Single funds investing in diverse asset classes are gaining ground. Nicholas Pratt looks at how four asset managers run their operational infrastructure to support investment in a range of assets and geographies.

The past decade has seen more asset managers expand the geographical breadth of their investments and take on new and sometimes complex asset classes. More recently, these assets have been combined into single fund offerings to try and provide relatively unsophisticated investors with diversification, dynamism and bigger returns.

But just as it becomes ever harder for logistical experts to support armies that operate further from home or who become more complex so, too, do asset managers have to face a new operational challenge with multi-asset funds.

Multi-asset funds are increasingly visible on the asset management landscape. Since the financial crisis, some managers have extended their multi-asset offerings while others have entered the market for the first time.

With the multi-asset funds profiled below we look at how asset managers support these products. The funds profiled include some almost ten years old and, in the case of Russell Investments, one that is newly launched. There are also differences in the asset allocation and risk profile of each fund but there are also similarities in the extent to which service providers are employed to carry out an increasing number of back and middle-office functions.

As multi-asset funds continue to evolve, managers will hope that system vendors and service providers will look to provide services that enable them to reap the investment benefits of a diverse and dynamic portfolio but without being hampered by operational functions and tools that are unable to span international markets or multiple asset classes.

Multi-asset investments, such as liability-driven investment (LDI), currently represent 18% of Schroder Investment Management’s global assets under management and are widely considered to be an important area of growth for institutional asset managers, says Markus Ruetimann, group chief operating officer. “To participate in this growth, asset managers must develop the full spectrum of solutions ranging from return-seeking strategies to downside risk management tools, from strategic beta to global macro.

Multi-asset investments, such as liability-driven investment (LDI), currently represent 18% of Schroder Investment Management’s global assets under management and are widely considered to be an important area of growth for institutional asset managers, says Markus Ruetimann, group chief operating officer. “To participate in this growth, asset managers must develop the full spectrum of solutions ranging from return-seeking strategies to downside risk management tools, from strategic beta to global macro.

Many of these investment solutions use derivatives extensively, so having a scalable investment platform to accommodate additional over-the-counter instruments and support greater levels of activity is a key success factor, says Ruetimann. However, opportunities for outsourcing key parts in the processing lifecycle of a derivatives transaction remain modest so that many global fund managers resort to building component-based internal systems and processes.

The post-trade world is relatively straightforward for multi-asset funds at Schroders in that funds are supported by shared, global IT solutions regardless of asset class (excluding property). The same approach is taken for internal administration teams and external securities services providers, says Ruetimann.

There are fewer services available for pre-trade processing, he says. “Technology solutions to support multi-asset portfolio management are still evolving, with few external software solutions on offer.”

Schroders uses proprietary software for asset allocation, portfolio management and portfolio construction as well as for investment risk analysis, liquidity management (supporting LDI) and performance attribution.

The administration and accounting services for the multi-asset fund are provided, in the main, by Aberdeen’s two key global strategic service providers – BNP Paribas Securities Services and State Street. These same asset service firms also provide custody and sub-custody for Aberdeen’s open-ended fund ranges. However, in the segregated mandate space, custodians and sub-custodians are client-appointed so Aberdeen would deal with numerous custodians.

The administration and accounting services for the multi-asset fund are provided, in the main, by Aberdeen’s two key global strategic service providers – BNP Paribas Securities Services and State Street. These same asset service firms also provide custody and sub-custody for Aberdeen’s open-ended fund ranges. However, in the segregated mandate space, custodians and sub-custodians are client-appointed so Aberdeen would deal with numerous custodians.

In terms of using different service providers for different asset classes and geographies, Atholl Forbes, global head of investment operations, says: “As we have a global operating model with both of our strategic service providers, we have the flexibility to allocate funds

to providers on the basis of both geography and asset class. We use this flexibility to ensure fund administration is operationally and commercially effective.”

This global operating model is based on an outsourced administration/accounting strategy so very little back-office services are performed in-house, says Forbes. “Aberdeen has retained a dedicated middle-office team whose role is to provide oversight of third-party service provision while providing a conduit between Aberdeen’s front-office and the outsourced back-office.”

Technology providers have also played an important role in developing Aberdeen’s in-house services. “We have invested heavily in our data warehouse technology and utilise Cadis as our enterprise data management platform. We also use Charles River for global

trade order management and execution as well as pre- and post-trade compliance.”

When asked to identify the biggest challenge in terms of the back-office servicing of multi-asset funds, Forbes highlights the different asset classes held within the portfolio and the impact this has on front-office platform requirements and also in terms of client reporting.

Russell Investments divides its back-office services into six categories: accounting, market data, custody, transfer agency, taxation and reporting. As part of the fund accounting process, prices for all share classes for Russell Ireland are calculated and validated daily.

Russell Investments divides its back-office services into six categories: accounting, market data, custody, transfer agency, taxation and reporting. As part of the fund accounting process, prices for all share classes for Russell Ireland are calculated and validated daily.

There is daily reconciliation of cash and stock positions to custody. Share prices are published, all expenses related to net asset values are calculated and processed, as are subscriptions and redemptions and fund income distribution.

The custody function involves the processing of all trading advised by the investment manager, the monthly reconciliation of the portfolio to the investment manager’s records as well as the opening of markets with sub-custodians to ensure the investment manager can trade in selected markets and the submission of tax reclaims by sub-custodians to the relevant tax authorities.

Taxation duties include the submission of overseas withholding reclaims to sub-custodians, providing the relevant withholding rates applied to the fund, and producing and submitting six-monthly tax returns. The transfer agency role involves setting up new client accounts, processing shareholders’ subscriptions and redemptions, maintaining a shareholder register, resolving shareholder complaints and providing daily client dealing reports and shareholder statements, and monthly statements to all shareholders.

Much of the financial reporting is undertaken by State Street in its asset servicing role, which includes providing auditors with an audit pack, answering queries and escalating issues when appropriate to Russell, providing Russell with all regulatory requirements relevant to the fund and producing financial statements.

Much of the financial reporting is undertaken by State Street in its asset servicing role, which includes providing auditors with an audit pack, answering queries and escalating issues when appropriate to Russell, providing Russell with all regulatory requirements relevant to the fund and producing financial statements.

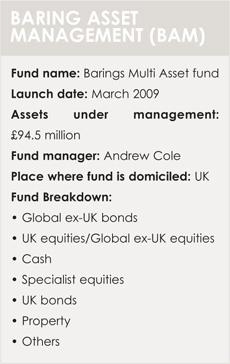

BAM employs Northern Trust to provide all custody, sub-custody, accounting, administration and OTC derivatives processing for its multi-asset fund, thus avoiding the use of different service providers for different geographies and asset classes. “We don’t really perform any back-office services in-house,” says David Poole, head of fund services. “It all depends on where you put the back/middle-office split, though. “The back-office piece is all done by the administrator and custodian, and we’ve kept all the middle-office functions.”

In employing technology vendors to develop the services retained in-house, BAM has created many for asset allocation, order management, trade compliance, investment accounting and performance measurement. “Again, it depends on what aspects of operations are being covered. If it’s back-office, so, no, we’ve effectively outsourced all this.”

©2012 funds europe