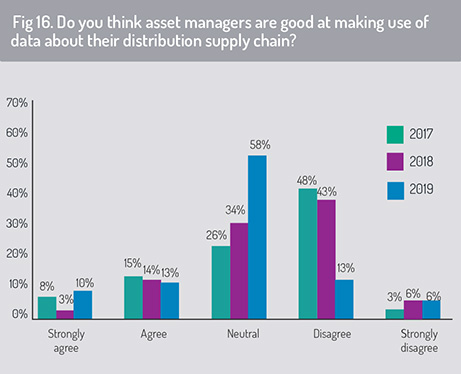

Repeating a question that was also included in the 2017 and 2018 surveys, we asked respondents whether asset managers are good at making use of data about their distribution supply chain (fig 16).

In 2019, 23% of respondents indicated that they agreed with this statement and 10% of these said that they agreed strongly, a sizeable increase on the 2018 survey.

Significantly, the percentage of respondents that disagreed with this statement has fallen dramatically over the past two years: from 51% in the 2017 survey (of which 3% disagreed strongly), to 49% in 2018 (6% disagreed strongly), to 19% in 2019 (6% disagreed strongly).

Just as respondents believed that asset managers are getting better at adopting new technology, they also identified an improvement in how well asset managers understand data about their distribution supply chains. This is important for asset managers in evaluating the performance of sales teams and distribution partners across their regional or global marketing networks. However, it may also have important regulatory implications – for asset managers registered in EU countries, for example, that are required to meet product governance and target market requirements under the second Markets in Financial Instruments Directive (MiFID II).

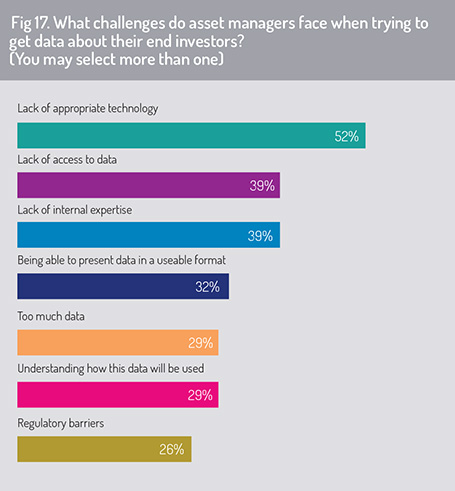

To meet these compliance obligations – and to evaluate their marketing and distribution strategies – asset managers may seek information on end investors buying units in their fund products. We asked respondents to highlight the major challenges that asset managers face in obtaining data on their end investors. They were permitted to select more than one answer (fig 17).

To meet these compliance obligations – and to evaluate their marketing and distribution strategies – asset managers may seek information on end investors buying units in their fund products. We asked respondents to highlight the major challenges that asset managers face in obtaining data on their end investors. They were permitted to select more than one answer (fig 17).

Respondents indicated that access constraints were caused first and foremost by lack of suitable technology (52%). This represents a larger obstacle than lack of internal expertise (39%) or the specific challenges of managing high data volumes (29%), ensuring data is in the correct format (32%) or understanding how data is to be applied (29%).

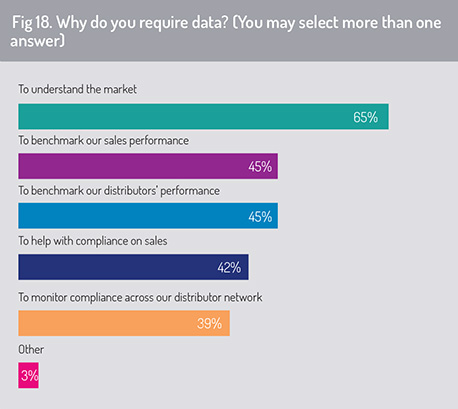

In the next question, we asked respondents why they require data to support their business activities. They were permitted to choose more than one response (fig 18). The largest group (65%) said that they use data primarily to “understand the market”. In line with this statement, 45% of respondents said that they use data to benchmark sales performance or the performance of distributors.

Data is also important in supporting compliance and regulatory reporting requirements, with close to 40% indicating that they use data to support compliance on sales and to monitor compliance across their distribution network.

Data is also important in supporting compliance and regulatory reporting requirements, with close to 40% indicating that they use data to support compliance on sales and to monitor compliance across their distribution network.

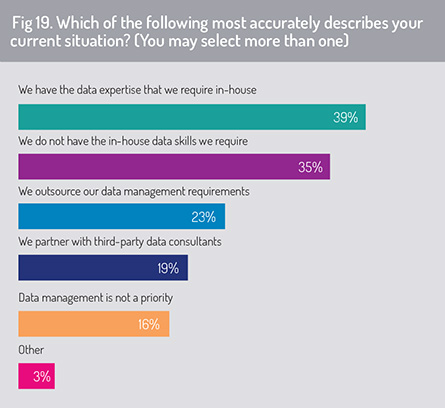

To evaluate how asset managers are managing their data requirements, we asked respondents to provide further details of their data strategies and the level of internal expertise on which they can draw. Respondents could select more than one answer (fig 19). The largest group (39%) indicated that they had the data expertise they require in-house and do not source skills externally from data management consultants. A slightly smaller group (35%) said they do not have the data skills that they require internally.

For the latter group, outsourcing and partnering with specialist data consultants represent the principal strategies that firms employ to manage this skills shortfall. Specifically, 23% indicated that they outsource their data management requirements, while 19% said they met this skills gap through partnership arrangements with third-party data consultancy firms.

For the latter group, outsourcing and partnering with specialist data consultants represent the principal strategies that firms employ to manage this skills shortfall. Specifically, 23% indicated that they outsource their data management requirements, while 19% said they met this skills gap through partnership arrangements with third-party data consultancy firms.

Given the importance of data as a strategic resource for many asset management companies, it is noteworthy that roughly a sixth of respondents stated that data management is not a current priority for their firm. Few firms in the funds industry can operate efficiently without high-quality data to drive investment decision-making, to evaluate sales and distribution performance, or to support efficient trade processing with low fail rates and high levels of straight-through processing. We expect the ability to manage big data sets and to interrogate these effectively to become ever-more important in a world that makes greater use of artificial intelligence and process automation.

Next article from the report »

©2019 funds europe