CAMRADATA’s Diversified Grouth Funds (DGF) investment research report for Q3 2019, which charts the performance of investments and asset managers across the DGF universe, highlighted the eighth consecutive quarter of outflows.

“Autumn is the mellower season, and what we lose in flowers we more than gain in fruits,” observed 19th century English author Samuel Butler. But current geopolitical uncertainties and a weak global economic outlook present questions for investors about where this fruit can best be harvested.

The US Federal Reserve met expectations that it would reduce interest rates, delivering 25bp cuts in July and September. This has encouraged US equities markets, although President Trump criticised Fed chair Jerome Powell for “lacking courage” to provide a larger (i.e. 50bps) boost to the economy. The European Central Bank also announced stimulus measures, with outgoing president Mario Draghi hinting that a resumption of quantitative easing is possible to revive a flagging eurozone economy.

Political questions around the US-China trade dialogue, Brexit and the outcome of the UK General Election continue to weigh on global growth expectations. China is in the spotlight as we monitor how its slowing economy responds to fiscal and monetary stimulus and how, over time, the global economy adjusts to a narrowing of China’s long-running trade surplus.

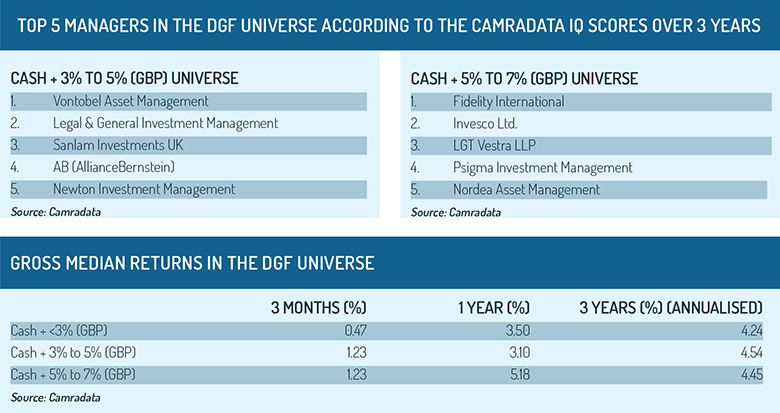

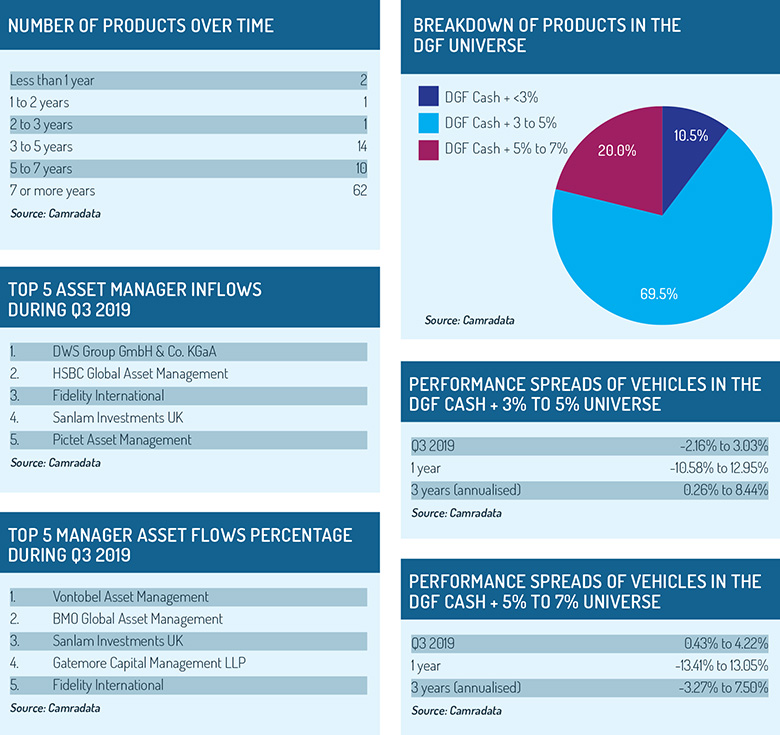

During Q3, more than 90% of funds in the DGF universe achieved breakeven or positive return, the second consecutive quarter that it has achieved this. However, some investors retain doubts about the ability of the DGF sector to meet their return and risk-management expectations, with net redemptions from the CAMRADATA DGF universe totalling £4.46 billion during Q3, the eighth consecutive quarter that it has witnessed net outflows.

In the year to September 30, the DGF universe has seen net outflows of more than £21 billion, despite delivering a median return of 4.1% in that period. However, some asset managers have delivered strong asset gathering performance, DWS Group heading the list with net inflows of £595 million into DGF funds during Q3. Assets under management in the CAMRADATA DGF universe have fallen by £2.1 billion since Q2, the third consecutive quarter in which AuM has fallen. This leaves AuM for this universe at £24.4 billion below its peak at the end of 2017.

The glory days of 2016 and 2017 must now seem a long way off for managers of DGF funds after several consecutive quarters of outflows. However, managers will hope that the final quarter of this year may provide them with some much needed relief.

To read more of our DGF investment research report or to carry out manager research across over 250 different asset classes please log in to CAMRADATA Live at www.camradata.com.

©2019 funds europe