Chilean mutual fund providers have been increasing their assets from the voluntary pension fund sector in the country. Nick Fitzpatrick looks at growth and investor appetite.

Chile has always presented an interesting pensions opportunity for local and foreign fund managers. The country’s pensions system, created under General Augusto Pinochet, is seen internationally as a model for other nations to study.

In addition to the mandatory pensions system, a voluntary pensions system (ahorro previsional voluntario, or APV) is operating and it encourages investors to make a further effort to improve their retirement allowance.

“Every day, more Chileans recognise that it will be very hard to maintain a similar income level after reaching the pension age if they only save in the mandatory pensions system,” says Monica Cavallini, general manager of the Chilean Mutual Funds Association.

Through the APV, people can increase what has been accumulated in their individual accounts and, therefore, the amount of pension to be received.

“Alternatively, it opens up the possibility of early retirement,” says Cavallini.

Since 2002, when the Chilean government tried to encourage more voluntary contributions by allowing savers who belonged to the voluntary pension system to invest in a broader range of investment providers such as mutual funds, the mutual fund industry has seen assets from that line of business grow to 4% of its total asset base. Total assets for the whole mutual fund industry stood at $35.5 billion (€26.8 billion) as of July this year.

Cavallini says: “As of 1 March, 2002, Law No. 19.768 reformed the mechanism for voluntary social security saving, extending the number of institutions allowed to manage funds. The mutual funds industry became a part of it and since then the industry has captured 20% of the market that was previously a captive market of mandatory pension fund administrators (Administradores de Fondos de Pensionses). This has introduced competition because it has added more than 500 fund alternatives for investors to choose from.”

Although the APV only represents 4% of assets under management for the mutual fund industry, the segment is growing fast, Cavallini adds.

Balanced funds

Today, the mutual funds industry is designing innovative products aimed at the APV. Cavallini says these include products to provide income for children and for spouses who do not work or receive any other income. These developments will enable the population to be better prepared for retirement and help the government to deal with an increasing life expectancy.

Rodrigo González, general manager of Principal Financial Group, which offers fund management for pension plans, says balanced funds are gaining traction in the market.

“By ‘balanced funds’, we mean life cycle-type funds – target-risk and target-date funds. Both are gaining pace and share. We expect this trend to continue in the near future.”

Investors in these funds do not just seek domestic equities. “Given the nature of this type of savings and, therefore, the time horizon involved, there is a natural bias towards equities, local and foreign,” González says.

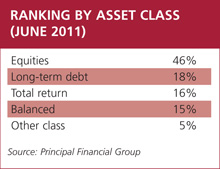

He adds that equities make up 46% of allocations and fixed income funds account for about 21% of total savings (see box).

There is complete segregation of assets in the industry, says González, as legal entities are different. “The asset manager is one legal entity, and every fund has its own legal vehicle, different from the asset manager. This is valid for every type of manager [whether a pension fund investment manager or a general asset manger].

There is complete segregation of assets in the industry, says González, as legal entities are different. “The asset manager is one legal entity, and every fund has its own legal vehicle, different from the asset manager. This is valid for every type of manager [whether a pension fund investment manager or a general asset manger].

“Custody for Chilean equities is given to the DCV (Depósito Central de Valores, the sole depository for all eligible securities in Chile), which is independent from all asset management companies. Custody for international shares is by other global institutions, such as Citi, in Principal’s case.”

Ladislao Larrain, chief executive officer at LarrainVial, a fund management company with $2.80 billion under management, says the principle opportunities for fund managers in the C hilean pension fund market, including the broader corporate market, are in funds that invest actively in Latin America. LarrainVial has a Chilean small-cap business, and also runs small and mid-cap Latin American equities and Latin American high-yield.

“The underlying assets that pension funds currently use us for are Latin American,” he says. The products with the most success for LarrainVial in the pension market are public equity funds. These are its Beagle and Magallanes II funds. Both are equities funds, the first investing in Chilean small-caps and the second in Latin American small and medium-cap companies.

“The underlying assets that pension funds currently use us for are Latin American,” he says. The products with the most success for LarrainVial in the pension market are public equity funds. These are its Beagle and Magallanes II funds. Both are equities funds, the first investing in Chilean small-caps and the second in Latin American small and medium-cap companies.

The Chilean pension system has not been without its drawbacks over the years, such as high administrative costs. Nevertheless, the pension project is considered to have economically benefited Chile and led to greater capital market development.

©2011 funds global