Merger and acquisition (M&A) deals involving asset managers in high-growth emerging markets and their counterparts in Europe and America could total an additional £1 billion (€1.2 billion) by the end of 2013.

This is on top of the £1 billion that Deloitte, a business advisory firm, estimated as the value of cross-border investment management M&A deals in developing and emerging markets since January 2011.

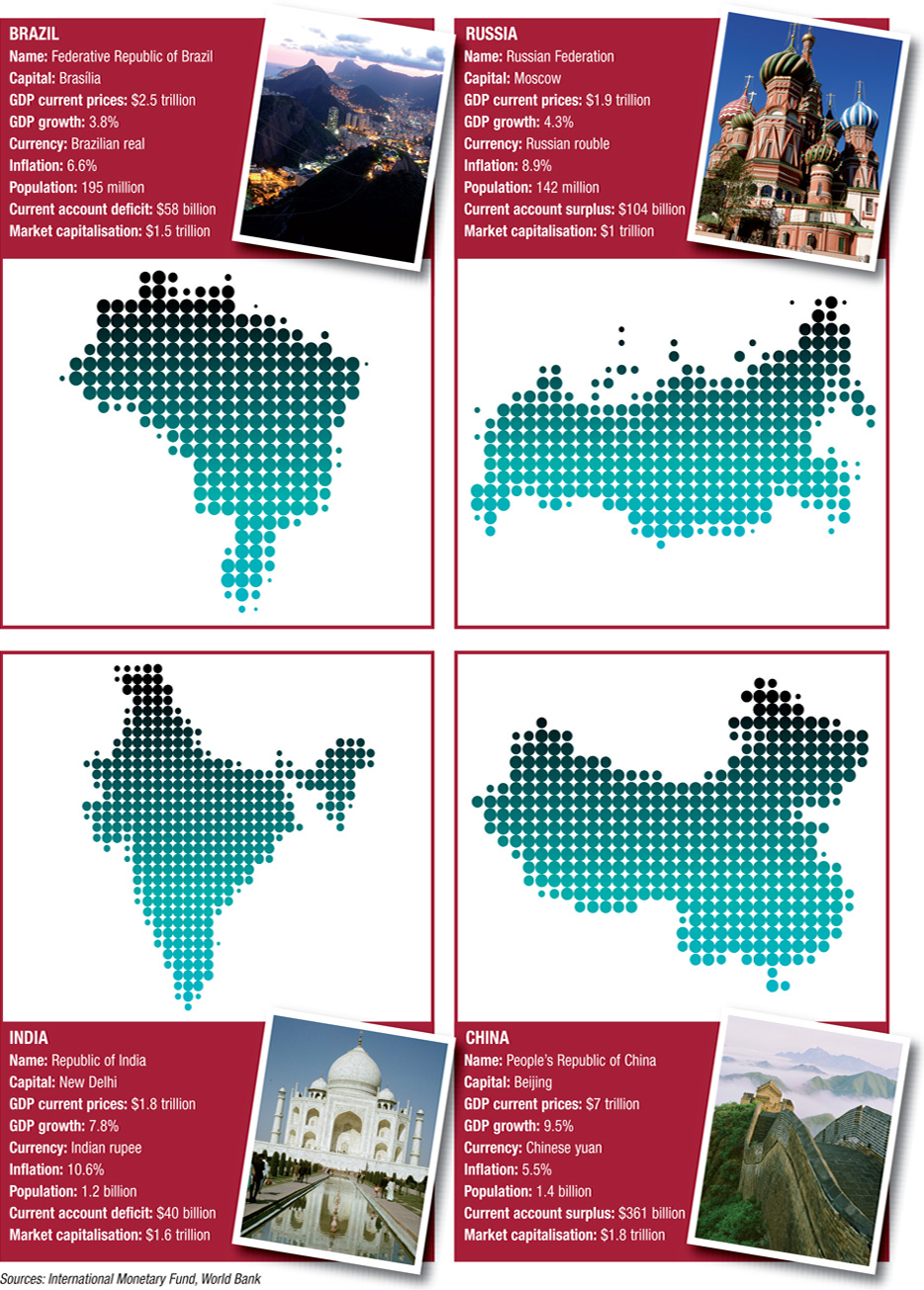

The firm said that asset managers in Brazil, Russia, India and China – the so-called Bric countries – could become targets for mergers and joint ventures with European and North American financial institutions that want access to faster growing markets.

Baber Din, investment management M&A director at Deloitte, said: “As the investment management sectors in North America and Europe become increasingly competitive, emerging markets will continue to attract the attention of larger, stable investment managers who are looking to position themselves in new markets, either through acquisitions, investments or strategic partnerships.”

GDP in Brics countries, worth about $13 trillion (€10 trillion), was forecast to expand to $95trillion by 2050, Din said.

However, markets, taxes and regulations vary widely between regions. In some jurisdictions the restrictions affecting foreign investment and ownership are complex, with Russia and China at the harder end of the spectrum, India in the middle and Latin America and South East Asia the most open, Din said.

“Differing distribution models locally, as well as the profile of the existing investment management sector can also make identifying the right targets or partners difficult. Companies must understand and manage these factors effectively if mergers or partnerships are to be successful.”

©2012 funds europe