Nathan Travell of Milestone Group examines the rise of multi-asset investment solutions and the need to break down the operating silos that constrain efficient delivery within institutions.

Investors’ needs are changing. The baby boomers are firmly into their retirement and Generation X is getting closer to it. Increasingly, there’s a feeling that they’re just not fully prepared. Volatile markets add to concerns over collective and individual financial security given the sensitivity of defined contribution and IRA investments to value fluctuations near retirement. The result is that investors are looking to access better engineered, innovative products and options to deliver solid returns and protect their investments. With the demise of DB in favour of DC plans, there has been a marked shift to outcome-oriented investing.

This is often achieved through the blending of existing underlying building blocks of funds and portfolios to create multi-asset funds.

The rise of multi-asset businesses and product ranges is a trend that continues in 2016 and is set to extend well beyond.

With a range of research indicating that return is predominantly generated through effective asset allocation, as opposed to manager selection or portfolio construction, it is no surprise that multi-asset products are the weapon of choice in the battle for inflows. Pension funds looking for the appropriate outcome-based default fund investment for their members is also a key driver.

For all of this attention, multi-asset strategies are not necessarily new. Fund of funds and manager of managers have been active in this area for some time and have been producing products based on asset allocation theory as they attempt to generate a medium-term risk/return profile. However, absolute return funds, diversified growth funds and blended funds have recently entered the arena with different degrees of mandate constraint as well as the generic, all-encompassing multi-asset players.

Building the right operational capabilities to service the variety of multi-asset strategies is not easy. Both the old hands and the new entrants are facing significant operational and technological challenges. It’s not simply a question of having the right technology to manage each asset class. The wave of asset class-specific technology that continues to break upon the shores of the financial services industry means that asset managers have a plethora of partial solutions to select and assemble. Companies are well able to analyse their requirements for each individual asset class and choose best in breed software but, unfortunately, this is precisely the problem.

PREMIER LEAGUE

A January 2016 Citisoft white paper called ‘Sweet 16’ highlighted 16 trends they predict will shake up asset management technology and operations in 2016. One of these was focused on multi-asset strategies and looked at how the ‘best of breed’ approach can actually hamper profitability. It’s a bit like selecting a Premier League team of 11 players from around the world who are the very best at each position, then realising that none of them speak the same language. While they may all be fantastic at their individual roles, they will struggle to act as a coherent and unified team – a disaster at any level of sport. They need a coach to co-ordinate and fit them into the organisation. A multi-asset class fund needs the same from its operational platform. While larger asset managers will typically be able to cover all the asset classes they need, smaller players may actually have to outsource to make up for their own product gaps. The problem can lie in co-ordinating asset allocations into all these ostensibly unrelated funds, whether in-house or outsourced.

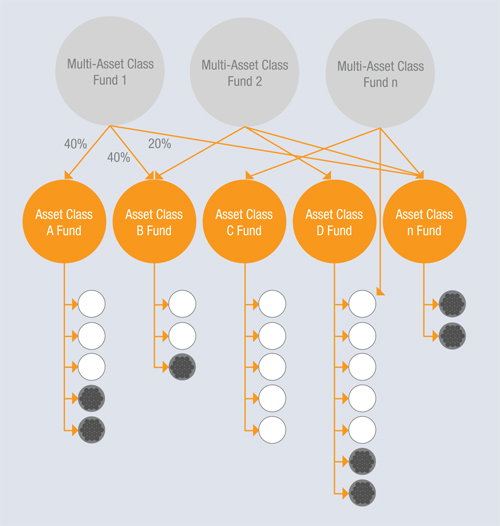

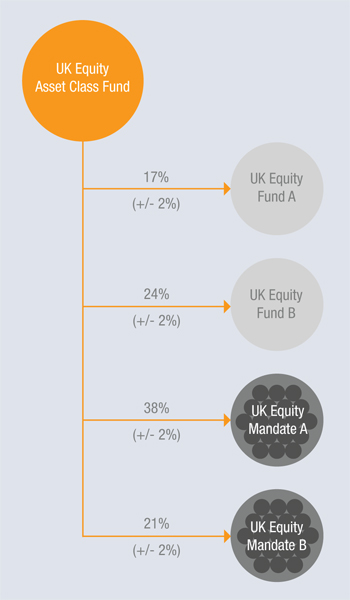

However, with the appropriate infrastructure and technology in place, a range of underlying asset class funds and portfolios can be used to create any number of multi-asset class solutions. Rather than becoming a challenge, they can become the building blocks of the solution. Using asset class funds and mandates as the building blocks allows different sector-based solutions to be created. Subsequently, these asset class solutions can themselves be combined into a range of diversified funds with different risk/return profiles which can then be targeted at different cohorts of investor. The diagrams demonstrate this ‘building block’ approach.

However, with the appropriate infrastructure and technology in place, a range of underlying asset class funds and portfolios can be used to create any number of multi-asset class solutions. Rather than becoming a challenge, they can become the building blocks of the solution. Using asset class funds and mandates as the building blocks allows different sector-based solutions to be created. Subsequently, these asset class solutions can themselves be combined into a range of diversified funds with different risk/return profiles which can then be targeted at different cohorts of investor. The diagrams demonstrate this ‘building block’ approach.

But, as asset managers move away from silos of asset class specialists and towards an organisation which needs to use those skills in the construction of unconstrained, multi-asset solutions, the operational environment must respond. The processing of multi-sector, fund of funds or multi-portfolio solutions has a completely different processing profile to a traditional asset class like equity, fixed income or cash. This is where there is a need for platforms that can seamlessly and easily combine the different silos.

The difficulty has been in finding the right technology. Asset managers and their outsourcing partners will continue to experience operational inefficiencies, along with the resulting detriment to margins and constraints to product offerings until dedicated multi-asset processing platforms are put in place. These platforms have been designed to deal specifically with the complexities of operating multi-tiered fund solutions based on blending underlying building blocks. As if there weren’t enough challenges already, this technology needs to be scalable to support both smaller players and able to cope with the demands of the larger global companies.

To answer this challenge, Milestone Group has developed its pControl Multi Asset software platform from the bottom up to specifically target the needs of all key stakeholders supporting the effective operation of multi-asset businesses. The pControl Multi Asset solution addresses portfolio management as well as middle and back office challenges inherent in multi-asset class products. Process automation is a key feature of the platform and reduces the necessity to manually manage all parts of the process. The convergence of the multi-asset team’s front, middle and back office needs onto a single platform creates dramatic processing efficiencies, control and scalability. Any team needs great individual capabilities, however, making sure the team can play together is critical to elite performance – and that’s where pControl Multi Asset comes in.

©2016 funds europe