quality of the dividend and in Brazil there are some quality opportunities.”

©2013 funds global latam