Clearly, regulation is a big influence on fund companies’ attitudes towards data. This observation was confirmed when we asked respondents which was the main factor driving the acquisition of distribution-related data by fund managers. A majority, 57%, said that meeting regulatory requirements was the main factor (see figure 11 on page 10), while 38% said “commercial reasons (to assist sales teams)” was most important.

This finding indicates that regulation is such an important influence on decision-making at fund managers that it outweighs commercial imperatives. Perhaps fund company managers are reasoning that the necessity of avoiding regulatory fines is greater than the need to raise new money.

There is, of course, no reason that fund companies cannot do both – acquire data for regulatory purposes while also using it to influence their marketing efforts. Since many potential sources of data are available for fund manager sales teams, we asked our respondents to rank a selection of them in order of usefulness. In figure 12 on page 11, the sources are arranged from top to bottom in ascending order of average ranking, meaning that the top source was, on average, deemed to be the most useful and the bottom was deemed to be the least.

Fund distributors, such as platforms, topped the list; they were ranked as the most useful source by two-thirds (67%) of respondents. Financial advisers/private banks, which were ranked second by 46% of respondents, came next, beating third-party data providers on average. At the bottom of the list, search engines and social media were deemed the least useful sources of information to sales teams. This ranking suggests our respondents view their traditional partners, such as fund platforms and private banks, as the most helpful allies, while the likes of Google and Twitter are viewed with some scepticism.

Regulation, of course, is generally seen as a burden to fund companies, and perhaps no aspect of regulation is more burdensome than know-your-client (KYC) and anti-money-laundering (AML) procedures, which can make the process of onboarding new clients a lengthy and tedious endeavour. Our survey revealed dissatisfaction with these procedures in that only 26% of respondents thought they were generally efficient and in need of no improvement (of which 2% held the view strongly: see figure 13 on page 11). This finding suggests significant appetite for technical solutions to make KYC and AML simpler.

As for the regulators themselves, respondents were divided about how the data collected by regulatory bodies would be analysed. Although 46% said they thought regulators would handle the data themselves, a similar proportion (41%) felt regulators would outsource data review to third parties such as asset servicing companies (see figure 14 on page 12). A cynical minority (13%) opted for “neither”, indicating perhaps that these respondents believed the data assiduously collected for the benefit of regulators would go unanalysed.

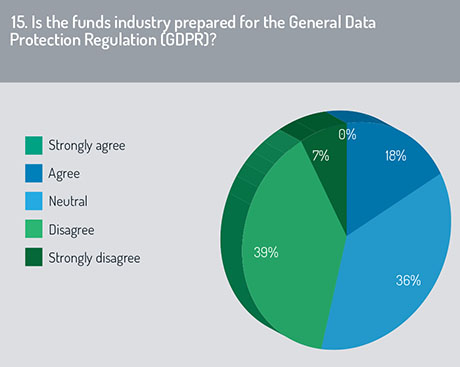

To finish the survey, we asked a question about a large piece of regulation that has ramifications across almost all industries, not only the financial ones. The General Data Protection Regulation (GDPR) aims to give individuals control over their data by imposing regulatory demands on organisations that collect and store such data. Was the funds industry ready for GPDR, which was implemented on May 25, 2018 (about a week after the survey closed)? The findings were not encouraging.

A total 46% of respondents said the industry was not ready (of which 7% held the view strongly: see figure 15, previous page). We can only hope that since the survey closed, the funds industry has swiftly put its data privacy policies in order.

Hard work ahead

This survey has revealed that data management at fund companies is an increasingly important function, both for regulatory reasons and to help steer marketing campaigns and distribution efforts. But our survey found a persistent concern among respondents that standardisation is hard to achieve, as well as a lack of awareness of some of the main initiatives in this area. There was also some cynicism about the practical obstacles to achieving better data policy. As one respondent put it, “Data is too diverse within the fund companies to standardise. There is also no incentive to do so, and the data analysts who produce the numbers are under significant pressure from sales teams to report ‘the larger number’.”

When we also consider the separate problem that owning customer data can itself be a costly matter, it is not difficult to see why many fund manufacturers have been happy to offload their data responsibilities to distributors and other service providers. Whether such a strategy will be tenable under regulations such as MiFID II remains to be seen.

Clearly the industry must work hard to overcome these challenges if the benefits of “big data for funds” are to be unlocked.

©2018 funds europe