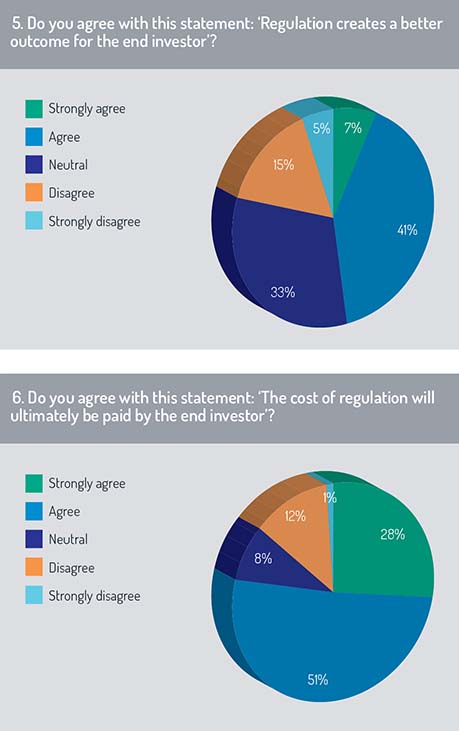

The previous results established that our respondents believe regulatory demands are rising. But what about the supposed beneficiaries of these compliance efforts – are the industry’s customers being well served? We asked respondents if they agreed that “regulation creates a better outcome for the end investor”. Nearly half of respondents (48%) said they thought regulation created a better outcome for the end investor (of which 7% held the view strongly: see figure 5). A third of respondents indicated that they were neutral and a total of 20% disagreed.

The results are hardly overwhelming, and there are clearly a number of people in our survey who did not think regulation was bringing benefits to the people it ought, ultimately, to help; that said, there was not as much cynicism as might have been feared. We think this finding indicates a reasonable level of support for legislators’ efforts.

However, there was a refreshing honesty revealed in the answer to the next question, which asked respondents if they thought that “the cost of regulation will ultimately be paid by the end investor”. A total of 79% indicated that they thought the end investor would ultimately pay the regulatory costs (of which 28% held the view strongly: see figure 6). This was a decisive result and one of the clearest demonstrations of the way financial industry regulation is seen to be a trade-off. For the end investor, regulation is meant to promote transparency and reduce risk, but, according to our respondents, the implementation of the rules will lead to more expensive products, which is hardly what regulators want.

However, there was a refreshing honesty revealed in the answer to the next question, which asked respondents if they thought that “the cost of regulation will ultimately be paid by the end investor”. A total of 79% indicated that they thought the end investor would ultimately pay the regulatory costs (of which 28% held the view strongly: see figure 6). This was a decisive result and one of the clearest demonstrations of the way financial industry regulation is seen to be a trade-off. For the end investor, regulation is meant to promote transparency and reduce risk, but, according to our respondents, the implementation of the rules will lead to more expensive products, which is hardly what regulators want.

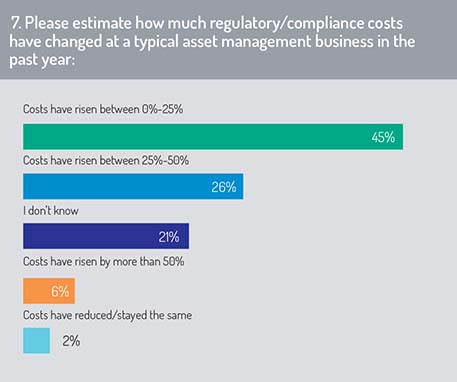

How much have regulatory costs increased? According to 45% of our respondents, costs have risen by up to 25% in the past year. A further 26% said costs have grown by between 25%-50% in the same period (see figure 7). Only 2% of our respondents said their regulatory costs had fallen or stayed the same.

Dubious legacy

The next section of our survey examined technology. The funds sector relies on technology across all parts of the business, but, unfortunately, much of this consists of “legacy” systems that were devised or implemented years or even decades ago.

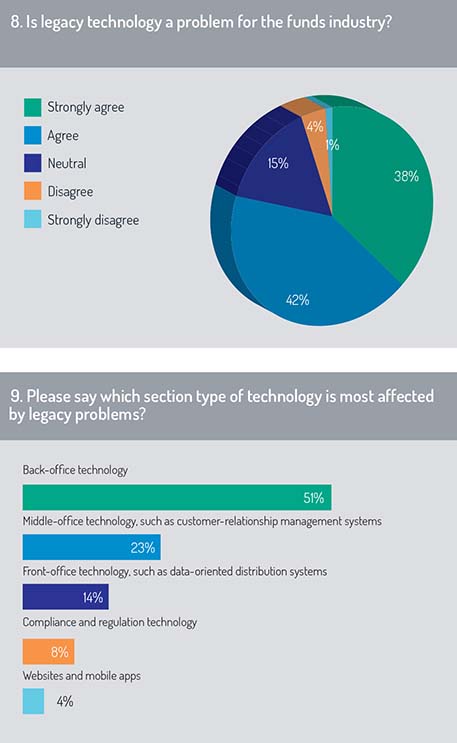

We asked respondents if they thought legacy technology was a challenge for the funds industry and the answer was a clear “yes”. A total of 80% of respondents said legacy technology was a problem (of which 38% held the view strongly: see figure 8). This finding underlines the importance of future investment in technology: the old systems are due an upgrade.

Which types of technology are most blighted by legacy problems? Again, we got a clear result – the back office. More than half (51%) said back-office technology was most affected by legacy challenges (see figure 9). This finding, perhaps, is not a surprise. The back office has for years been seen as the humdrum, “unsexy” part of the funds business and it is only relatively recently that senior executives have taken an interest in it.

Which types of technology are most blighted by legacy problems? Again, we got a clear result – the back office. More than half (51%) said back-office technology was most affected by legacy challenges (see figure 9). This finding, perhaps, is not a surprise. The back office has for years been seen as the humdrum, “unsexy” part of the funds business and it is only relatively recently that senior executives have taken an interest in it.

The answers shown in figure 9 suggest that investment in back-office technology should be a priority for fund companies. But, given the regulatory challenges identified earlier, it is safe to assume that many firms will struggle to find the time and energy for this process, despite recognising its importance.

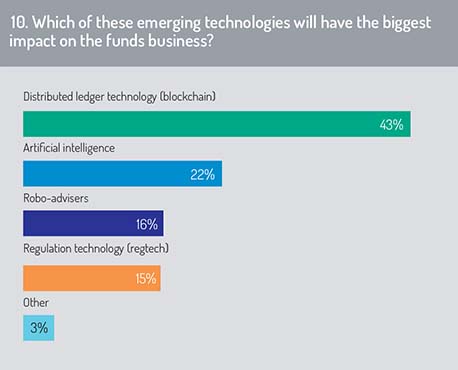

From the 20th century, we move to the 21st. Out of a list of emerging technologies, which would have the biggest impact on the funds industry? Our respondents gave a clear lead to distributed ledger technology, otherwise known as blockchain, which 43% of them opted for (see figure 10).

Those who voted have clearly absorbed some of the excitement in industry circles about this technology, made famous by Bitcoin and other cryptocurrencies. Decentralised registers have the potential to revolutionise many aspects of financial services. Fund companies from across the industry are right to watch developments in blockchain to see how it will affect their businesses.

Those who voted have clearly absorbed some of the excitement in industry circles about this technology, made famous by Bitcoin and other cryptocurrencies. Decentralised registers have the potential to revolutionise many aspects of financial services. Fund companies from across the industry are right to watch developments in blockchain to see how it will affect their businesses.

Artificial intelligence was chosen by 22% of respondents, ahead of robo-advisers and regulation technology. Respondents who answered “other” were asked to say which type of technology they had in mind; answers included “new dealing and settlement systems and APIs [application programming interfaces]” and “big data”.

Data and all

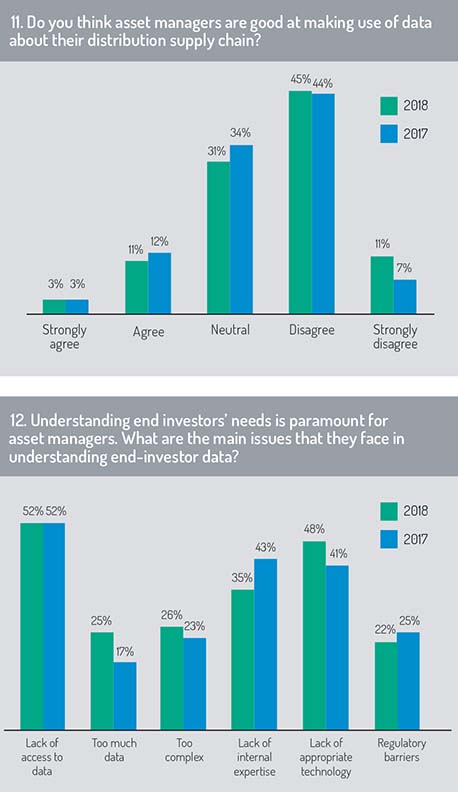

The next few questions were repeated from 2017’s collaborative survey between Funds Europe and Calastone, ‘Distribution state-of-the-nation’. As in last year’s poll, we asked respondents if they thought asset managers were good at making use of data about their distribution supply chain. A total of 56% of respondents said they disagreed with the statement (of which 11% said they disagreed strongly: see figure 11 on page 12). The result was slightly stronger than in last year’s survey, when a total of 51% said they disagreed with the statement. Although this is not a large rise, the finding prompts us to speculate whether asset managers have become worse at using data in the period (which seems unlikely) or, on the other hand, whether there is a growing recognition about asset managers’ shortcomings.

Next was another repeated question, this time asking respondents to identify the main issues that asset managers face in understanding end-investor data (see figure 12) respondents could pick more than one answer to this question). “Lack of access to data” came out on top for the second year running, with exactly the same proportion of responses (52%) as last time.

Next was another repeated question, this time asking respondents to identify the main issues that asset managers face in understanding end-investor data (see figure 12) respondents could pick more than one answer to this question). “Lack of access to data” came out on top for the second year running, with exactly the same proportion of responses (52%) as last time.

“Lack of appropriate technology” came second with 48%, compared with 41% last year, a result that may indicate a growing awareness that legacy issues are hindering fund companies from making the most of their data resources. This year, 25% of respondents said there was “too much data”, compared with 17% who said the same last year.

Another repeated question asked if, based on their track records for technology implementation, asset managers were good at adopting new technology. A total of 48% disagreed with the statement (of which 5% disagreed strongly: see figure 13). This was a slight increase compared with last year, when a total of 44% said the same. Again, it seems somewhat unlikely that asset managers have become notably poorer at adopting new technology in the past year; we suspect this finding indicates a greater awareness in the industry that asset managers have room for improvement.

The 48% who disagreed with the statement were asked to say why they thought asset managers were not good at adopting new technology (see page 20 for an edited list of the responses). A number of thoughtful comments were left. “Asset managers are typically averse to increased costs where the outcome is not certain,” said one. “They are good at buying new things but bad at making use of technical capabilities,” said another. A third noted: “The competitive environment restricts collaboration […] therefore the ability to achieve standardisation against an ever-moving technology landscape is almost impossible.”

The 48% who disagreed with the statement were asked to say why they thought asset managers were not good at adopting new technology (see page 20 for an edited list of the responses). A number of thoughtful comments were left. “Asset managers are typically averse to increased costs where the outcome is not certain,” said one. “They are good at buying new things but bad at making use of technical capabilities,” said another. A third noted: “The competitive environment restricts collaboration […] therefore the ability to achieve standardisation against an ever-moving technology landscape is almost impossible.”

One punchy respondent remarked: “It’s because you have a bunch of old people at the C-levels of asset management who have allergic reactions to the thought of change or evolution.”

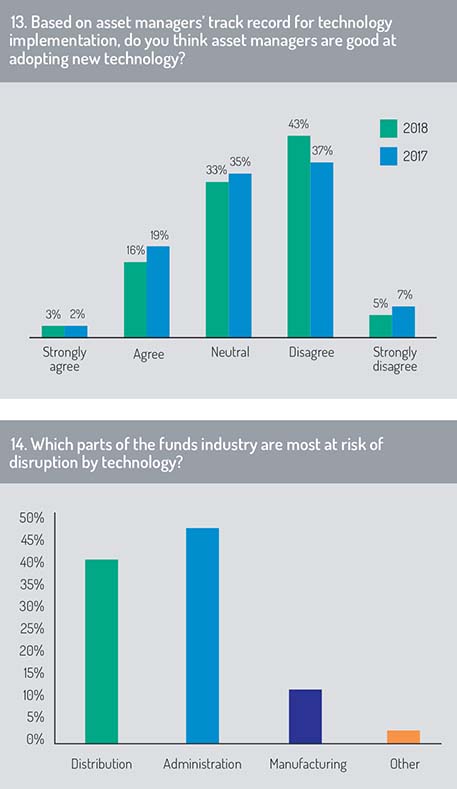

Given the accusation that asset managers are technically inept, we felt it was prudent to ask if parts of the funds industry are at risk of disruption. Nearly half (46%) of respondents said administration was the part of the funds business most likely to be disrupted, compared with 39% who said distribution and 12% who said manufacturing (see figure 14). This finding is another indication that the back office is expected to be a focus of technological change in the years ahead.

Friends and enemies

Friends and enemies

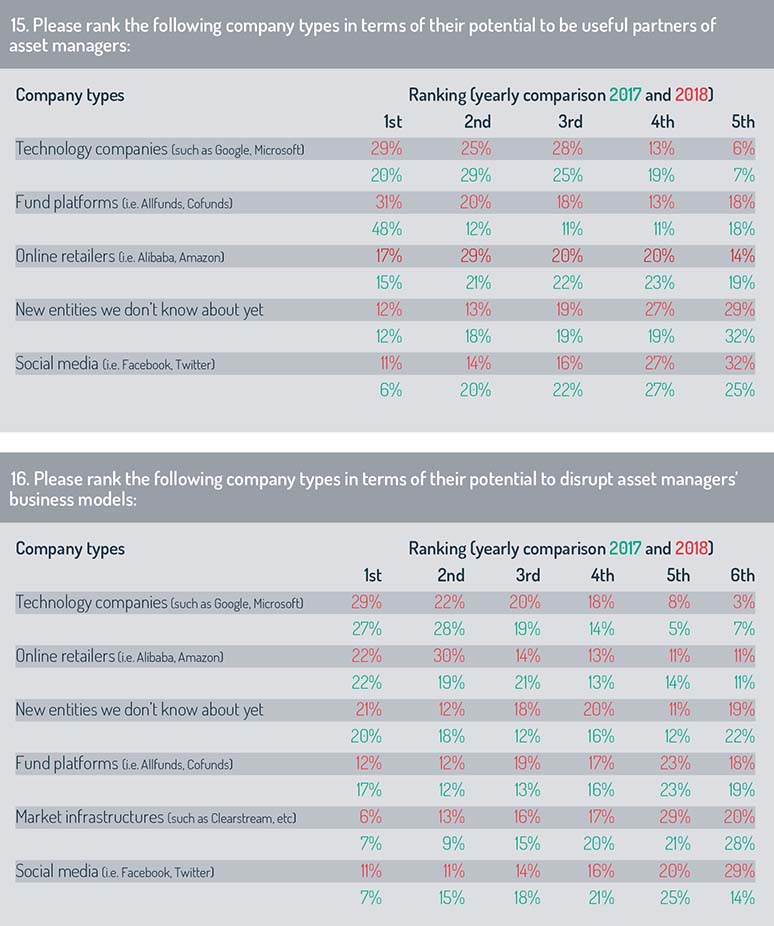

The next section was also a repeat from last year’s survey. The intention was to establish which types of company had the greatest potential to be useful partners to the asset management industry and which types of company were most likely to be disruptors.

This year, technology companies such as Google and Microsoft came top (see figure 15: the company types are arranged in order of average ranking with the highest ranked at the top). The result reflects a change from last year, when fund platforms such as Allfunds or Cofunds came top. Have our respondents became less sanguine about the benefits of allying with fund platforms, or have they become more optimistic about the opportunities of technology partnerships? Further research in this area could be fruitful.

The next question asked which types of company were most likely to disrupt asset managers’ business models. Technology companies were again ranked top (see figure 16), a finding that matches the result gained last year. What does this data point mean? We think it shows that the likes of Google and Microsoft are viewed with a certain awe. These technology giants have the power to be valuable partners or formidable enemies. They can aid or they can destroy. Clearly, the question of how to work with them is pivotal.

For the final part of the report, click here.

©2018 funds europe