So far, we have provided a short overview of AI’s foundations and how this is understood by the scientific community.

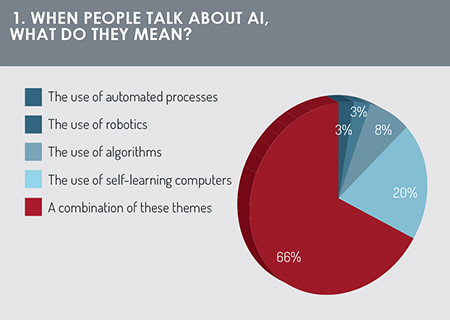

In our survey, we began by asking respondents what they understand by the term ‘artificial intelligence’ (fig 1). The most popular response (66%) was that AI is a portmanteau term that implies a combination of the use of automated processes, use of algorithms and robotics, and use of self-learning computers. The most popular single answer was that AI implies the use of self-learning computers. This response aligns with the definition of AI that we advanced earlier, where we proposed that AI typically implies the use of an intelligent agent that will select actions designed to give the ‘best’ outcome, but will also have the ability to ‘learn’ and to improve its performance over time.

Most readers of this survey will be interested in AI for its practical applications – for the benefits this can deliver for their operational efficiency, business profitability and for the quality and range of services this can help deliver to customers.

To explore this further, we asked respondents where they expect AI to deliver greatest benefit for their business.

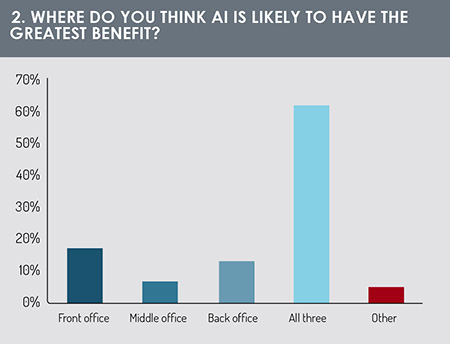

Two-thirds stated that the benefits of AI will not be limited to the front, middle or back office, but will be realised across each of these three areas of the investment value chain (fig 2). Many firms are seeking to apply AI to promote end-to-end automation across the investment life-cycle and this response aligns with that view.

From the remaining respondents, 18% indicated that the benefits of AI would be experienced predominantly in the front office, while 14% believed these would be primarily in the back office.

We already see examples of prototypes and implementation in each of these areas. In the front office, big data is being analysed to learn about the customer and their buying preferences. Predictive analytics may then be used to build a model portfolio, rather like Amazon or Netflix provide suggestions based on a customer’s previous purchases. Investor preference data may also be used to classify investors into categories based on their risk appetite and required rate of return (automated segmentation analysis).

We already see examples of prototypes and implementation in each of these areas. In the front office, big data is being analysed to learn about the customer and their buying preferences. Predictive analytics may then be used to build a model portfolio, rather like Amazon or Netflix provide suggestions based on a customer’s previous purchases. Investor preference data may also be used to classify investors into categories based on their risk appetite and required rate of return (automated segmentation analysis).

In the middle office, firms are experimenting with AI in NAV calculation, bringing greater automation to NAV generation and reducing the time involved (i.e. targeting 60-min NAV and below). AI is being applied extensively in optimisation algorithms for liquidity and collateral management. Natural language processing is being used for populating structured message fields from free text or for use in compliance checking (KYC, AML) and parallel regulatory technology applications.

In the back office, firms are exploring opportunities to apply AI to support smart contracting in transaction settlement (typically in combination with blockchain technology), along with prototypes to deliver automated income collection, corporate actions management, client reporting and to automate simple client service queries.

AI and investment strategy

We moved on to focus on investment strategy, asking how the use of AI will affect the investment process and whether specific types of investment strategy will benefit from its application. Respondents were asked to select as many as three statements that they most agreed with from a list.

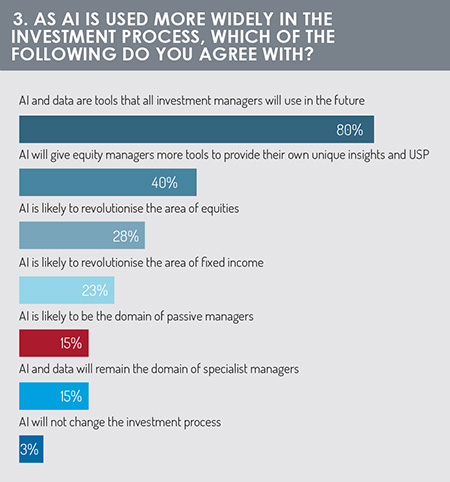

There was almost universal agreement that AI will change the investment process. Only 3% of respondents said that this would not be the case (fig 3). Meanwhile, 80% of respondents said AI and data engineering will be tools that all investment managers will use in the future. They identified particular benefits for equity managers, indicating that the use of AI will provide actively managed equity teams with additional tools to bring their own unique insights to the investment process and differentiate themselves from competitors. Application of AI will also benefit fixed income managers (23%), although to a lesser extent than teams managing equity strategies.

There was almost universal agreement that AI will change the investment process. Only 3% of respondents said that this would not be the case (fig 3). Meanwhile, 80% of respondents said AI and data engineering will be tools that all investment managers will use in the future. They identified particular benefits for equity managers, indicating that the use of AI will provide actively managed equity teams with additional tools to bring their own unique insights to the investment process and differentiate themselves from competitors. Application of AI will also benefit fixed income managers (23%), although to a lesser extent than teams managing equity strategies.

Only 15% of respondents said that AI will be primarily the domain of passive managers. It will be interesting to watch this space, given that AI in robo-advisory applications may be well suited to some passive investment strategies.

Examining the data

AI is a data-intensive discipline and relies on a high-quality data set to deliver effective results. To drive AI strategies, the algorithms will typically run initially on a ‘training’ data set which, as the name suggests, is used to train the model. That is how the model learns to recognise words and patterns in natural language processing algorithms, or facial recognition algorithms learn to distinguish a human face from other objects. The training data set tends to be the largest part of the overall data set, representing 75%-80% of the data for the project.

Having trained the model (and typically undergone additional validation checks), it is then applied to a ‘test’ data set and asked to make predictions. Here the model is being applied to real-world scenarios, to do the job it is created to do in an applied context.

In this AI world, data is air and water, essential nutrients that enable the intelligent agent to learn and to do its work. A large dataset is needed to train the AI model, to run the validation and testing. In this process, data quality is paramount. If the model is trained with poor-quality data, the predictive analytics it delivers will typically also be of poor quality.

In this AI world, data is air and water, essential nutrients that enable the intelligent agent to learn and to do its work. A large dataset is needed to train the AI model, to run the validation and testing. In this process, data quality is paramount. If the model is trained with poor-quality data, the predictive analytics it delivers will typically also be of poor quality.

In this section, we looked at the importance of data in driving investment strategy, operational processing and compliance. Again, respondents were asked to select statements they most agreed with from a list (choosing up to three).

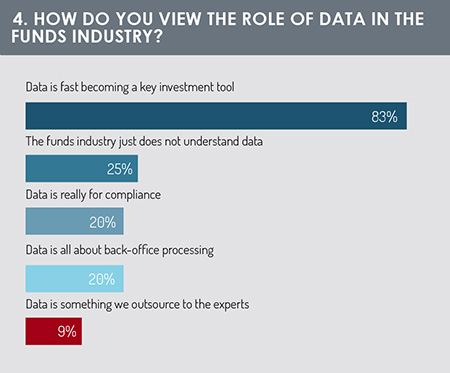

Four-fifths of respondents confirmed the rising importance of data as an essential input to the investment process (fig 4). Given this importance to investment decision-making, it is significant that a large majority of respondents wished to perform their data management in-house. Only 9% indicated that data management was a function best outsourced to a third party.

In keeping with this answer, respondents were sceptical of the view that data is important just for compliance or for back-office processing functions.

As many as a quarter of respondents indicated that the funds industry “just does not understand data”. This is therefore a domain where research and education can offer major benefits.

For the next part of the report, click here.

©2019 funds europe