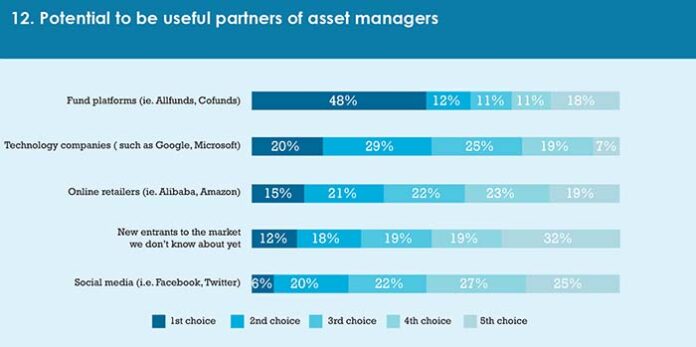

One of the most interesting dilemmas facing asset managers is which types of company to ally with, and which types to defend themselves against. We asked respondents to rank the likely usefulness of several types of company as potential partners to asset managers. Receiving the top average ranking were fund platforms (nearly half the respondents to this question gave fund platforms the top ranking). Technology companies such as Google and Microsoft came second, followed by online retailers and new market entrants not yet known about. Social media such as Facebook and Twitter were ranked as the least useful.

Bella Caridade-Ferreira of Fundscape thinks respondents were right to put fund platforms at the top. After all, asset managers have a “symbiotic relationship” with the platforms. However, she thinks fund companies may be “missing a trick” by viewing social media as an unlikely potential partner.

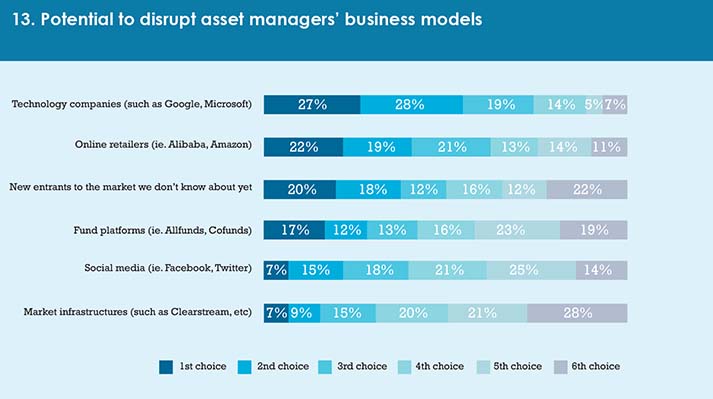

The next question sought to identify the enemies: the types of firm with the most potential to disrupt asset management business models. Technology companies such as Google and Microsoft topped the list here, followed by online retailers such as Amazon and Alibaba. The least disruptive company type was deemed to be market infrastructures.

Are fund companies right to be afraid of technology firms? JB Beckett of the Association of Professional Fund Investors thinks the threat has been exaggerated. “Running asset management is capital-heavy, running a tech company isn’t,” he says. “There are plenty of other sectors for the likes of Amazon and Google to go into.”

Looking ahead

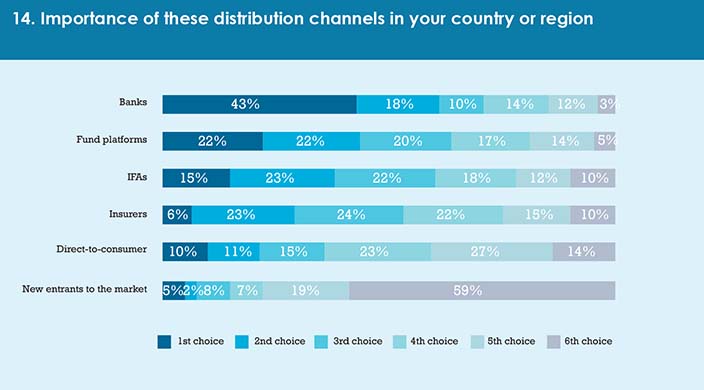

The final two questions looked at distribution channels. We asked respondents to rank the priority of several types of distributor today and to predict their priority in ten years’ time. Banks were ranked as the most important distribution channel today, followed by fund platforms and independent financial advisers.

The high ranking given to banks is likely a result of the high proportion of respondents who come from continental Europe, where banks are a well-established distribution channel. Were this study to concentrate only on the UK, where banks are relatively minor players in fund distribution, a different result might have been obtained.

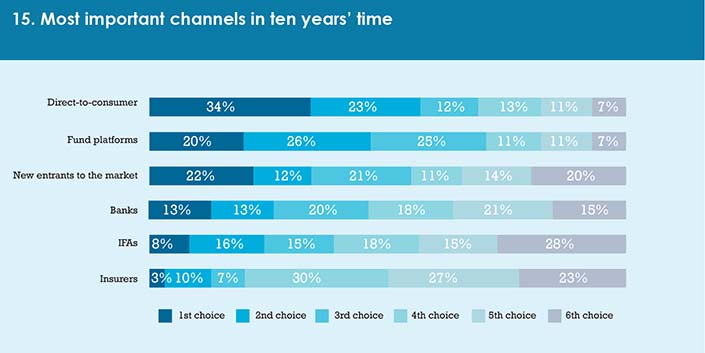

The ranking of these distribution channels looked very different when respondents were asked to look ten years into the future. Direct-to-consumer models were expected to be the most important channel, followed by fund platforms and, in third place, new entrants to the market. Insurers fell to last position in the future-looking ranking.

Are our respondents right in their forecasts for the future of funds? Diana Mackay admitted to being surprised by the high position allotted to direct-to-consumer models. “It’s possible you might see a little more direct-to-consumer in future,” she says. “But I’d be utterly astonished if direct-to-consumer channels accounted for more than 5% of the overall pie.”

She argues that running small books of business on behalf of hundreds of thousands of consumers would not be profitable for any but the largest asset managers. Richard Garland, of Investec, agrees. “There aren’t many firms who can do direct-to-consumer,” he says. “BlackRock can, they’re big enough.”

Our panel suggested that future research on this subject might consider a different categorisation of distribution channels. Banks, for instance, operate as distributors at several levels, both providing in-person service at branches and offering online robo-advice platforms. A future study might examine the possibility that banks can retain a dominant position by developing or acquiring different distribution capabilities.

Summing up

Our survey revealed a range of trends facing the funds industry. Clearly, there is a popular view that, in order to survive the digital transition facing the industry, fund companies must become better at engaging with their end investors. This would explain the high proportion of respondents who call for fund companies to develop direct-to-consumer capacities.

However, the input from our panellists revealed that there are significant costs involved with becoming a serious direct-to-consumer player. It seems likely that for many asset managers, the intermediated model will persist for some time yet.

In terms of disruption, there is an awareness that the global technology giants are a threat to asset managers. Yet, as our panellists commented, the likes of Amazon and Google are more likely to pick other industries to target than the highly regulated funds business, at least in the short term.

There are many challenges ahead, but the message from our research is that technology in and of itself need not be a danger.

©2017 funds europe