“Change is the nature of things,” declared the Greek philosopher Heraclitus. Few in the funds industry would care to disagree with him. Increasing regulatory requirements have placed an ever-greater demand on compliance departments, while competition from low-cost passive funds has led to pressure on fees. Meanwhile, new technological developments – from robo-advisers to Bitcoin – have threatened to unstitch the very fabric of the financial services industry.

For asset managers, not to mention the asset servicers, consultants and others that serve the funds industry, 2018 promises to be another turbulent year. Funds Europe, in association with CACEIS, surveyed 206 of its readers in an online poll to determine how funds professionals view the changing industry. We hope that their views, summarised below, will help fund professionals prepare for the future.

Brave new world

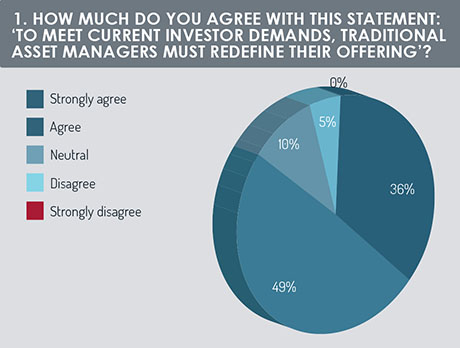

One thing our respondents were clear about was that immobility is not the answer. For our respondents, adapting to the developing environment requires not just tweaks but revolutionary new approaches. A large majority, 85%, agreed or strongly agreed that “to meet current investor demands, traditional asset managers must redefine their offering” (see figure 1). It would appear there is something approaching an industry-wide consensus that daring new approaches are needed.

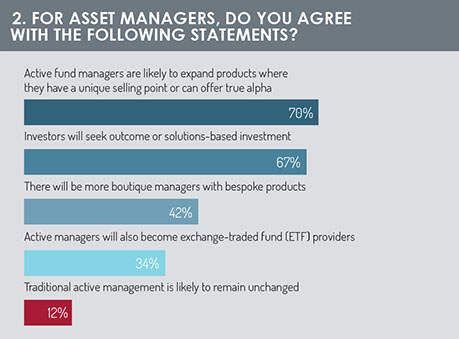

The question is what kind of new approaches. From a list expressing possible trends in the funds industry, we asked respondents to pick statements they agreed with (respondents could pick more than one). The most popular choice was “active fund managers are likely to expand products where they have a unique selling point or can offer true alpha”, closely followed by “investors will seek outcome or solutions-based investment” (see figure 2). Only 12% of respondents thought that “traditional active management is likely to remain unchanged”. Although opinions are divided about the best possible strategies for the traditional managers, standing still is not thought to be a sensible option.

The question is what kind of new approaches. From a list expressing possible trends in the funds industry, we asked respondents to pick statements they agreed with (respondents could pick more than one). The most popular choice was “active fund managers are likely to expand products where they have a unique selling point or can offer true alpha”, closely followed by “investors will seek outcome or solutions-based investment” (see figure 2). Only 12% of respondents thought that “traditional active management is likely to remain unchanged”. Although opinions are divided about the best possible strategies for the traditional managers, standing still is not thought to be a sensible option.

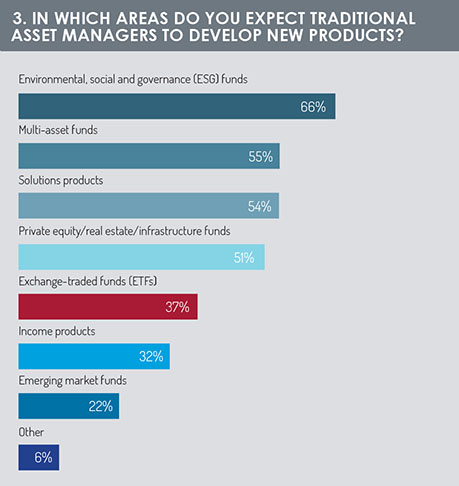

Whatever else happens in the investment industry, there are sure to be more products launched. But which areas will get the most attention? Our respondents predicted that environmental, social and governance (ESG) funds would attract the most product development from traditional managers, followed by multi-asset funds, solutions products and the main forms of alternative fund, namely private equity, real estate and infrastructure (see figure 3). Our respondents seem to be anticipating a growth in importance of responsible investment. Interestingly, the fund type that gained the fewest responses from our list was emerging market funds. According to our respondents, this fund type will be out of favour in 2018.

Whatever else happens in the investment industry, there are sure to be more products launched. But which areas will get the most attention? Our respondents predicted that environmental, social and governance (ESG) funds would attract the most product development from traditional managers, followed by multi-asset funds, solutions products and the main forms of alternative fund, namely private equity, real estate and infrastructure (see figure 3). Our respondents seem to be anticipating a growth in importance of responsible investment. Interestingly, the fund type that gained the fewest responses from our list was emerging market funds. According to our respondents, this fund type will be out of favour in 2018.

Better together?

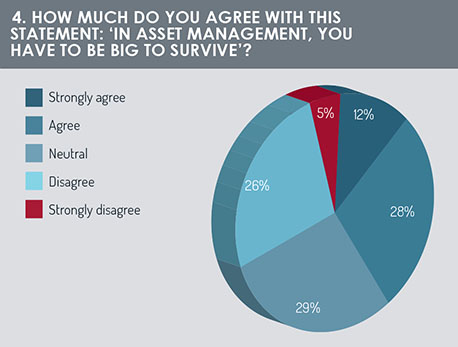

Asset managers face many challenges. Regulatory costs have tended to rise in recent years and, with the implementation of mammoth pieces of legislation such as MiFID II, this trend seems to be accelerating. Some consultants have suggested that consolidation is the solution. Through mergers and takeovers, asset managers can become bigger, more stable and more resilient. “Bigger is better” is not a view universally shared by our respondents, though. Together, 40% agreed or strongly agreed that, “in asset management, you have to be big to survive”; 31% disagreed or strongly disagreed (see figure 4).

Perhaps unsurprisingly, respondents who themselves worked at large asset managers (those with more than €20 billion under management) were slightly more likely to agree that “in asset management, you have to be big to survive”. Of this subset, 44% agreed or strongly agreed with the statement. The corresponding figure for respondents who worked at asset managers with €20 billion or less was 27%.

Perhaps unsurprisingly, respondents who themselves worked at large asset managers (those with more than €20 billion under management) were slightly more likely to agree that “in asset management, you have to be big to survive”. Of this subset, 44% agreed or strongly agreed with the statement. The corresponding figure for respondents who worked at asset managers with €20 billion or less was 27%.

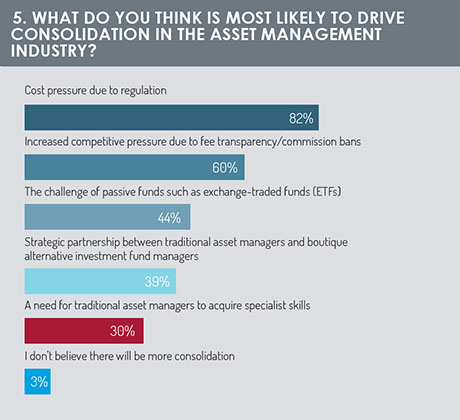

Our next questions sought to understand the causes of consolidation. Cost pressure due to regulation was chosen by 82% of respondents, who were asked to choose from a list of statements expressing possible factors that were likely to drive consolidation in the asset management industry (see figure 5; respondents could choose more than one statement).

Competitive pressure due to fee transparency and commission bans came second, followed by the challenge of passive funds. Only 3% of respondents said they didn’t believe there would be any more consolidation. This seems a strong indication that consolidation is widely anticipated in the industry.

Competitive pressure due to fee transparency and commission bans came second, followed by the challenge of passive funds. Only 3% of respondents said they didn’t believe there would be any more consolidation. This seems a strong indication that consolidation is widely anticipated in the industry.

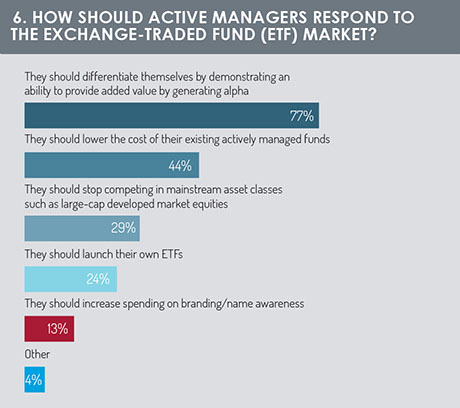

One of the supposed drivers of consolidation, among traditional asset managers at least, is competition from providers of low-cost passive funds. Exchange-traded funds (ETFs) have become especially widespread, increasingly used by institutions as well as fund managers themselves. For those fund houses that still do traditional, active management, what is the correct response to the growing popularity of ETFs? Our respondents (77%) said active managers should differentiate themselves by demonstrating an ability to provide value by generating alpha (see figure 6). This answer was much more popular than other options, including “they should lower the costs of their existing actively managed funds” (44%) and “they should launch their own ETFs” (24%).

Those who opted for “other” were asked to specify some alternative strategies. One respondent recommended partnerships with ETF providers; another proposed variable management fee structures to align with demonstrable alpha generation; another suggested active managers develop stronger governance of their holdings, presumably to demonstrate the stewardship they provide.

Those who opted for “other” were asked to specify some alternative strategies. One respondent recommended partnerships with ETF providers; another proposed variable management fee structures to align with demonstrable alpha generation; another suggested active managers develop stronger governance of their holdings, presumably to demonstrate the stewardship they provide.

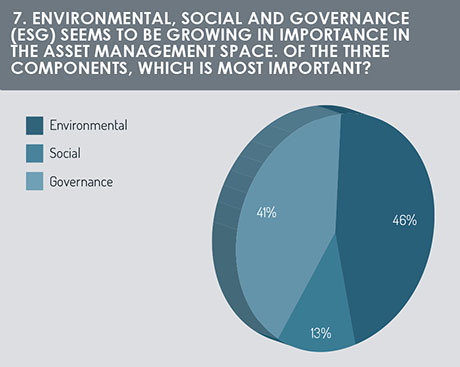

The question of governance brings us to figure 7, in which respondents were asked which of the three elements of ESG (environmental, social or governance) was the most important. Governance gained a strong score with 41%, but it was the environmental aspect that won out, attracting 46% of responses. Respondents deemed the social element to be the least important.

The question of governance brings us to figure 7, in which respondents were asked which of the three elements of ESG (environmental, social or governance) was the most important. Governance gained a strong score with 41%, but it was the environmental aspect that won out, attracting 46% of responses. Respondents deemed the social element to be the least important.

For the next part of the report, click here.

©2018 funds europe