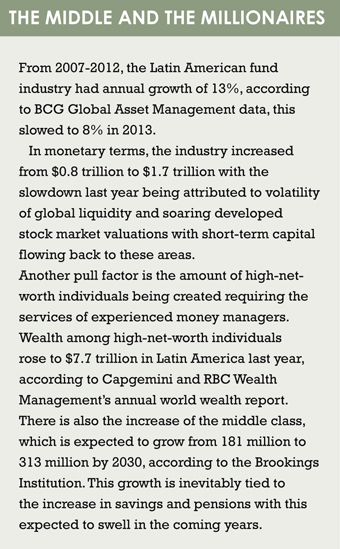

Latin America could be the fastest growing region in the next five years, finds Andrew Short. Though good for international asset managers, it makes it unlikely that Brazilian investors will want to venture abroad.

After surging drug violence, economic turmoil and a slew of debt problems, the 1980s were a difficult decade for Latin America. In fact, at the time, nobody would have guessed that thanks to strong economic growth and growing international influence, 2014 has the potential to be yet another solid year. However, Argentina’s debt crisis and Brazil’s recession have overshadowed opportunities and coloured perception about the region. Despite this, there have been many positives, including reforms in Mexico and Chile, plus strong GDP growth in Colombia and Peru.

For fund managers trying to contend with anything other than a disappointing recovery in Europe, Latin America has become an indispensable part of a diversified business plan. But why is the region of importance to European managers? Who are the major players? And what do they think the key drivers will be in the longer term?

BOOTS ON THE GROUND

The growth in Latin America has been witnessed first-hand by Schroders – active in the region for more than 20 years. The UK-based fund house has been building up a local team with multiple offices (Brazil, Argentina, Chile and Mexico) and manages a broad spectrum of asset classes with $10 billion under management for high-net-worth individuals, to pension funds. Its most recent venture is an office in Chile.

According to Schroders deputy head of distribution and global head of institutional, John Troiano, having a physical presence in the region should be part of any serious money manager’s business plan for the long term. “We’ve been in the Latin American region for over 20 years and this was a strategic move. For the business, we now feel this will be the fastest growth region for the next five years,” he says.

Pioneer Investments has been in the region for a number of years and has offices in Chile, Argentina and Mexico serving retail, institutional and high-net-worth clients. Head of Iberia, North America offshore and Latin American markets, José Castellano, has witnessed the growth of institutional and retail channels in these countries. He says: “We expect this substantial growth to continue, driven by the growth of the middle class and demographic trends overall.”

This demographic growth also compelled BNP Paribas Investment Partners to set up shop in the region. The fund house has offices in Brazil, Mexico, Colombia, Argentina and Chile, and sales coverage from Argentina for Central America, Peru, and Venezuela.

Ligia Torres, head of Asia Pacific and emerging markets, echoes the points above and says this increase in wealth is a big driver for the region and a pull for asset managers. She adds: “Further acceleration in wealth accumulation, will help to propel the asset management industry over the medium to long term.”

TOO EARLY TO JUDGE

The three managers above have been slowly driving resources to the region, adding to their foothold as opportunities arise, and each highlights the fact this is a long-term play and the rewards come with time.

A number of other fund managers have been trying different structures to dip their toes into the region. For example, last year Edmond de Rothschild Asset Management formed a distribution partnership with Brazil’s BBM Investimentos, while Alceda Fund Management partnered Latin America specialist Afina Holdings.

Axa Investment Managers has also tried to capture assets in the region and manages a $4 billion fixed income mandate for a Chilean pension fund and has a small number of representatives in Lima, Peru, and Santiago, Chile. It is planning to broaden its footprint to Brazil, Mexico and Colombia, according to media reports. However, it is too early to say at present if these partnerships and new ventures will pay off in the long term.

Axa Investment Managers has also tried to capture assets in the region and manages a $4 billion fixed income mandate for a Chilean pension fund and has a small number of representatives in Lima, Peru, and Santiago, Chile. It is planning to broaden its footprint to Brazil, Mexico and Colombia, according to media reports. However, it is too early to say at present if these partnerships and new ventures will pay off in the long term.

DRIVERS AND OUTLOOKS

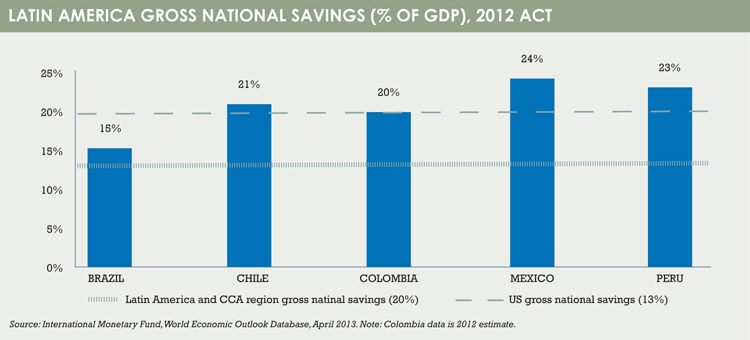

If Latin America was split in terms of assets under management, the most appealing market would be Brazil, the region’s powerhouse economy. Next would be Mexico, and then Chile. Brazil also has the largest pool of pension funds in the region – the system had 630 billion real ($275 billion) as of June 2013. However, for Troiano at Schroders, this number is largely irrelevant because of how difficult it is to win institutional business in the region and also because retail distribution is dominated by a few big banks. For some time now, Brazilians have had little interest in investing abroad, or in investing with foreign managers. This lack of appetite is because the lure of the domestic market is too hard to resist. Many of Brazil’s pension funds are linked to the country’s interest rate, which has been increasing for the past year and sits at 11%.

Troiano says: “These funds would need a huge incentive to invest elsewhere.”

However, he is positive on Mexico after winning one of the first contracts to manage money for Mexican pension funds. Afore Banamex, a pension fund and wholly owned subsidiary of Citigroup in Mexico, launched Mexico’s first international investment mandate – initially a $200 million global segregated account – with Schroders. This is the first mandate to be awarded to an international asset manager in the history of the mandatory pension fund system in Mexico. These pension funds, known as “Afores”, are allowed to invest up to 20% abroad and collectively invest $15 billion overseas, according to Pioneer.

The government had restricted all foreign allocations to passive investments, but in April 2011 this restriction was lifted, suggesting opportunities would open up for a range of foreign managers.

Schroders is driving more resources to the region to win more business, and this has not gone unnoticed by other managers in Europe. BNP Paribas Investment Partners has started to increase head count in the region and, as well as looking to attract institutional cash, also would like to drive their retail business.

“We have recruited a senior management team in Mexico – a chief investment officer, a chief operating officer and a head of sales – to create a fully fledged asset management subsidiary,” says Torres. “We are also in the process of applying for an investment management licence, providing us with Mexican fixed income and Mexican equity investment capabilities.

Some of best opportunities in the region for foreign asset managers are in Chile, despite it having only the third most assets under management, according to Pioneer’s Castellano. The country’s fully privatised pension system consists of five funds called “administradoras de fondos de pensiones”, or AFPs. These are permitted by law to allocate up to 80% abroad. In practice they allocate 36% overseas, according to Pioneer, which adds up to an appealing $51.6 billion. This foreign investment will rise to more than $75 billion this year.

“The country’s mutual funds have also allocated money for foreign investment – $3.5 billion of total assets of $36 billion. This enthusiasm for investing abroad stems from limited opportunities at home and we feel this will continue to be a trend,” Castellano says.

TOMORROW’S MARKETS

Finally, Peru and Colombia also have fast-growing pension funds. They are the future of the Latin American funds industry and could provide ripe markets for foreign asset managers. For Peru’s $28 billion in pension assets under management, the foreign investment limit is 30%. This is expected to double, according to the Peru’s banking, insurance and pensions authority, Superintendencia de Banca, Seguros y AFP. Colombia’s pension funds have $66 billion under management and legal limits on foreign exposure range across funds from 40% to 70%. Currently $6 billion is invested overseas and this is also forecast to double in the coming two years, according to the Superintendencia Financiera de Colombia.

Pioneer’s Castellano concludes “these two countries have done an excellent job developing their economies and the region in general is in an excellent position to continue growing”.

©2014 funds global latam