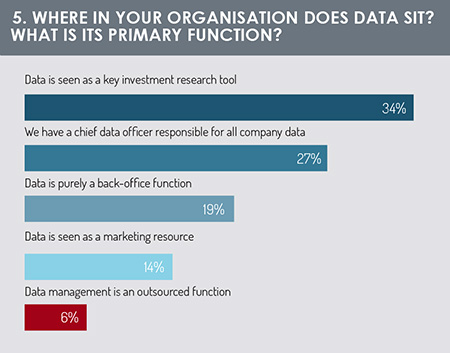

We moved on to ask respondents how data was used within their organisation (fig 5). Just over a third view data management primarily as a task to feed their investment research (34%). Some firms have established specialist data engineering and data science teams to manage their data resources, overseen by a chief data officer (27%). A smaller number of firms view data management primarily as a back-office function (19%).

It is testament to the importance of data as a strategic asset that only 6% of respondents said that they had outsourced their data management to a third party. Many investment firms view data as a crucial input that can drive better investment decision-making, a deeper understanding of performance and risk, higher operational efficiency and potential automation across more stages of the investment life-cycle.

AI in practice

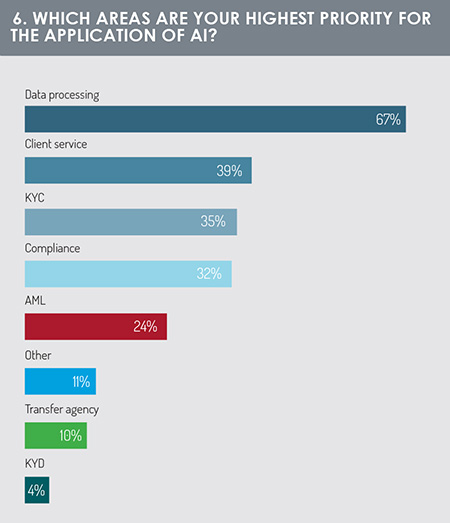

The next question asked respondents to specify which areas within their business are highest priority for the application of AI (fig 6). Given the importance of data as a strategic asset, it may come as little surprise that data processing was by far the most common answer (67%). This aligns with the strong movement towards use of data science, reinforcement learning and predictive analytics to support respondents’ investment strategies, performance and risk analysis, and reporting requirements.

Other priority areas for the application of AI were client service (39% of respondents), KYC (35%), compliance (32%) and AML (24%).

Each of these areas is seeing significant development activity from fintech firms and from their investment management or investment services partners. For example, robotic cognitive automation is being used to assist with document preparation and reconciliation – applying AI to populate structured message fields and to check consistency of documentation (to ensure, for example, that information in a Key Investor Information Document aligns with that in a fund prospectus). AI-based platforms are also being used to develop an automated service for AML, identity verification and enhanced due diligence.

Each of these areas is seeing significant development activity from fintech firms and from their investment management or investment services partners. For example, robotic cognitive automation is being used to assist with document preparation and reconciliation – applying AI to populate structured message fields and to check consistency of documentation (to ensure, for example, that information in a Key Investor Information Document aligns with that in a fund prospectus). AI-based platforms are also being used to develop an automated service for AML, identity verification and enhanced due diligence.

For those that responded ‘other’, we asked them to specify areas within their organisations that are a priority for application of AI. The answers that we received include:

• Augmented investments.

• Any function where large complex documents or data sets can be interrogated (incorporating machine learning) for rules-based interpretation (e.g. fund prospectuses).

• Asset liability management and strategic asset allocation (SAA) derivation, along with prediction models for capital markets to support investment strategy definition.

• Fund administration.

• Investment process and stock selection.

• Independent financial adviser (IFA) and common reporting standard (CRS) management.

• Risk and portfolio management.

• Business intelligence.

• Investment decision support.

Constraints

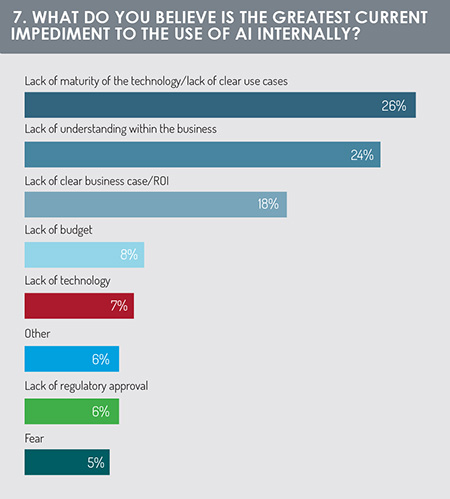

Having asked respondents to identify areas of highest priority for the application of AI, in the next question we asked them to identify the major impediments that they face in applying AI. The most important constraint (fig 7) was a lack of maturity in the technology and a lack of existing use cases that demonstrate how this technology can be applied (26%).

In all, 24% of respondent firms indicated that there was still a lack of understanding among key decision-makers or budget-holders within the firm regarding how AI will benefit their business and bring added value to customers.

In all, 24% of respondent firms indicated that there was still a lack of understanding among key decision-makers or budget-holders within the firm regarding how AI will benefit their business and bring added value to customers.

A further 18% indicated the lack of a clear business case to justify investment in AI applications at this time or a fear that AI projects will fail to deliver their targeted return on investment (ROI) within a required timeframe.

Given that there is a limited track record of successful AI implementations in the funds industry, firms remain cautious of backing the wrong horse or of ‘early adopter risk’ – the danger of implementation costs and inefficiencies borne by the ‘pioneers’ that may not be shared by the ‘followers’, who may time their entry to learn from the mistakes and successes of their predecessors.

Only 8% of respondents indicated that the major obstacle to AI implementation was lack of budget. There appears to be a level of agreement that if a firm identifies a business case for utilising AI and key decision-makers have an understanding of the technology, then the firm will typically make budget available to finance the project.

AI and regtech: Confronting the cost of compliance

We now turn specifically to compliance responsibilities. There is a huge resource cost associated with managing KYC and AML reporting requirements and this may be one area where use of AI may deliver major efficiency benefits.

But what are the principal impediments to the use of AI to support compliance and regulatory reporting?

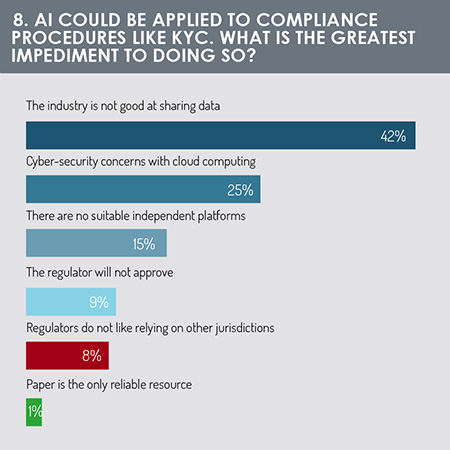

The largest impediment (fig 8), according to respondents, is that the industry is not good at sharing data (42%). This is compounded by fears around data secrecy and data security. This is particularly the case for compliance solutions that employ cloud computing for delivery (for example, Software-as-a-Service, or SAAS) or for data management.

For some respondents, lack of suitable technology is also a primary constraint: 15% indicated that development in this area is held back by an absence of suitable independent platforms. Given the sizeable investment being made in platform development by technology companies (often in partnership with large asset management or asset servicing companies), it is important to monitor how this sentiment changes over the coming 12 and 24 months.

For some respondents, lack of suitable technology is also a primary constraint: 15% indicated that development in this area is held back by an absence of suitable independent platforms. Given the sizeable investment being made in platform development by technology companies (often in partnership with large asset management or asset servicing companies), it is important to monitor how this sentiment changes over the coming 12 and 24 months.

It is noteworthy that less than 10% of respondents were discouraged from applying AI-based compliance solutions on the grounds that these are not favoured by the regulatory authorities. Financial regulators have been working with industry associations and their members in a number of jurisdictions to refine use of compliance technology solutions that may improve the efficiency of regulatory reporting.

For the next part of the report, click here.

©2019 funds europe