The Abu Dhabi Investment Authority (ADIA), which manages global investments for the oil-rich emirate of Abu Dhabi, has hired Gregory Eckersley as global head of internal equities.

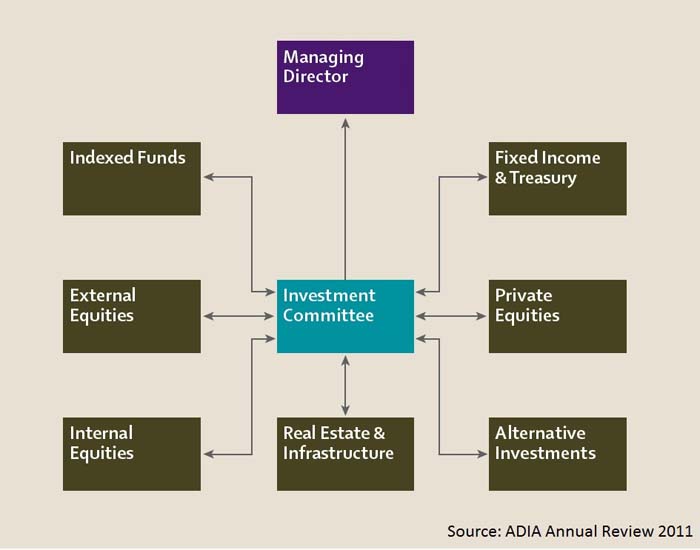

One of seven departments at the authority (see diagram), the internal equities division is tasked with investing directly in equity markets, rather than through external fund managers.

Eckersley’s role will be to develop investment strategy for the department and oversee its portfolios, a job that includes overseeing risk management and due diligence. He will report to Mohamed Darwish Al Khoori, executive director of the department.

Eckersley spent 16 years of his career at AllianceBernstein, helping to establish the firm’s South African business before moving to New York to manage AllianceBernstein’s Global and Large Cap Growth Equity portfolios. He has also worked for Cigna International Investment Advisors, Century Asset Management, and Draycott Partners.

His most recent role was at an energy, mining and commodities fund, 1770 Capital, that he launched with two colleagues in 2011.

©2013 funds europe