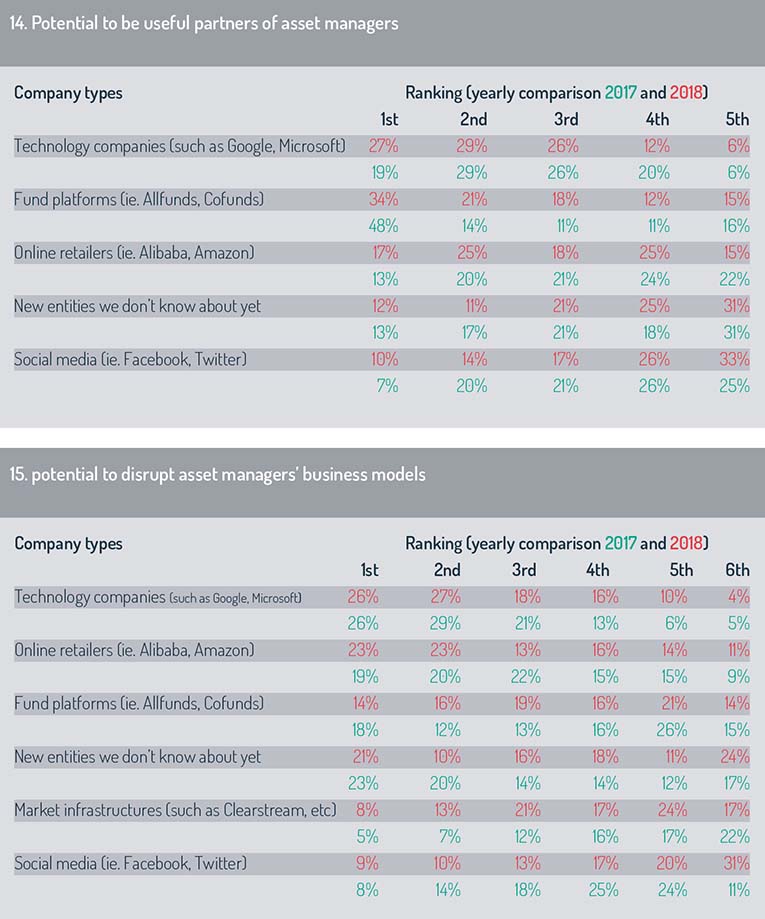

The next section was also a repeat from last year’s survey. The intention was to establish which types of company had the greatest potential to be useful partners to the asset management industry and which types of company were most likely to be disruptors.

This year, technology companies such as Google and Microsoft came top (see figure 14 on page 20: the company types are arranged in order of average ranking with the highest ranked at the top). The result reflects a change from last year, when fund platforms such as Allfunds or Cofunds came top. Have our respondents became less sanguine about the benefits of allying with fund platforms, or have they become more optimistic about the opportunities of technology partnerships? Further research in this area could be fruitful.

The next question asked which types of company were most likely to disrupt asset managers’ business models. Technology companies were again ranked top (see figure 15), a finding that matches the result gained last year. What does this data point mean? We think it shows that the likes of Google and Microsoft are viewed with a certain awe. These technology giants have the power to be valuable partners or formidable enemies. They can aid or they can destroy. Clearly, the question of how to work with them is pivotal and will be much discussed in coming months.

Distributors

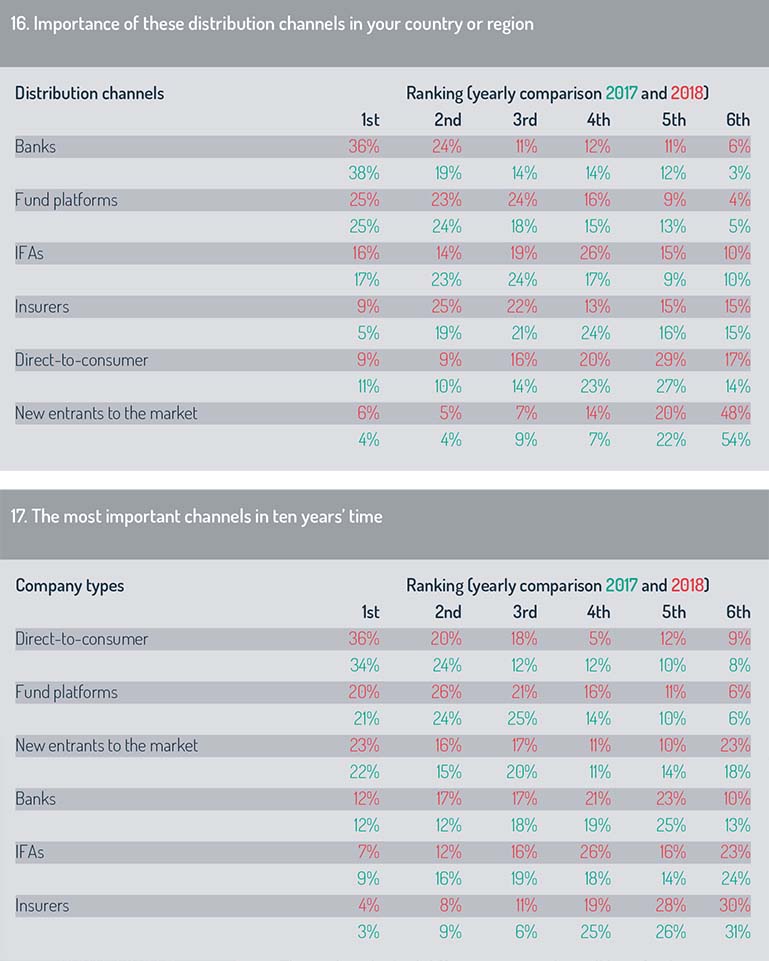

Another repeated section of the survey looked at distribution channels. Respondents were asked to rank the importance of six channels in their country or region. As in last year’s survey, banks were the most important channel overall, followed closely by fund platforms (see figure 16). Insurers came in third, replacing independent financial advisers (IFAs), who occupied third place last year.

The order of priority depended on a respondent’s location, however.

This finding indicates that the importance of distribution channels varies greatly from country to country.

The ranking looked different in the following question, when we asked respondents to predict which will be the most important distribution channels in ten years’ time (see figure 17). Here, direct-to-consumer channels came top overall.

As we observed in last year’s report, the priority placed on direct-to-consumer channels is interesting because consultants have argued that only a subset of asset managers, namely big firms with well-known brands, will realistically succeed with this strategy.

It remains to be seen if the growth in direct-to-consumer sales will be a further spur to an ongoing process of industry consolidation.

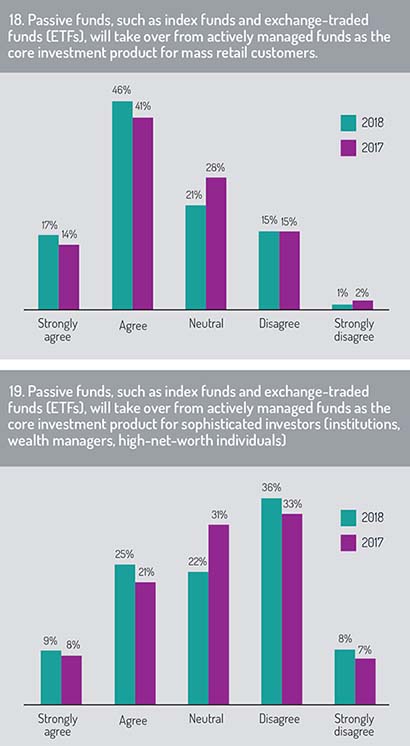

Funds and fees

The final section of the survey looked at trends in product demand. One of the most significant developments in the funds business in recent years is the rise in indexing as opposed to traditional actively managed funds. A total of 63% of respondents said they thought passive funds, such as exchange-traded funds (ETFs), would take over from actively managed funds as the core investment product for mass retail customers (of which 17% strongly agreed with the statement: see figure 18). This was an increase on the 55% of respondents who agreed with the statement when the same question cropped up in last year’s survey.

We then asked respondents to say if they thought passive funds, such as ETFs, would take over as the core investment product for sophisticated investors, such as institutions, wealth managers and high-net-worth individuals. A total of 34% thought they would (of which 9% agreed strongly with the statement: see figure 19). This was a similar proportion as agreed with the statement in last year’s survey, though at that time, slightly more people agreed strongly.

As in last year’s survey report, we observe a belief among our respondents that sophisticated investors are more likely to require actively managed funds than retail investors. This finding may provide a clue as to which types of investor the traditional active managers will seek to target with their marketing.

What about the trend for robo-advisers, otherwise known as algorithm-based services that provide automatic financial advice in response to user inputs? Slightly less than half of respondents (46%) said they thought robo-advisers would become the main distribution channel for raising assets from the mass retail market (of which 7% held the view strongly: see figure 20). This was a rise of seven percentage points compared with last year’s survey, when a total of 39% said they agreed with the statement.

If these results are anything to go by, there appears to be a rising belief in the commercial value of robo-advice as a tool for raising assets from retail investors. It will be interesting to see if this trend continues.

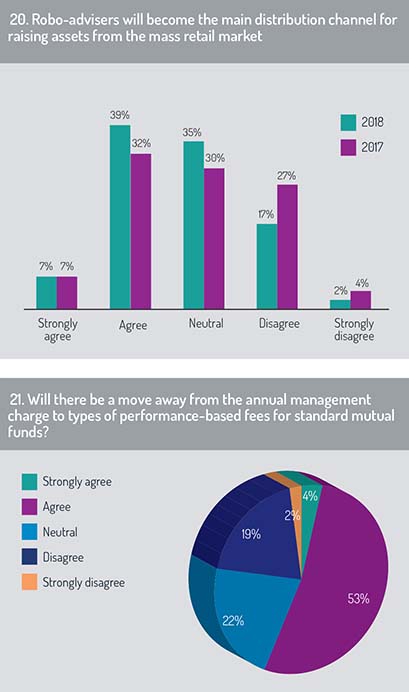

The last question was new for this year’s survey and tackled the question of fees. We asked our respondents if there would be a move away from the annual management charge to types of performance-based fees for standard mutual funds. A majority (57%) said they thought there would be (of which 4% strongly agreed: see figure 21). Although this was not a decisive result, it shows a significant interest in performance-based fees, which suggests asset managers are likely to bring in more products offering these structures in future. Our respondents may have been reasoning that the potential benefit, in terms of improving investor confidence and trust in their managers, is worth the additional work required to administrate these different types of fees.

Conclusion

Conclusion

This study has revealed concerns among our respondents that regulatory costs are eating up resources that might be deployed elsewhere. Two-thirds of respondents said that if their regulatory costs fell to zero, the money would be spent on technology investment. What kinds of technologies would attract this investment? An indication was given by figure 8, which found that the back office is seen as the biggest priority for investment. Another relevant finding, shown in figure 9, was that respondents believed that distributed ledger technology, known as blockchain, would have the biggest impact on the funds business. This discovery will reassure firms investing in blockchain-related initiatives.

Clearly, regulation and technology are intimately linked. According to our research, a fall in the cost of regulatory compliance would lead to a rise in investment in areas such as blockchain. That could lead to efficiency savings across the industry and, ultimately, a better experience for the end investor.

There is another possibility: technology may itself help to bring down the cost of regulatory compliance. If so, a virtuous circle might be created in which technological progress unlocked investment for more technology.

Regulation is a challenge. Technology may be both solution and prize.

©2018 funds europe